Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

11 results about "Risk Control" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Risk Control refers to techniques that reduce the frequency or severity of losses. This technique for managing risk is something that is seen in the community every day by risk managers and the insureds that they work to protect from risk. Risk managers usually use this technique and risk financing for treating each type of loss exposures. Some of the major risk control techniques include avoidance, loss prevention, and loss reduction.

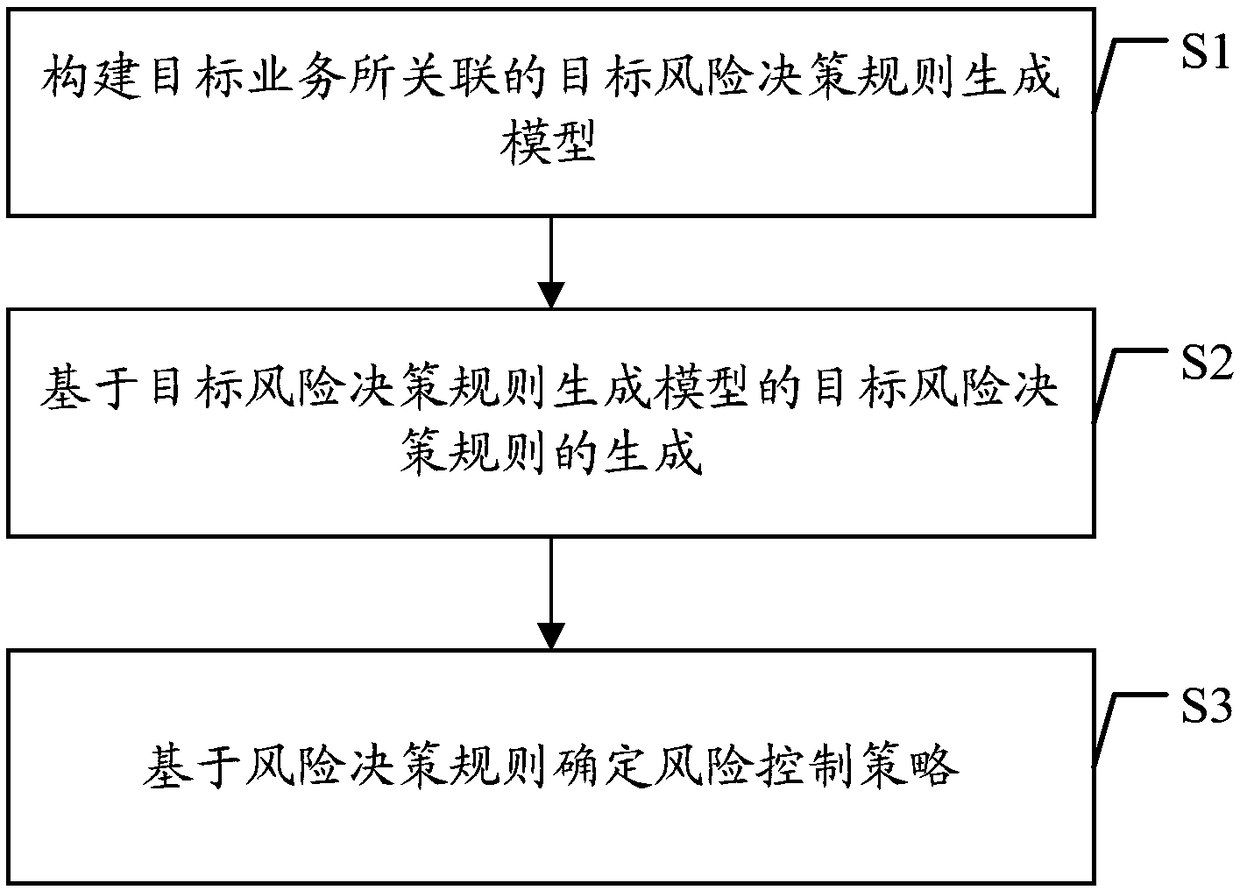

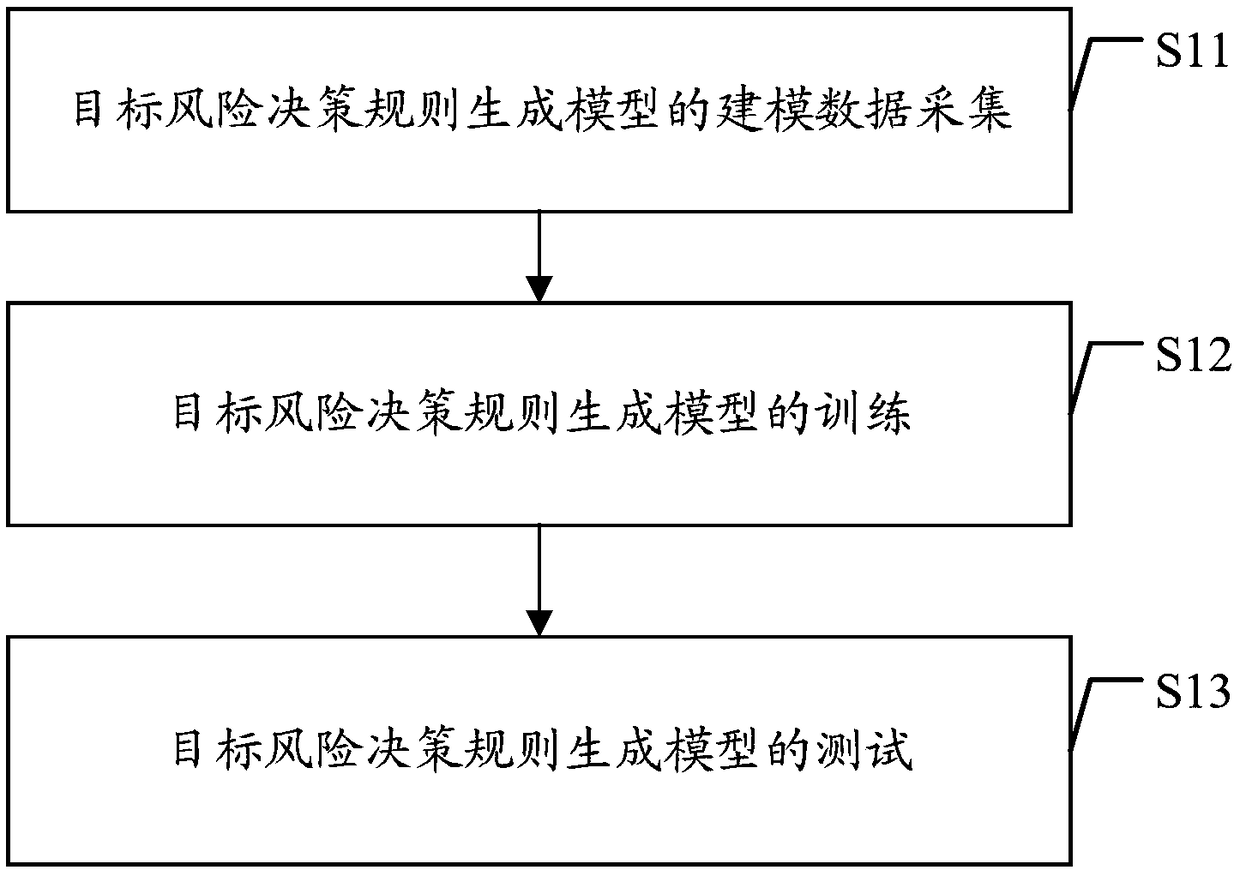

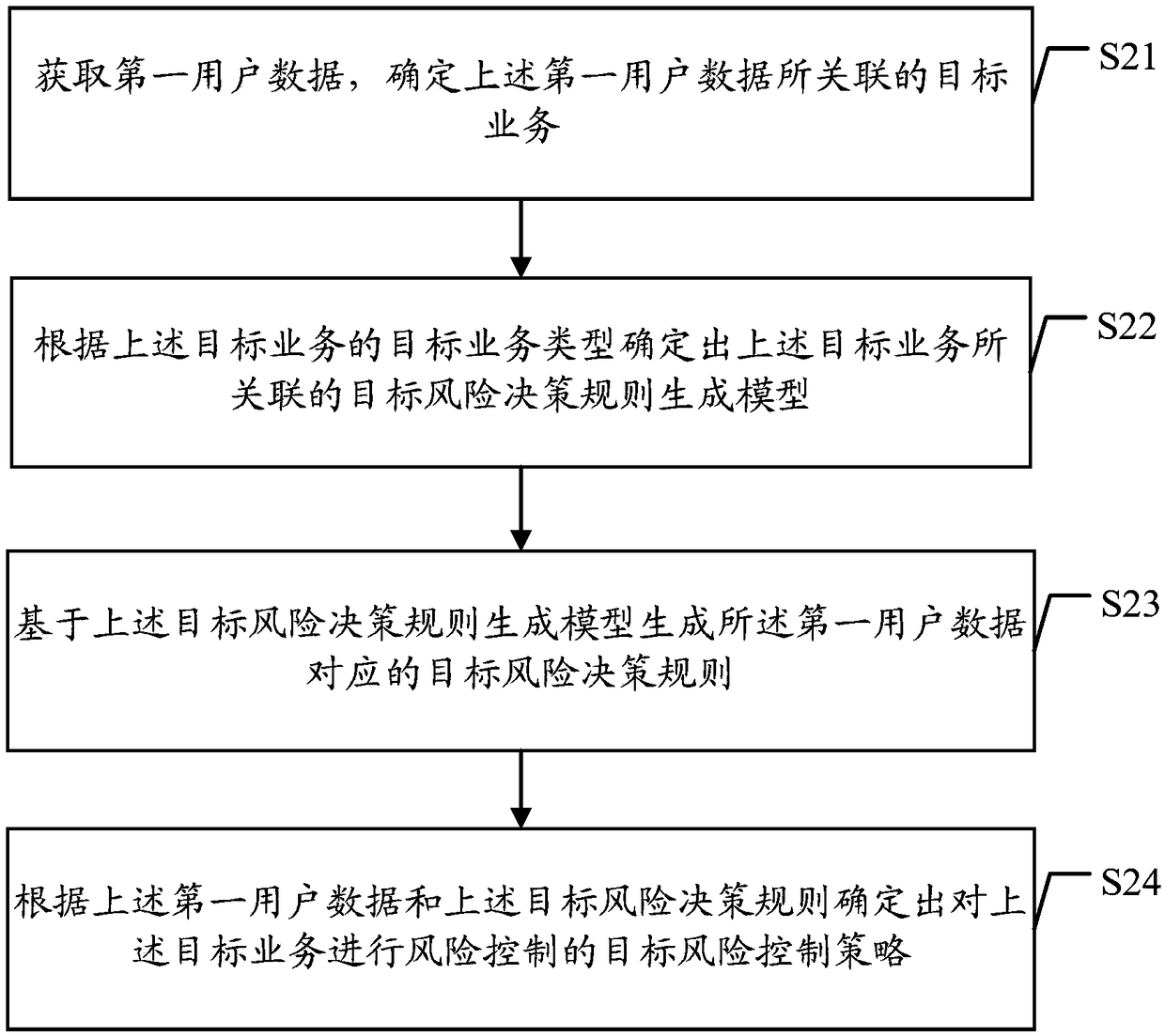

Method for determining risk control strategy based on predictive model and related device

ActiveCN109034660AIncreased generation flexibilityImprove reliabilityForecastingResourcesRisk ControlDependability

Owner:PING AN TECH (SHENZHEN) CO LTD

A vehicle financial risk control system and method

The invention provides a vehicle financial risk control system. The system comprises a vehicle-mounted terminal; and a teleprocessing terminal classifying users according to collected user vehicle driving data and performing risk control according to classification results. The teleprocessing terminal includes a receiving unit for continuously acquiring data transmitted from the vehicle-mounted terminal, a storage unit for storing the acquired data, a data analyzing unit for processing and analyzing the acquired data, a risk assessment unit for performing risk assessment on the users according to processing and analyzing results of the data analyzing unit, a user credit classification unit classifying credit risk ratings of the users according to the risk assessment results of the risk assessment unit and a decision unit performing decision and processing according to the credit ratings of the users. The beneficial effects of the present invention are that the teleprocessing terminal classifies the users and controls the risk based on the classification results, and minimizes the probability of non-performing loans to the limit by controlling the risk of goods repayment in user load application and offering.

Owner:FOSHAN TIANDIXING TECH CO LTD

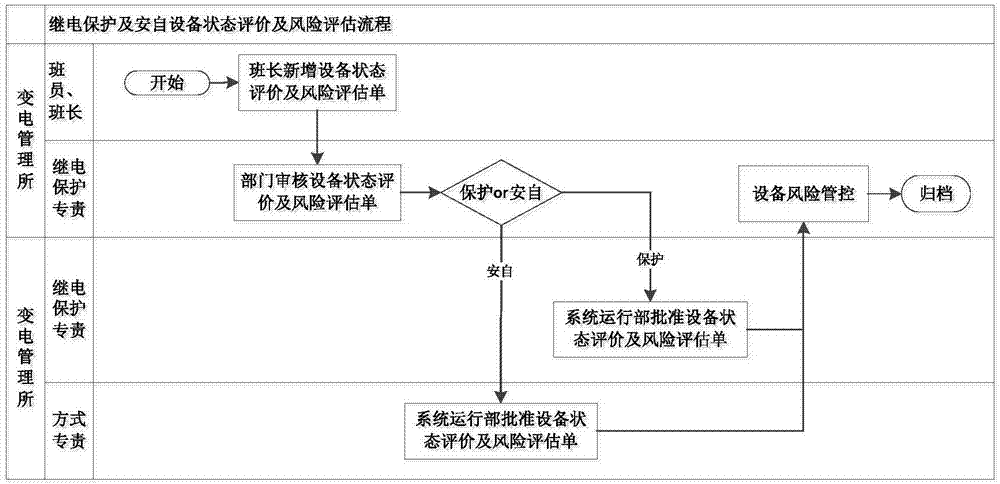

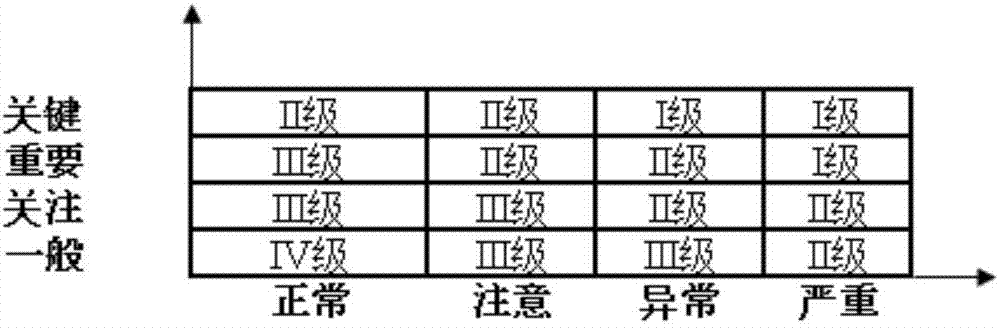

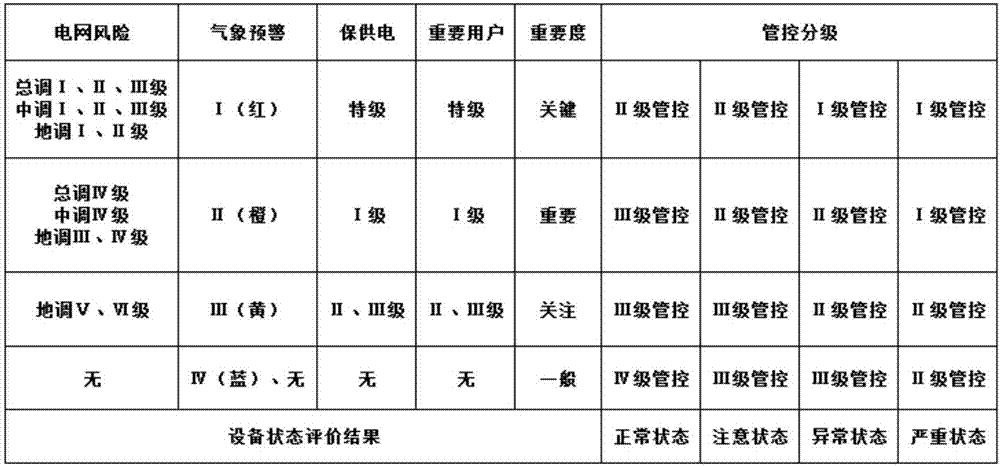

Implementation method for integrated linkage of power grid risk, equipment risk and operation risk

InactiveCN107368955AImplement business dependenciesAvoid mistakesResourcesRisk ControlBusiness Personnel

Owner:GUANGXI POWER GRID CORP

Method and device for screening users and electronic equipment

PendingCN110807653ATo achieve the purpose of refined managementImplement a differentiated screening strategyMarket predictionsFinanceRisk ControlEngineering

The invention discloses a method and device for screening users, electronic equipment and a computer readable medium, and the method comprises the steps: obtaining user data, and creating a user riskportrait; dividing the users into a plurality of customer groups according to the user risk portraits; constructing a risk rule, and filtering the users in the plurality of customer groups according to the risk rule; segmenting the users in the filtered customer groups to form customer group blocks; and screening the customer group blocks according to the income and risk data of the customer groupblocks to complete user screening. According to the invention, the customer groups can be divided through the user risk portraits, and the users in different customer groups are screened in combination with the risk rules and the user behavior scores, so that accurate risk control is achieved.

Owner:BEIJING QIYU INFORMATION TECH CO LTD

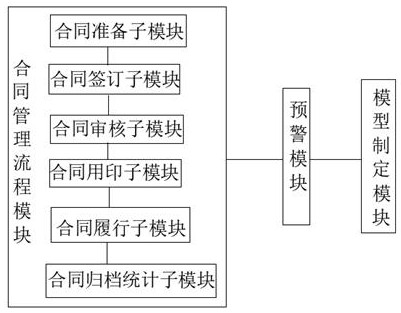

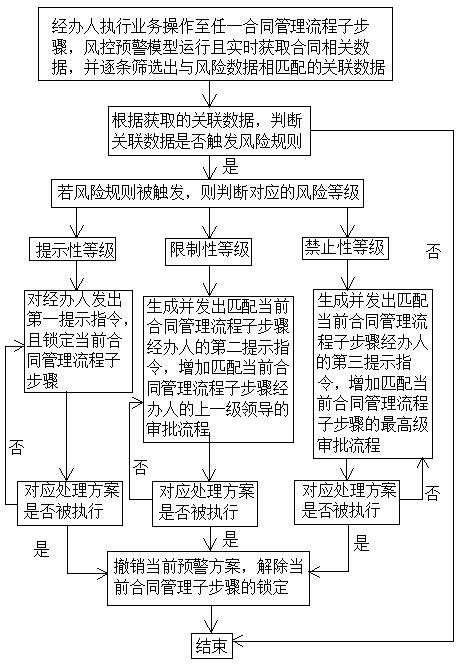

Contract signing management method, system and device

Owner:JIANGSU JINHENG INFORMATION TECHNOLOGY CO LTD +1

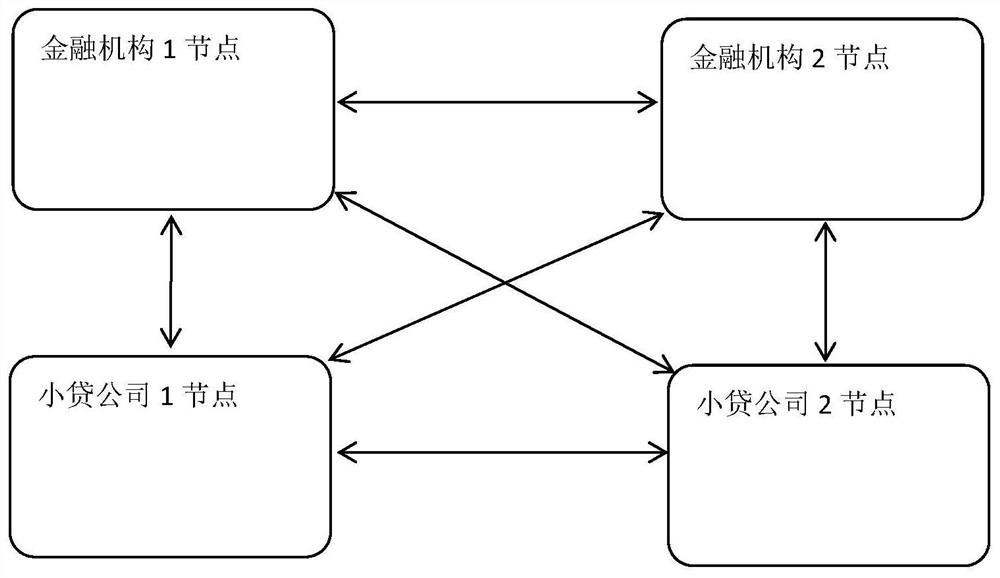

Combined loan business platform based on block chain and loan management method

PendingCN112508681AImprove liquidityAvoid Duplicate Loan SituationsFinanceSpecial data processing applicationsRisk ControlBusiness enterprise

Owner:CHINA ZHESHANG BANK

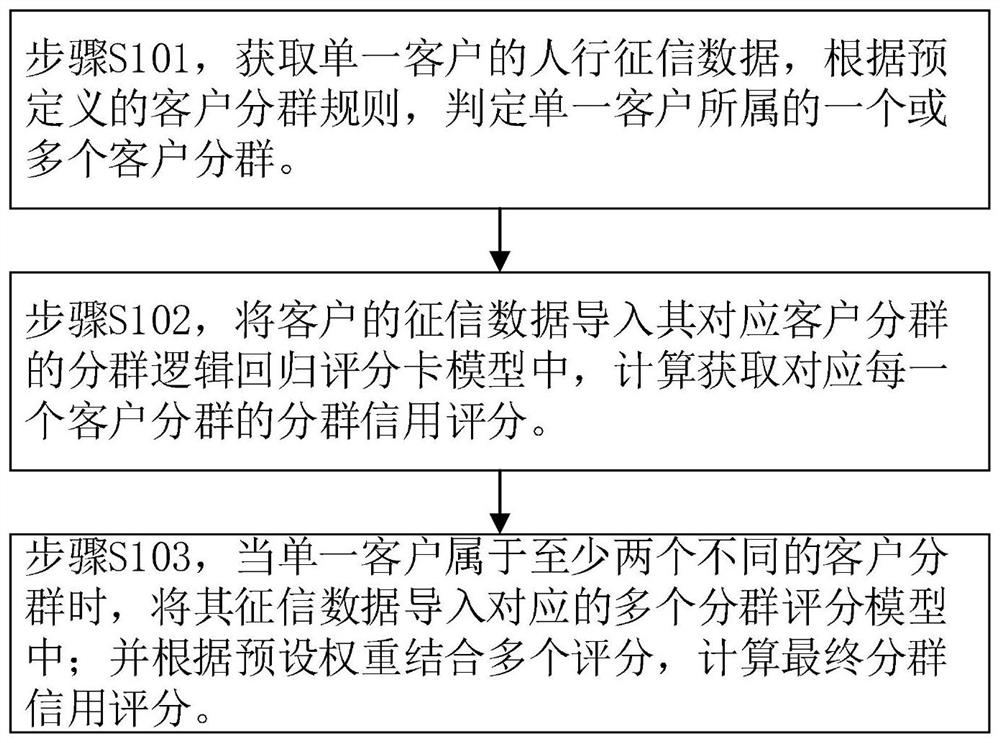

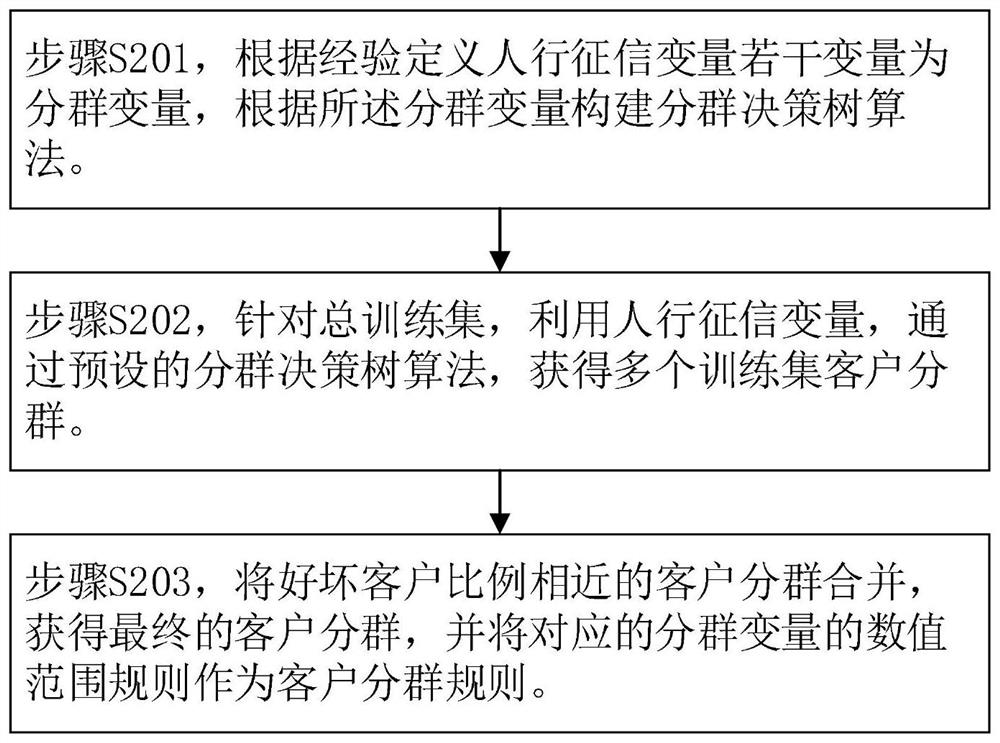

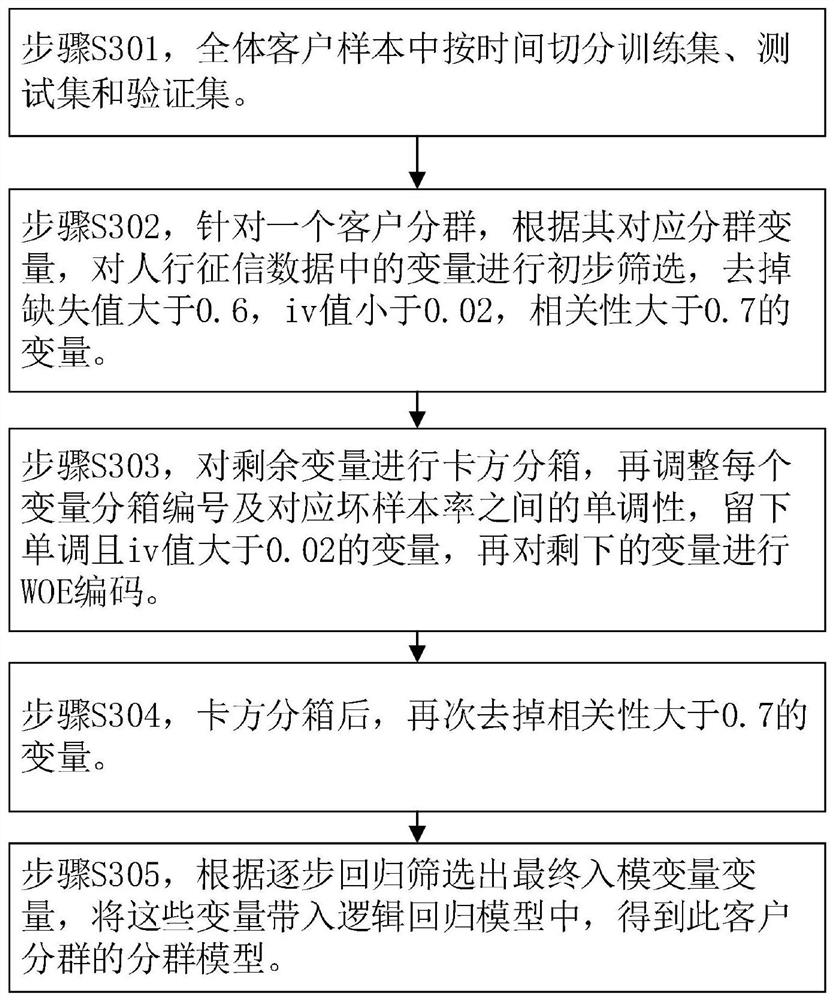

Consumption financial product credit scoring method and device based on customer grouping

Owner:杭州信雅达泛泰科技有限公司

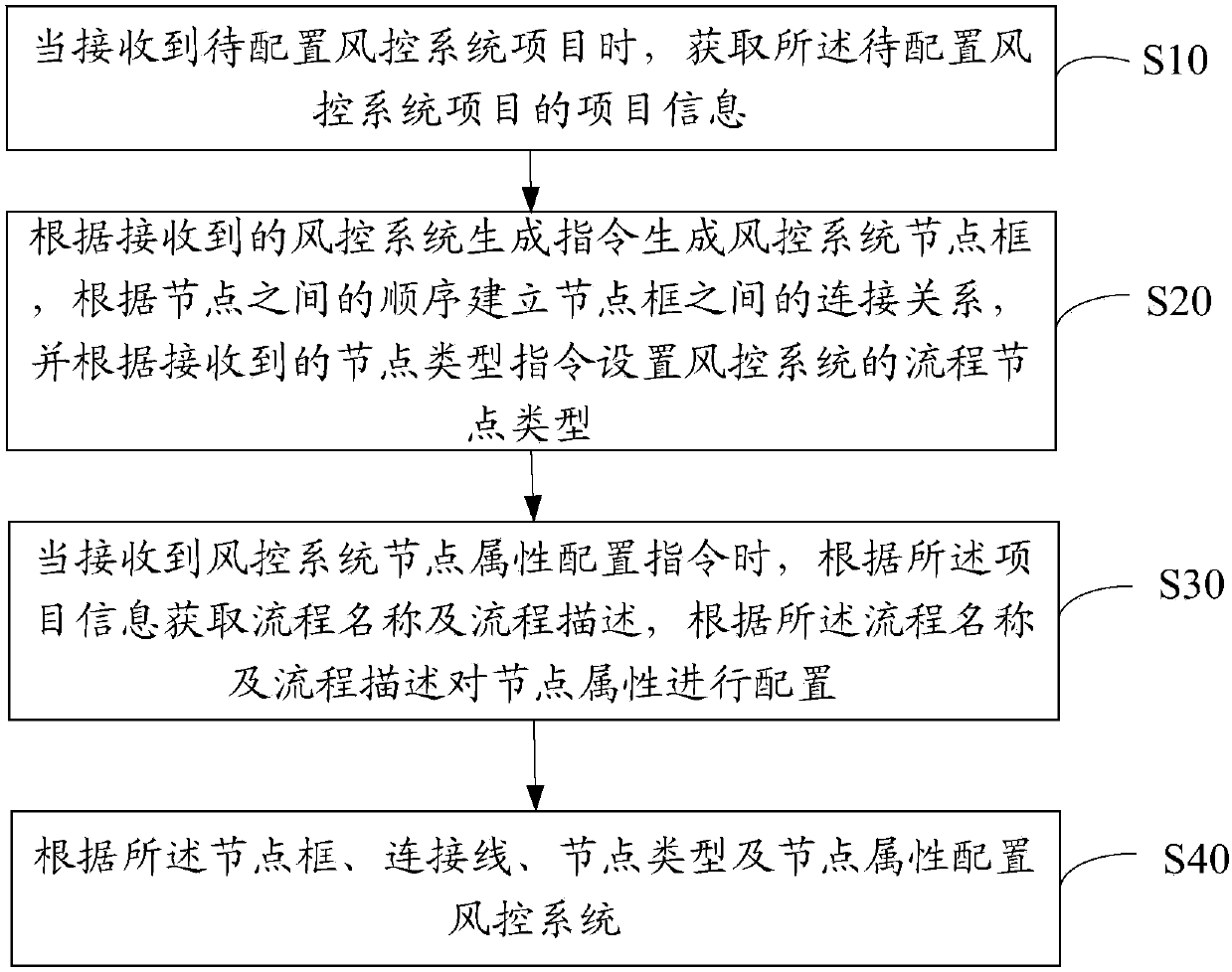

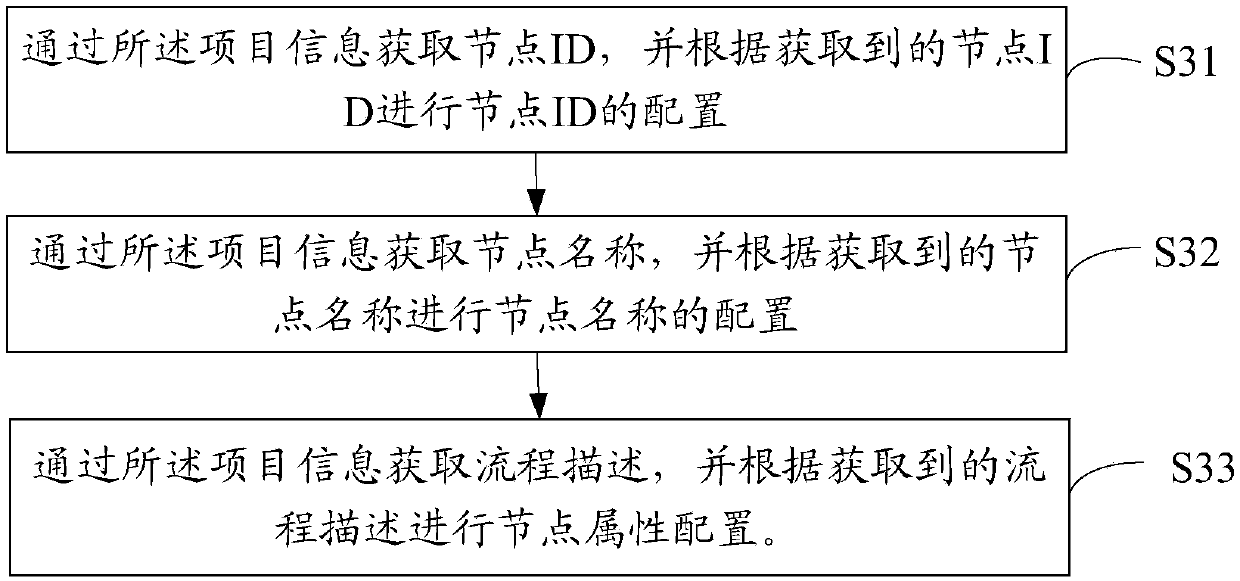

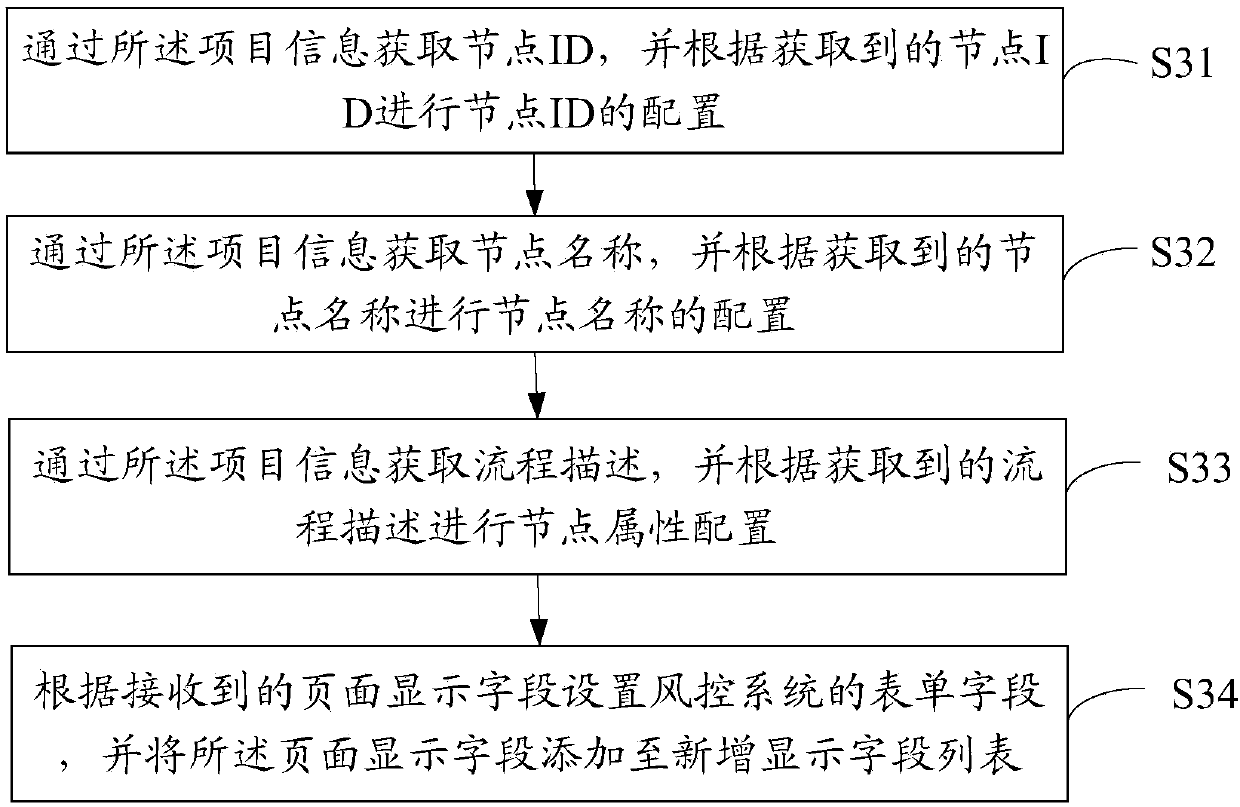

Risk control system configuration method, device and equipment and readable storage medium

InactiveCN109725884AImprove configuration efficiencyPromote rapid developmentSoftware designResourcesRisk ControlProcess description

Owner:平安好房(上海)电子商务有限公司

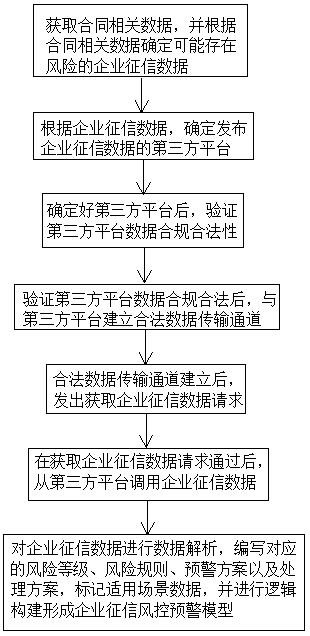

Supply chain financial risk management and control system based on insurance intermediary industry

PendingCN111882448ASolve the problem of authenticityNew real-timeFinanceDatabase management systemsRisk ControlBusiness enterprise

The invention relates to a supply chain financial risk management and control system based on the insurance intermediary industry, and the system comprises: a risk management module, wherein the inputend of the risk management module is connected with a credit module, and the output end of the risk management module is connected with a publicity module and a risk control data analysis module; thecredit module is used for collecting credit information of an enterprise; the risk management module is used for collecting receivable information and credit information of an enterprise, and performing data analysis and risk management anti-fraud verification; the publicity module automatically imports receivable pledge information and detention information after repayment; and the risk controldata analysis module is used for integrating and analyzing the financing request, and submitting the financing request to the insurance intermediary end and the fund party end after successful rechecking. The invention provides a supply chain financial business solution specially for the intermediary industry, and provides a supply chain financial risk management and control system based on the insurance intermediary industry in combination with risk points in a business link, which is used for supporting financing.

Owner:JIANGSU XINXINBAO TECH CO LTD

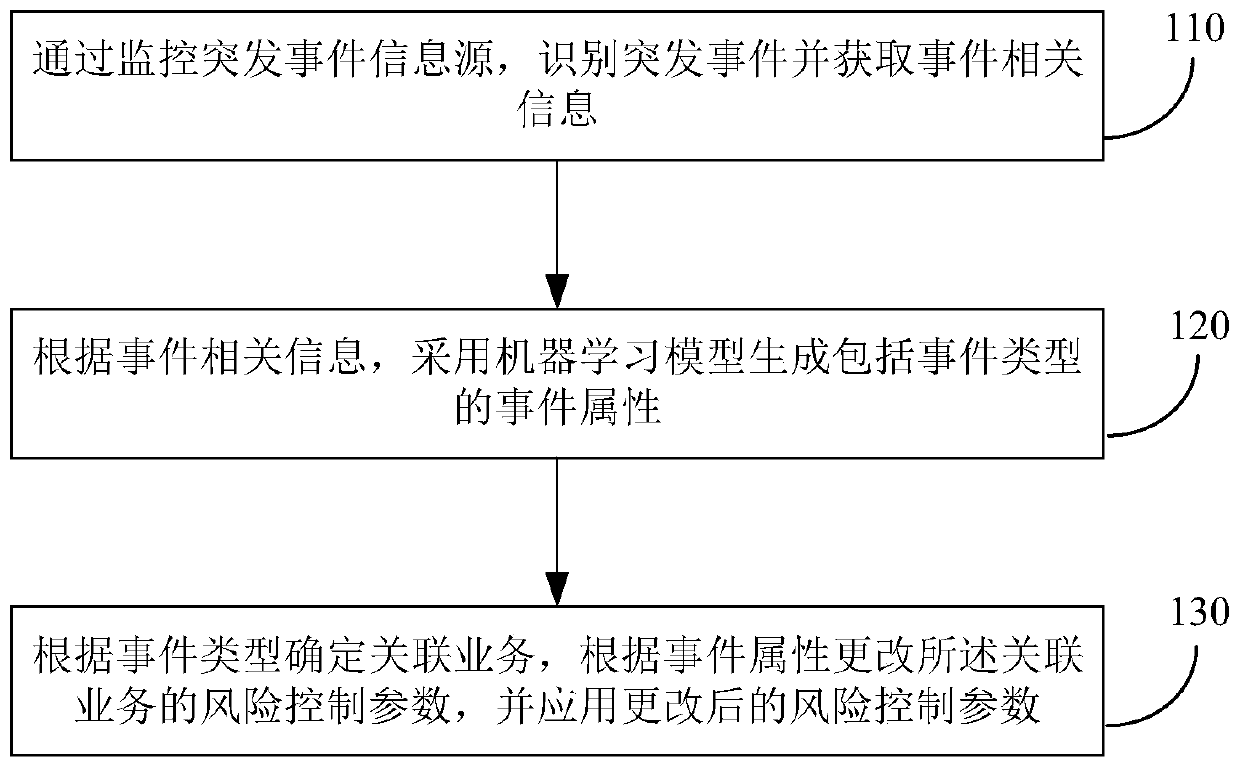

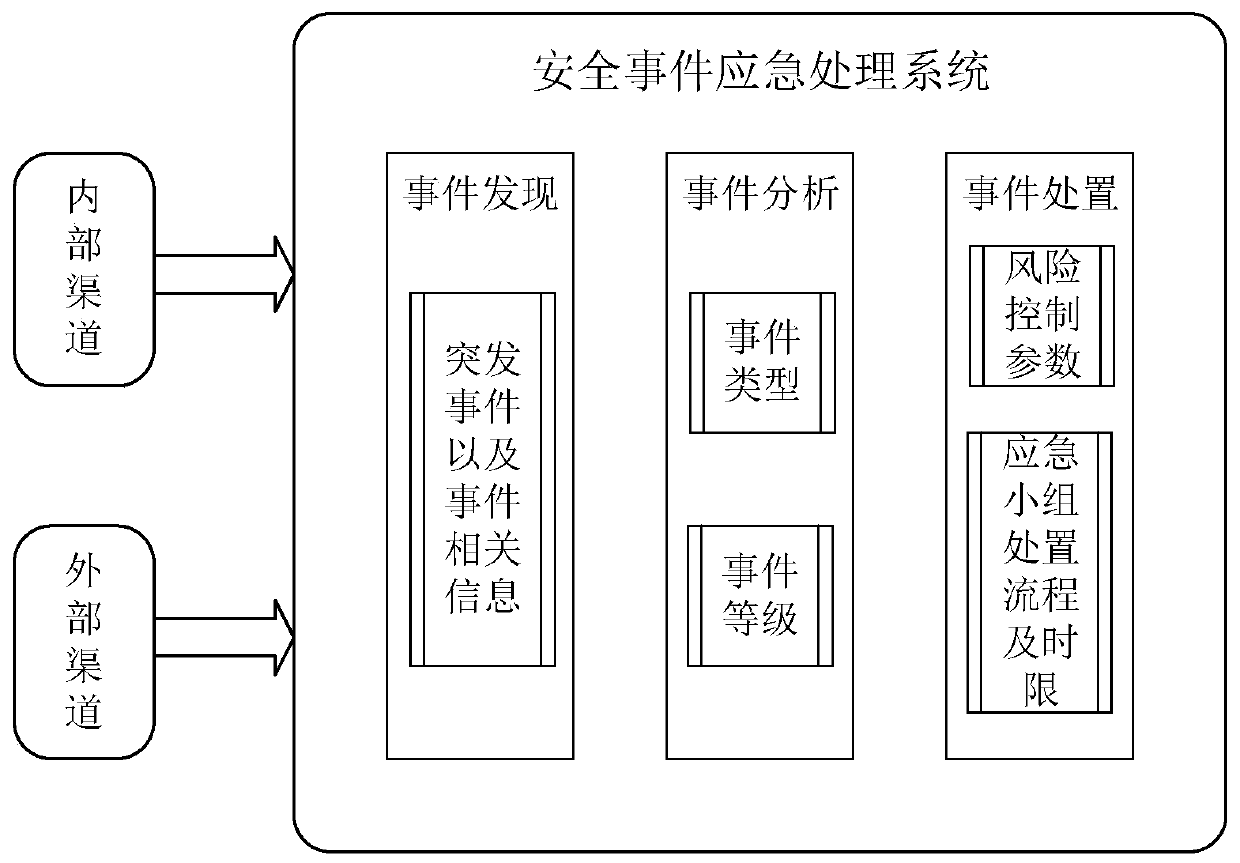

Method and device for coping with emergencies

Owner:ADVANCED NEW TECH CO LTD

Bank account opening risk control method and system

PendingCN114782192ARealize digital risk controlEnsure safetyFinanceCharacter and pattern recognitionFinancial data processingRisk Control

The invention provides a risk control method and system for bank account opening, and relates to the technical field of financial data processing, and the method comprises the steps: carrying out the classification of a customer set of a bank, and obtaining a plurality of customer categories; determining a risk category vector of the customer category; determining a risk category vector of each biological feature recognition mode; determining a biological feature recognition mode corresponding to the customer category; determining an abnormal distance vector corresponding to each account opening data; clustering the historical account opening data to obtain a plurality of historical account opening data subsets; determining a threshold value of the historical account opening data subset corresponding to each biological feature recognition mode; when a new customer opens an account in a bank, determining a customer category to which the new customer belongs and a corresponding abnormal distance vector according to customer information filled by the new customer; and determining a biological feature recognition mode and a corresponding threshold value when the new customer opens the account in the bank, and performing identity verification on the new customer by using the biological feature recognition mode and the corresponding threshold value.

Owner:BANK OF CHINA

Who we serve

- R&D Engineer

- R&D Manager

- IP Professional

Why Eureka

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Social media

Try Eureka

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap