Asset mortgage borrowing method and system based on blockchain pass

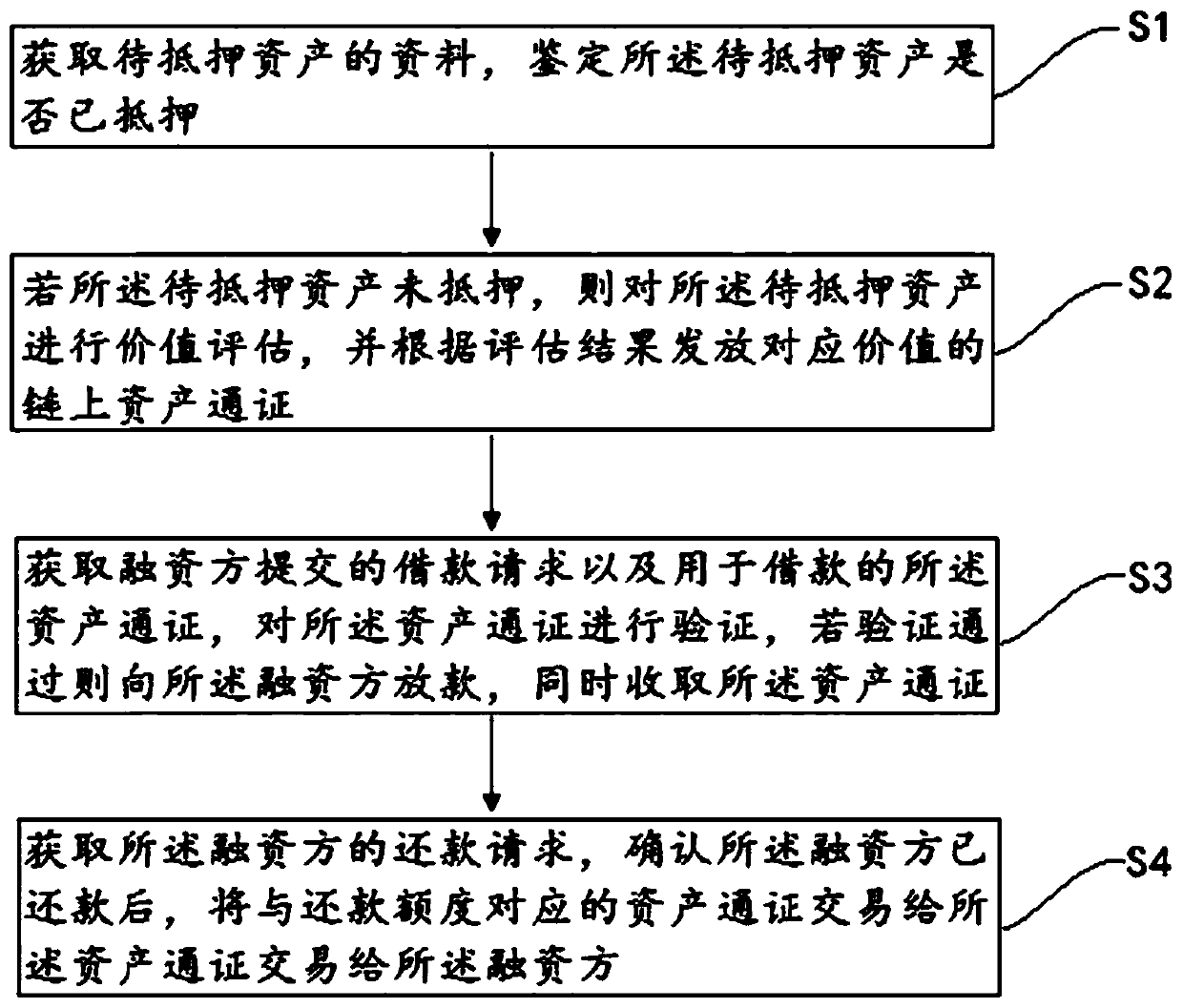

A mortgage loan and chain pass technology, applied in the blockchain field, can solve problems such as high financial risk, easy re-mortgage of assets, and difficult revaluation, etc., to reduce financial risks, shorten the loan cycle, and improve user experience.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047] In order to make the purpose, technical solutions and advantages of the present invention clearer, the technical solutions in the embodiments of the present invention will be clearly and completely described below in conjunction with the accompanying drawings in the embodiments of the present invention. Obviously, the described embodiments are only Some, but not all, embodiments of the invention. Based on the embodiments of the present invention, all other embodiments obtained by persons of ordinary skill in the art without making creative efforts belong to the protection scope of the present invention.

[0048] In the embodiment of the present invention, the participants mainly include blockchain network nodes, financing / loan individuals or enterprises, financial institutions, appraisal agencies, etc. Among them, the blockchain network nodes are mainly used to generate asset certificates, broadcast transactions through the blockchain network, match transactions, and bro

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap