Check cashing system

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Example

EXAMPLE 1

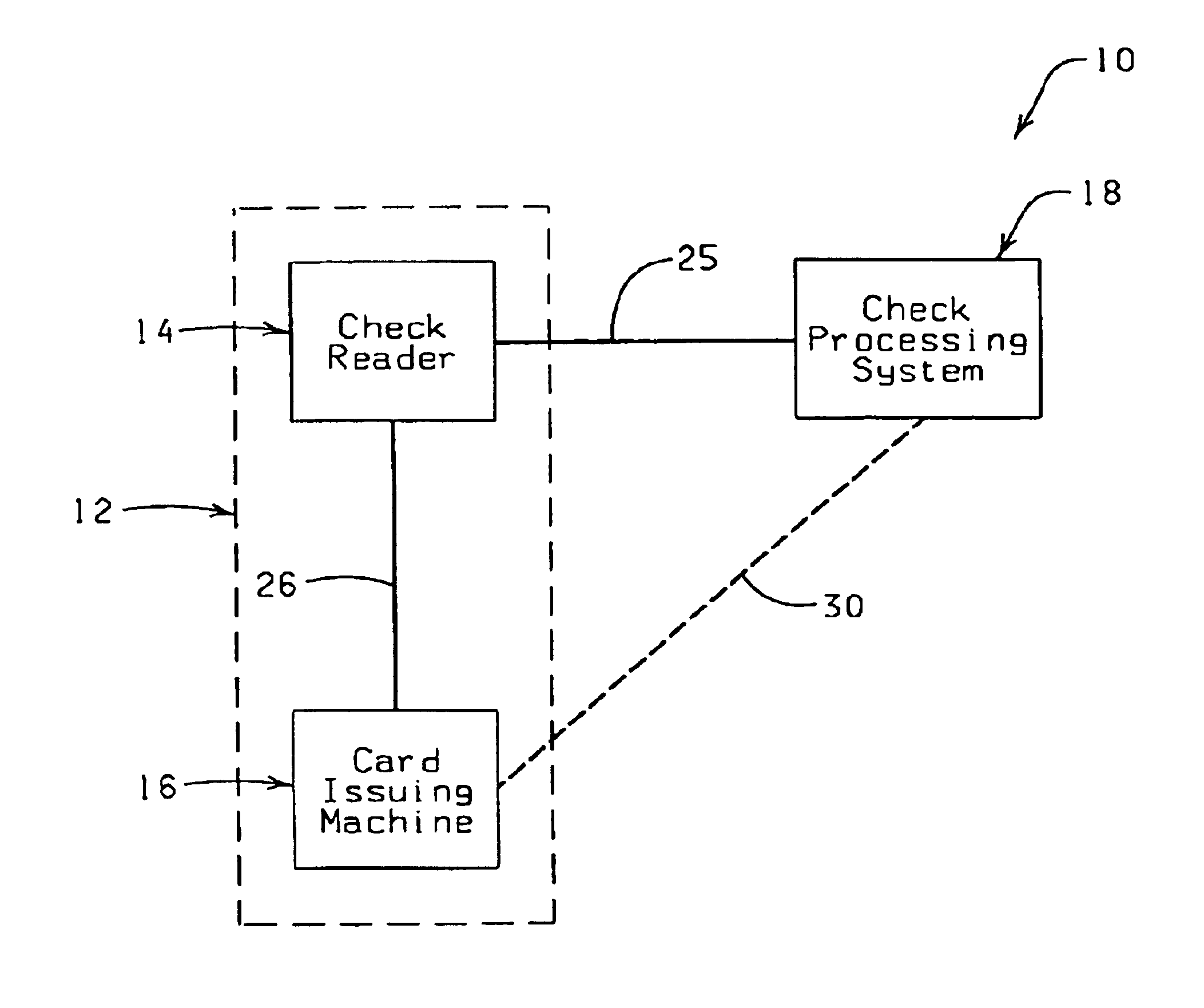

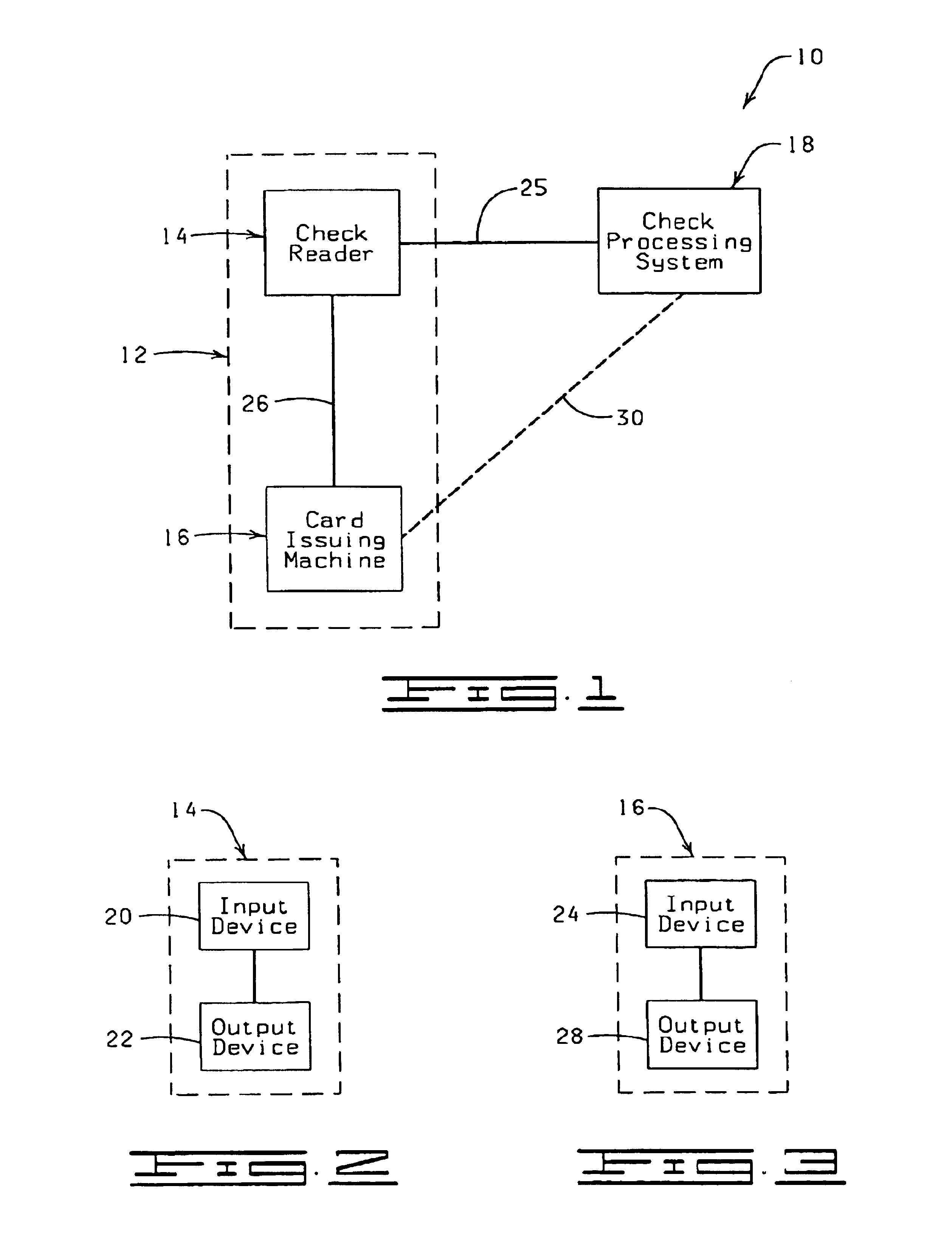

The check reader 14 can be positioned at a point-of-sale terminal provided at a retail location, such as a convenience store or a grocery store. The check processing system 18 can be a web-site on the Internet or a database server having computer hardware located at or remote from the retail location. A customer brings a check written for $100 to the point-of-sale terminal provided at the retail location. A check cashing signal, including the check code, is transmitted to the check processing system 18 via a local area network. The check processing system 18 validates and records the cashing of the $100 check and assigns a unique authorization code to identify the cashing of the $100 check. The authorization code is transmitted from the website to the check reader 14 via the signal path 20. The authorization code is transmitted to the point-of-sale terminal and printed on a receipt for the customer. The customer travels to any card issuing machine 16 having access to the Inter

Example

EXAMPLE 2

A customer brings a check written for $100 to the check reader 14 provided at a retail location. The check is read by the check reader 14 and a check cashing signal, including the check code, is transmitted to the check processing system 18 via a local area network. The check processing system 18 validates and records the cashing of the $100 check and assigns a unique authorization code to identify the cashing of the $100 check. The authorization code is transmitted from the check processing system 18 to the check reader 14 via the signal path 25. The authorization code is displayed on the check reader 14 where the clerk reads the authorization code and manually enters the authorization code into the card issuing machine 16 for the customer which is in the same location as that of the clerk. The card issuing machine 16 transmits the authorization code to the check processing system 18 via the signal path 30 and obtains authorization to provide the customer with the outputted c

Example

EXAMPLE 3

A son who lives in New York wishes to send money to his mother living in Oklahoma. The son goes to a kiosk and gives a clerk his paycheck. The clerk then runs the check through a check reader 14 or manually enters the check's routing code into a keypad provided by the check reader 14. The check code is transmitted via a signal path to the check processing system 18 or another third-party database. An authorization code is provided representing at least one of a guarantee or authorization. The check reader 14, provided with a printer terminal, receives the authorization code and prints a receipt having the authorization code. The clerk hands the receipt to the son. The son then calls or e-mails his mother and provides the authorization code to her. The mother goes to a card issuing machine 16 in Oklahoma and manually enters the authorization code into the input device 24 (keypad) of the card issuing machine 16, which in this instance is typically connected to part of a network

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap