Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

5 results about "Financial data processing" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

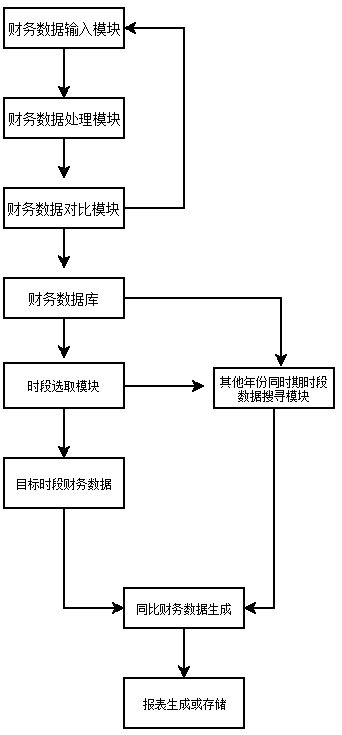

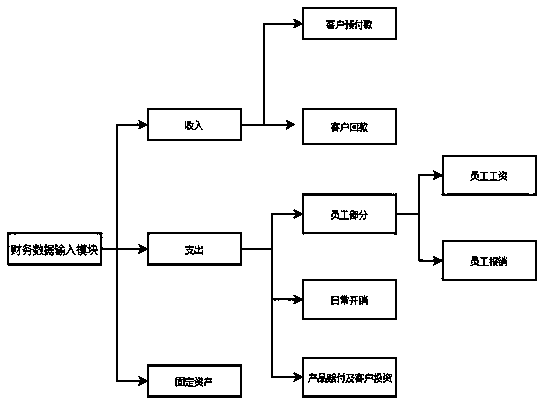

Financial data management method and system

Owner:CHANGZHOU NO 2 PEOPLES HOSPITAL

Financial data processing method, device, medium and electronic equipment

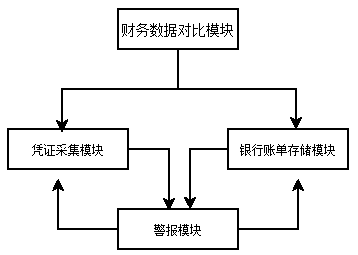

ActiveCN107798593ATroubleshoot inconsistent credentialsKeep Track of ChangesFinanceRedundant operation error correctionFinancial data processingVoucher

The embodiment of the invention provides a financial data processing method and device, a medium and electronic equipment. The financial data processing method comprises the steps of monitoring whether the business report related to the financial data is updated, generating counter-balance account data according to the data before updating of any business record when updating operation on the dataof any business record in the business report is monitored, and generating a counter-balance account voucher according to the counter-balance account data. According to the technical scheme providedby the embodiment of the invention, the counter-balance account vouchers can be consistent with the business data, and the problem that the data in the business system is inconsistent with the vouchers in a financial system is solved.

Owner:TAIKANG LIFE INSURANCE CO LTD

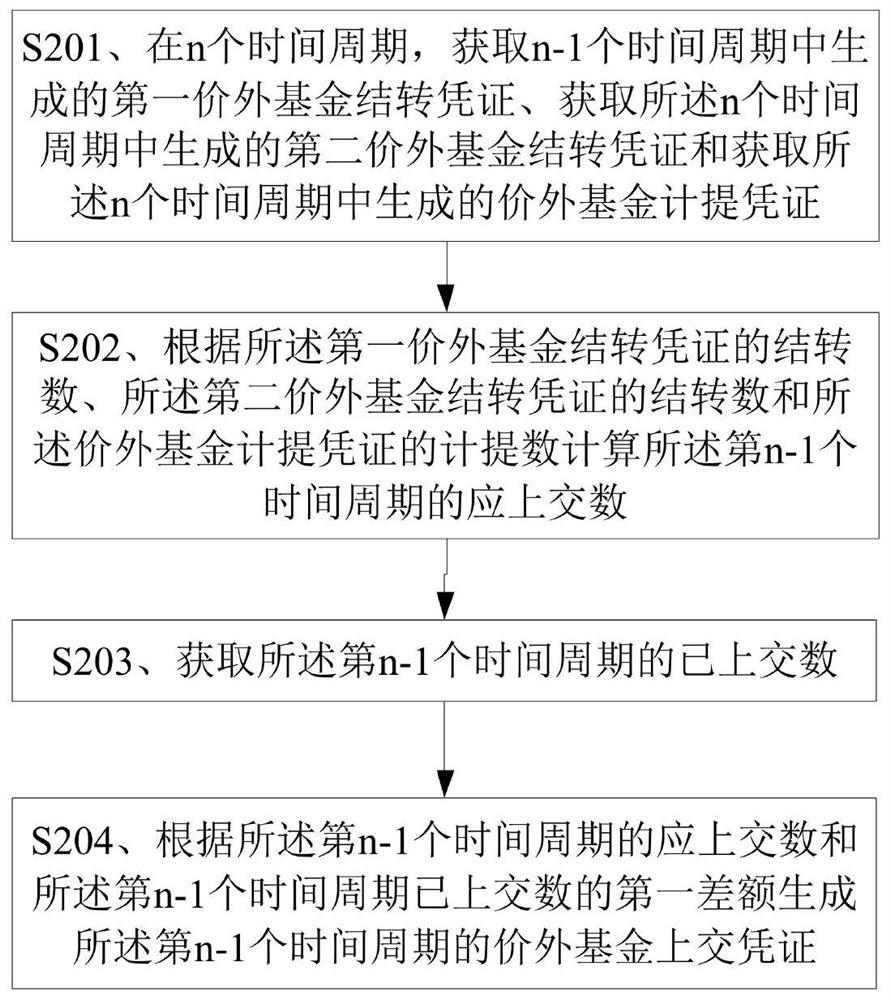

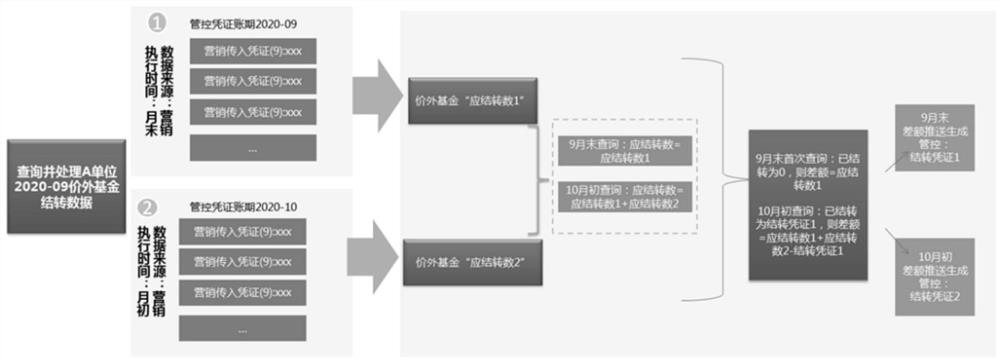

Method and device for generating fund payment voucher beyond price, storage medium and electronic equipment

Owner:YGSOFT INC

Bank account opening risk control method and system

PendingCN114782192ARealize digital risk controlEnsure safetyFinanceCharacter and pattern recognitionFinancial data processingRisk Control

The invention provides a risk control method and system for bank account opening, and relates to the technical field of financial data processing, and the method comprises the steps: carrying out the classification of a customer set of a bank, and obtaining a plurality of customer categories; determining a risk category vector of the customer category; determining a risk category vector of each biological feature recognition mode; determining a biological feature recognition mode corresponding to the customer category; determining an abnormal distance vector corresponding to each account opening data; clustering the historical account opening data to obtain a plurality of historical account opening data subsets; determining a threshold value of the historical account opening data subset corresponding to each biological feature recognition mode; when a new customer opens an account in a bank, determining a customer category to which the new customer belongs and a corresponding abnormal distance vector according to customer information filled by the new customer; and determining a biological feature recognition mode and a corresponding threshold value when the new customer opens the account in the bank, and performing identity verification on the new customer by using the biological feature recognition mode and the corresponding threshold value.

Owner:BANK OF CHINA

Who we serve

- R&D Engineer

- R&D Manager

- IP Professional

Why Eureka

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Social media

Try Eureka

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap