Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

2 results about "Electronic form" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

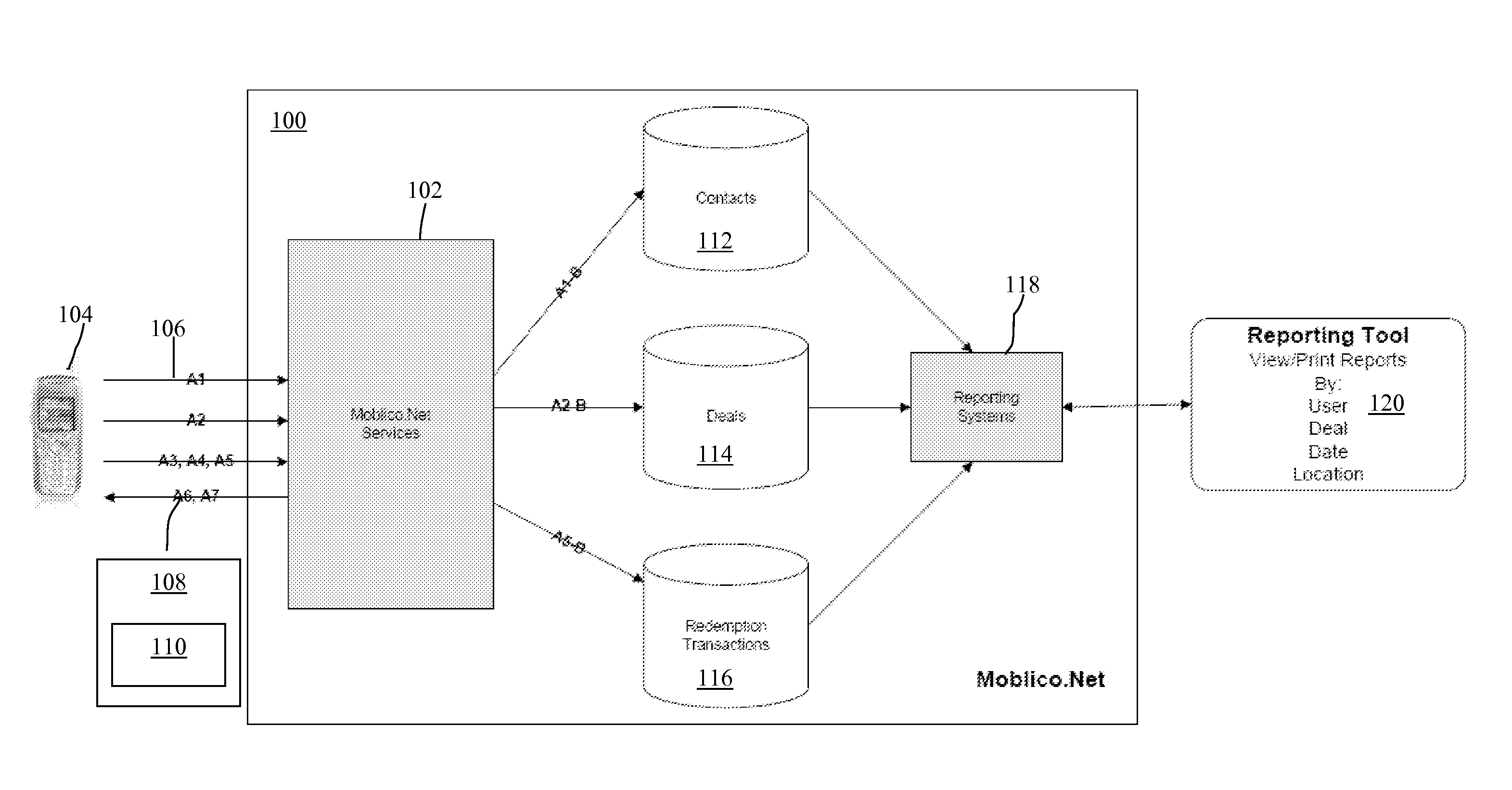

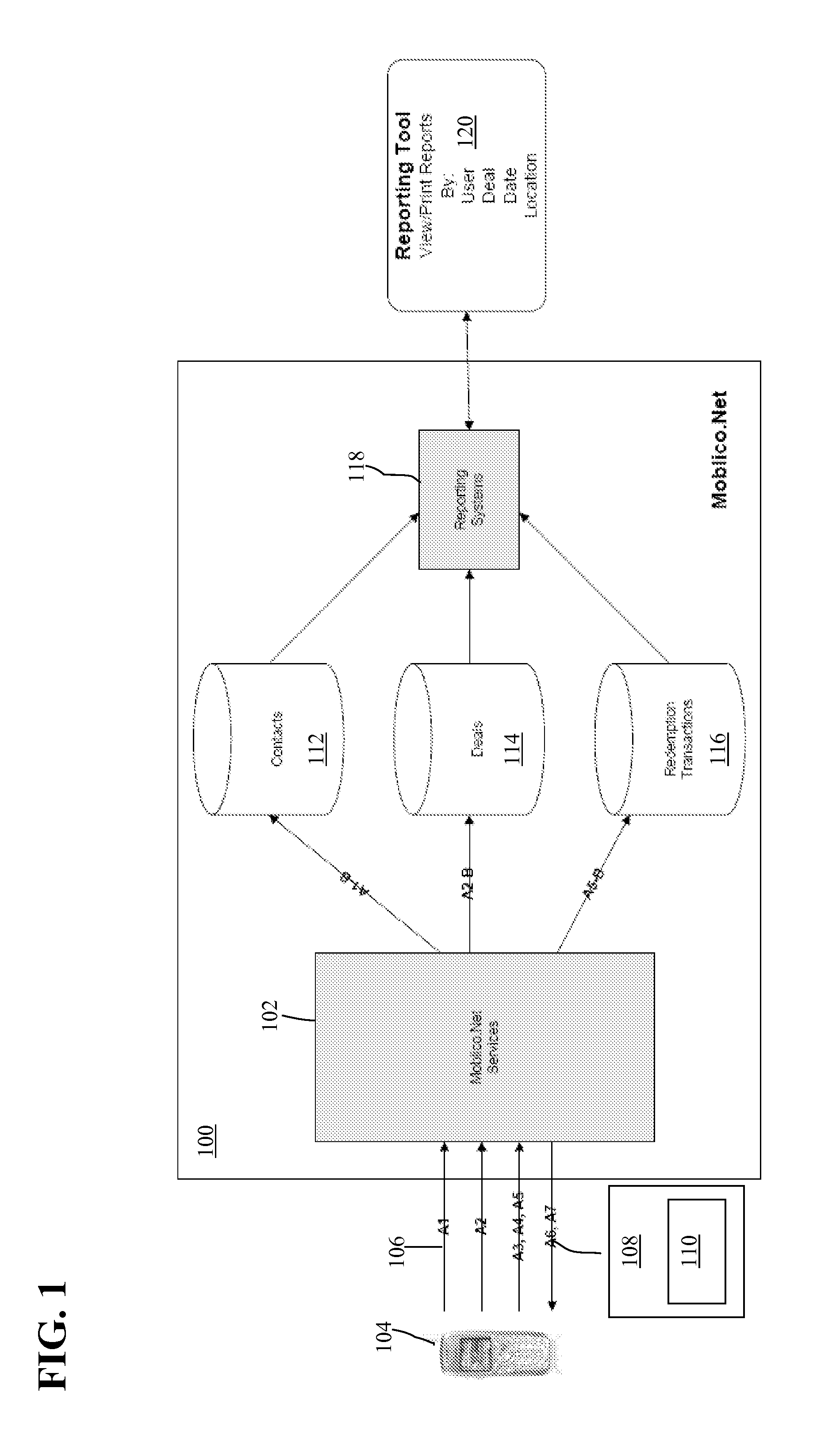

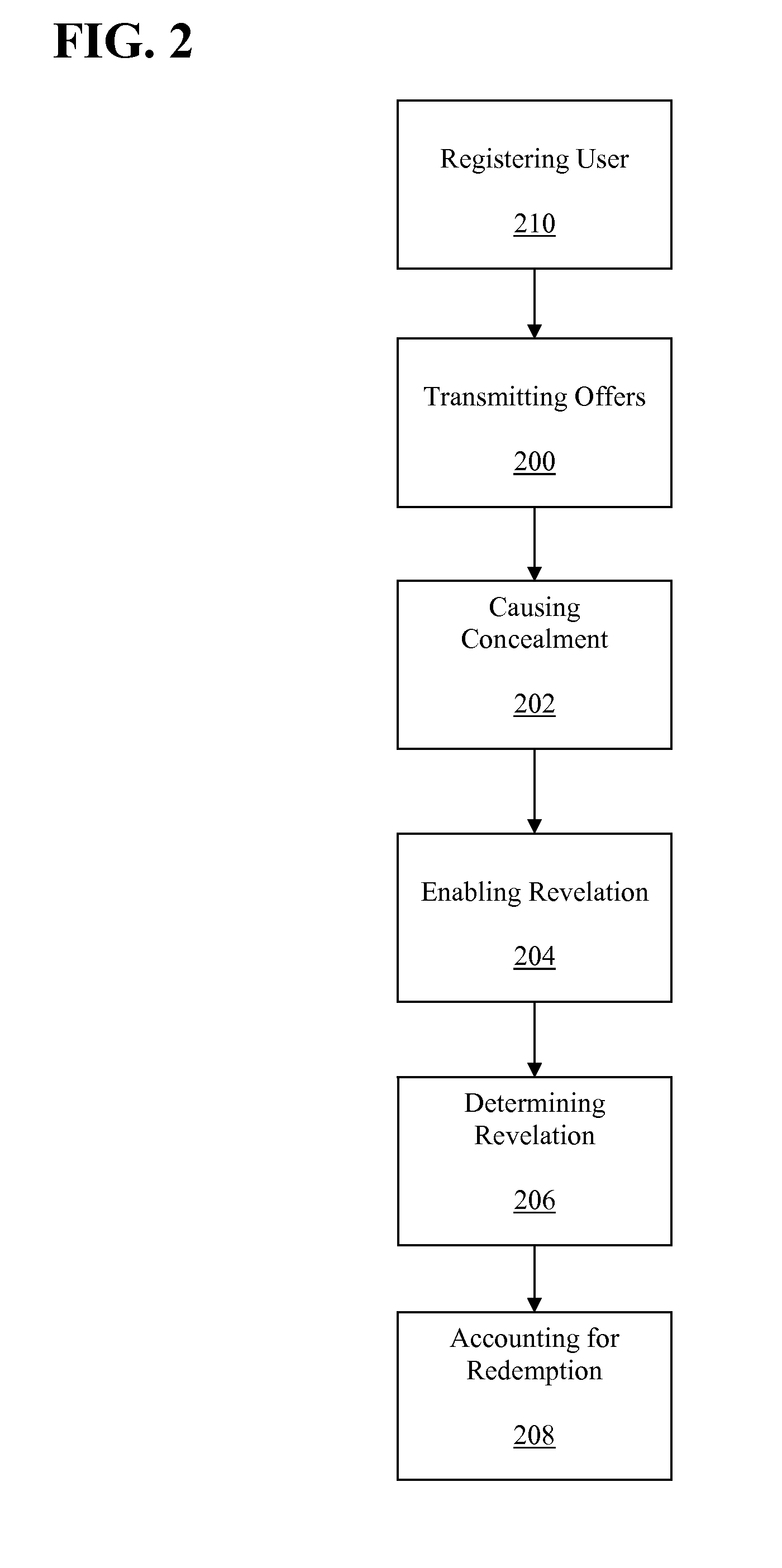

Management of an offer for a financial incentive

Owner:DST SYSTEMS

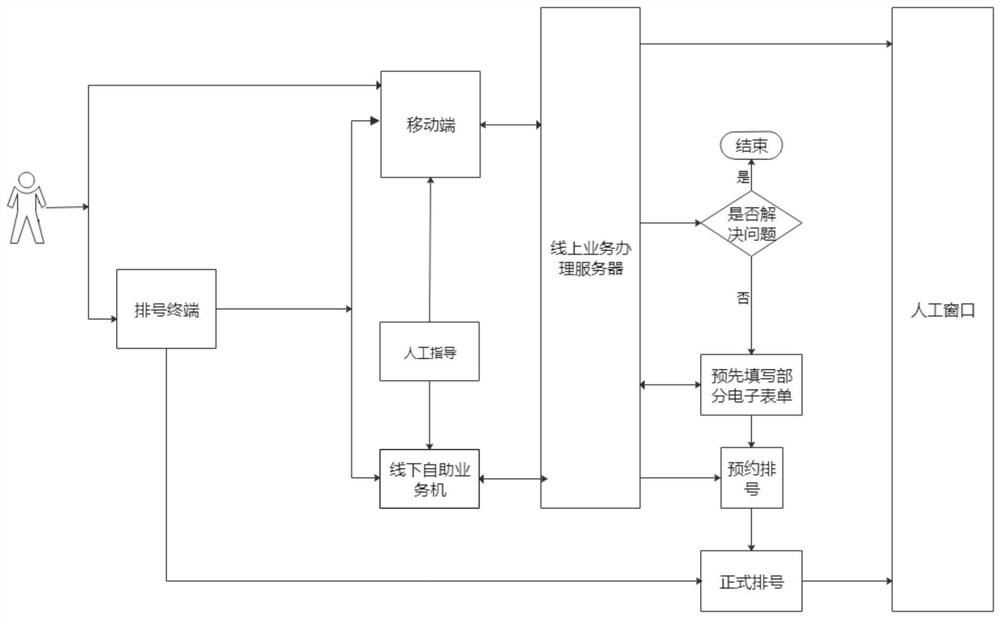

Rapid banking business handling method

PendingCN112085235ASimplify the processing stepsImprove processing speedFinanceReservationsBanking industryElectronic form

Owner:湖南三湘银行股份有限公司

Popular searches

Who we serve

- R&D Engineer

- R&D Manager

- IP Professional

Why Eureka

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Social media

Try Eureka

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap