Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

66results about "Payment architecture" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Roadside assistance service provider assignment system

Owner:ALLSTATE INSURANCE

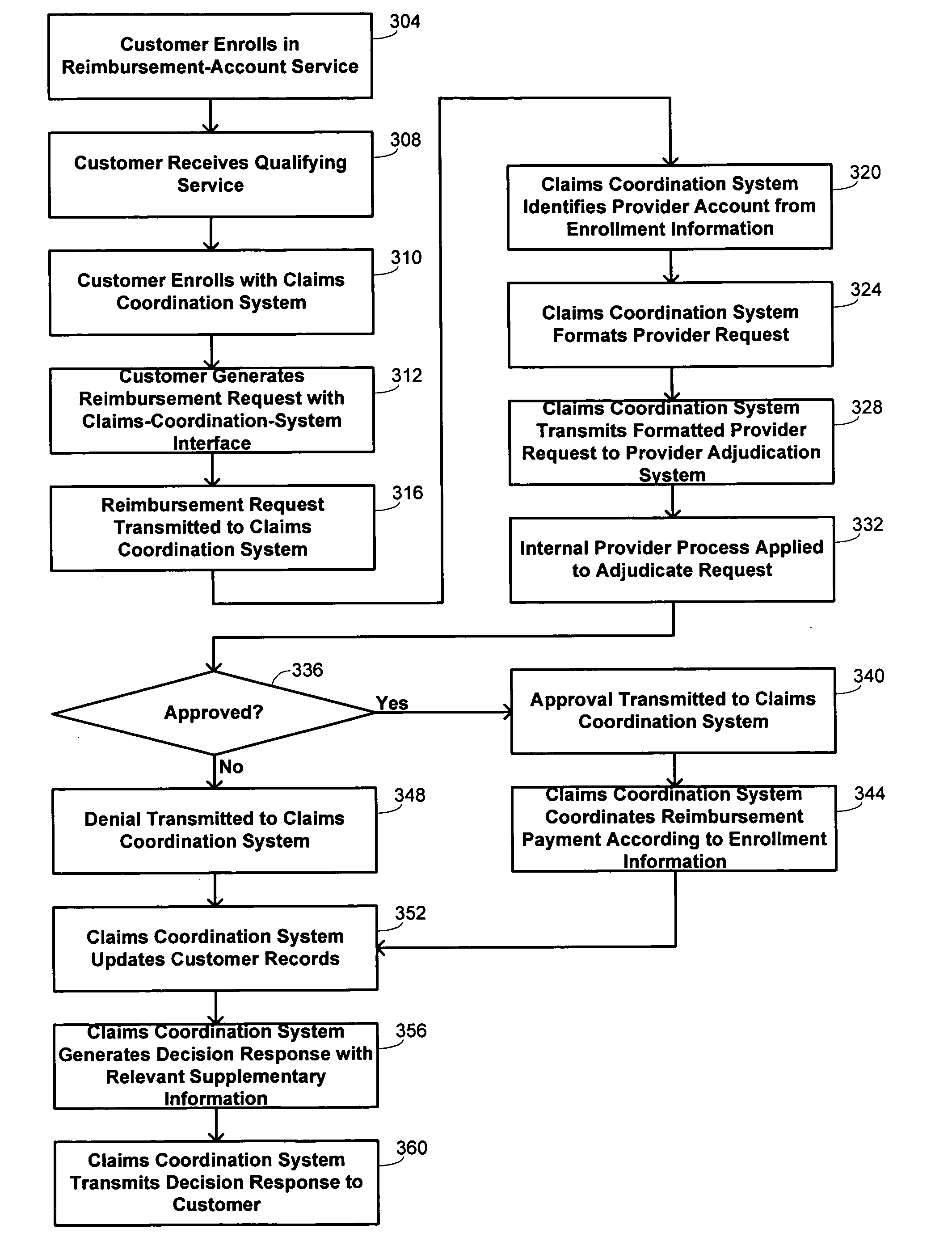

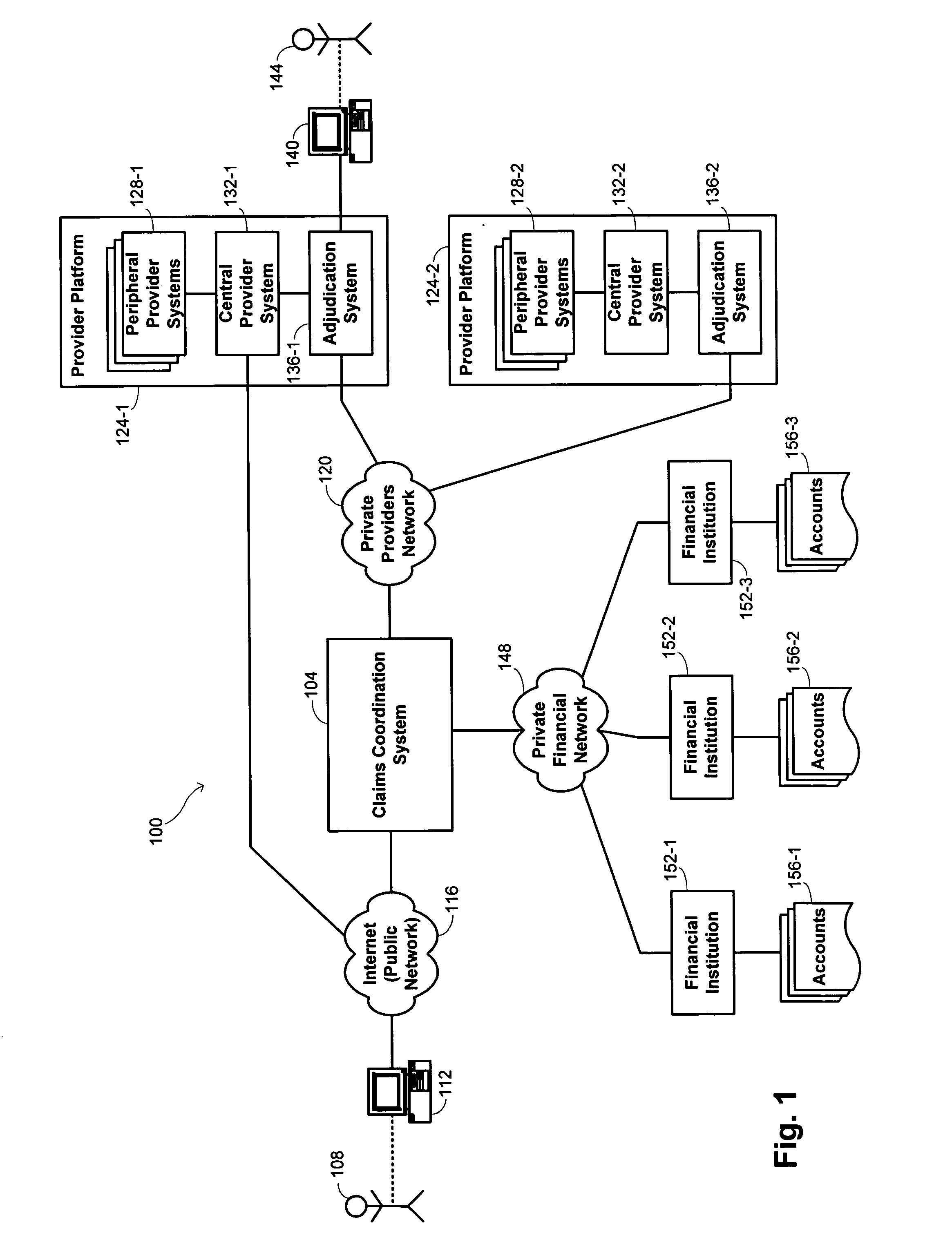

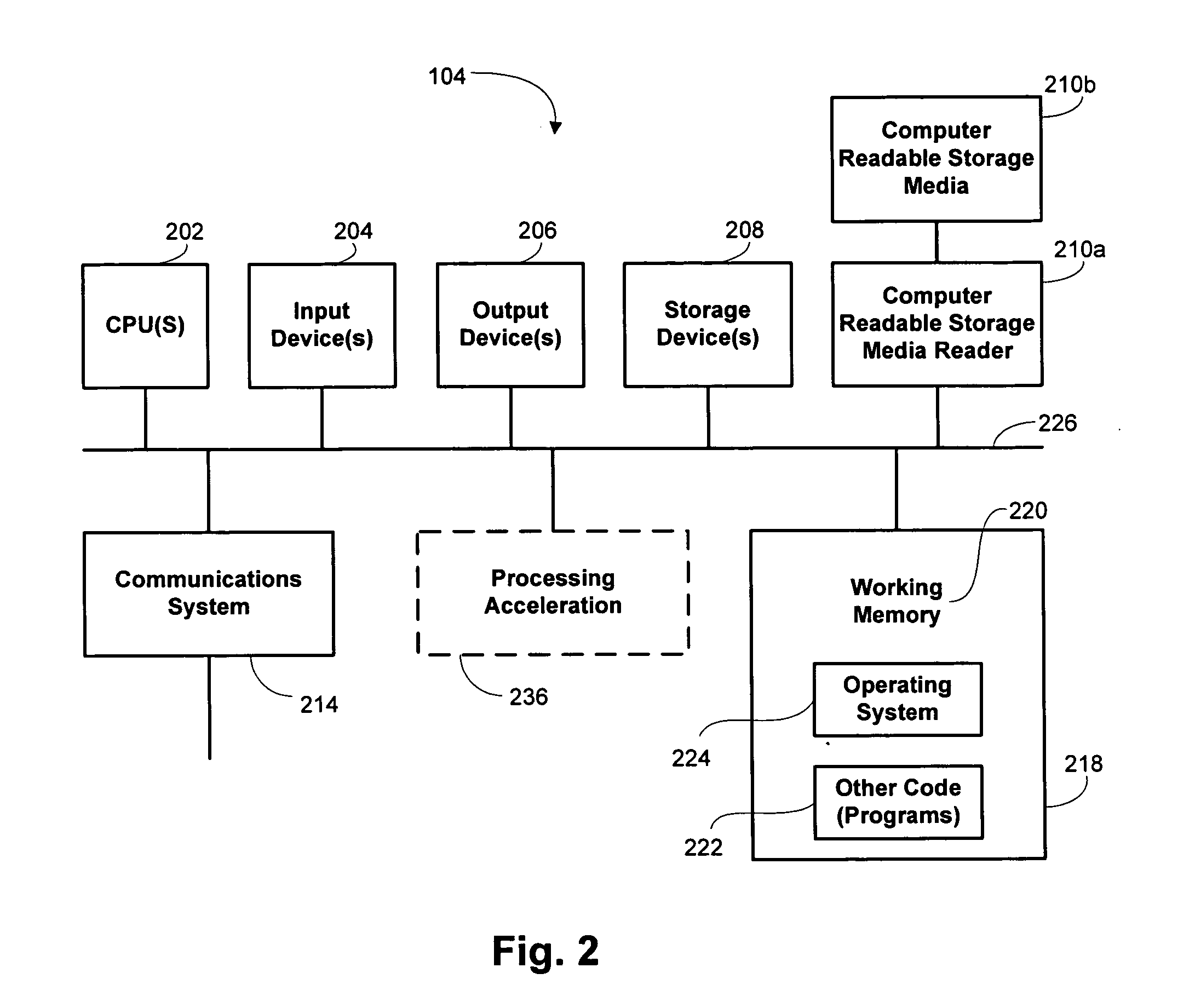

Methods and systems for adjudication and processing of claims

Owner:FIDELITY INFORMATION SERVICES LLC

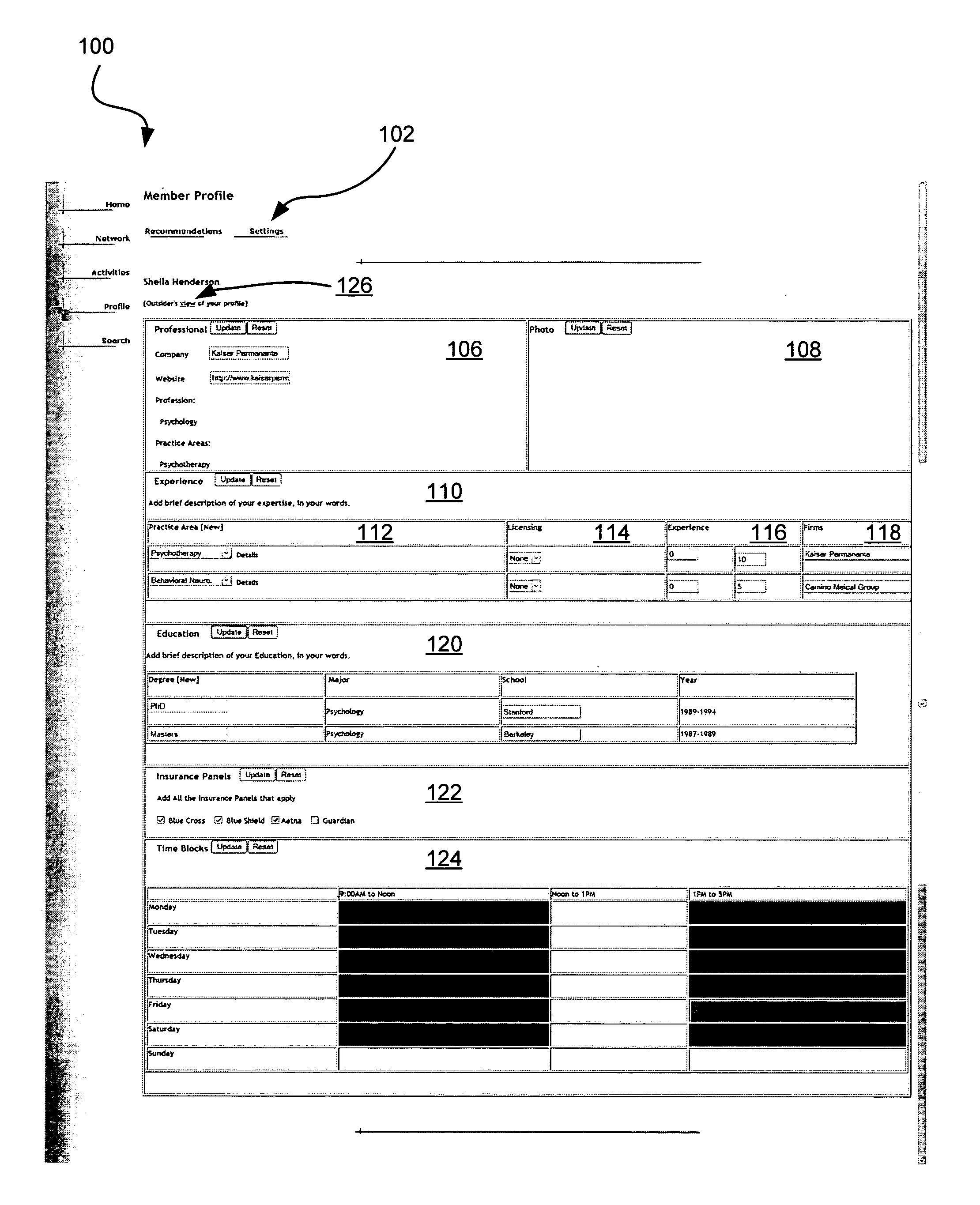

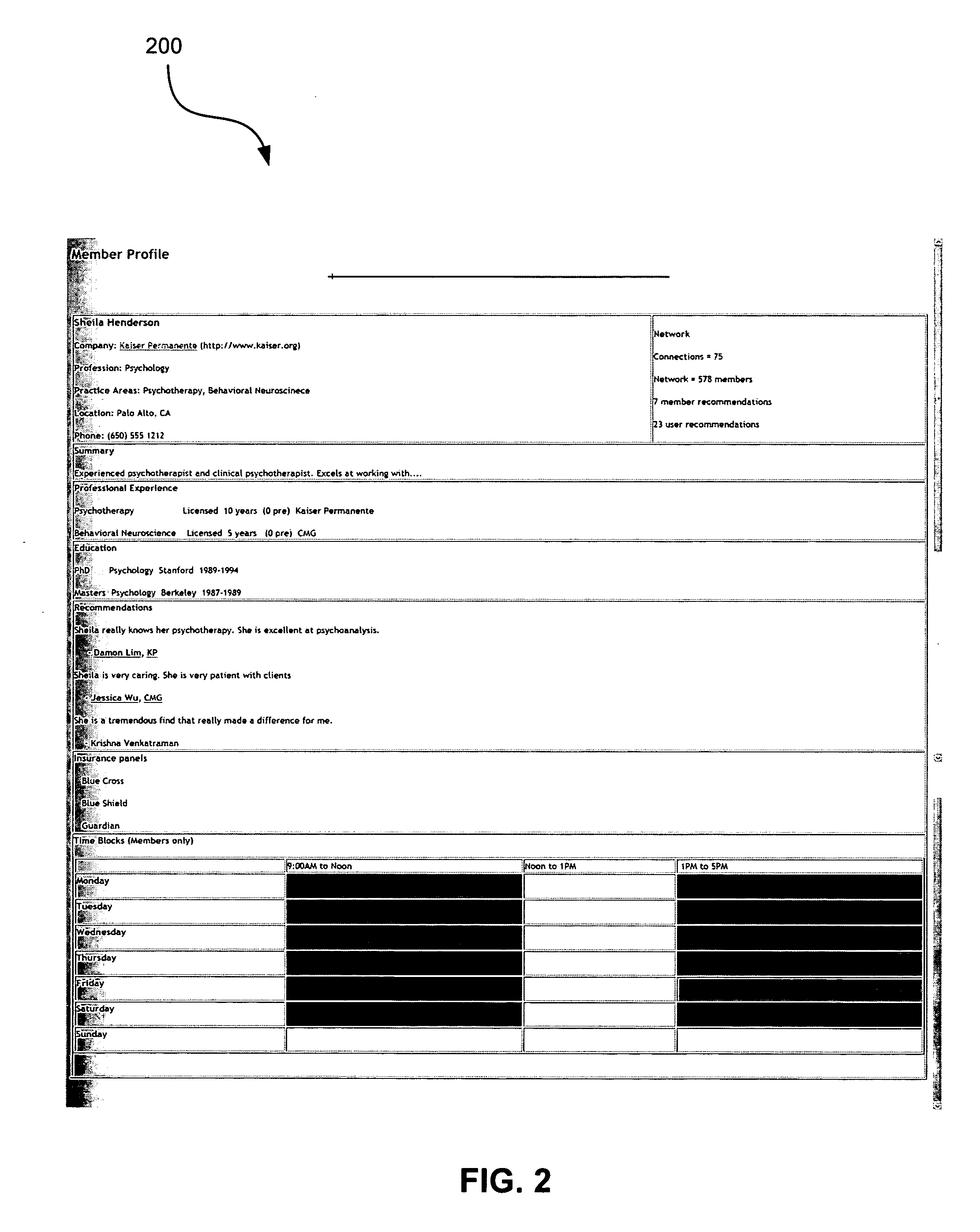

System and method for online professional services networks

InactiveUS20060004623A1Facilitate negotiationTelemedicinePayment architecturePaymentTerms of service

Owner:JASTI RAJA V

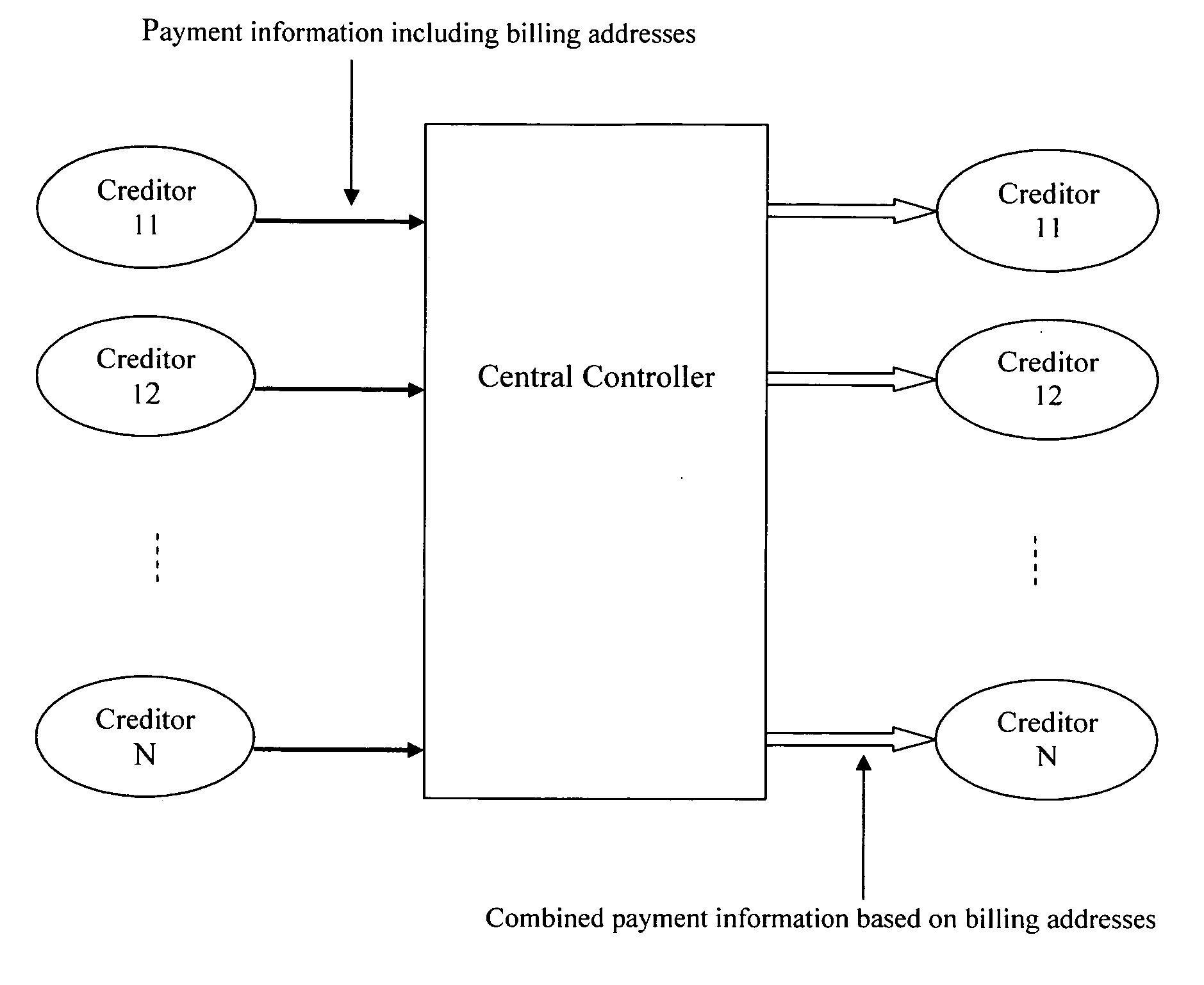

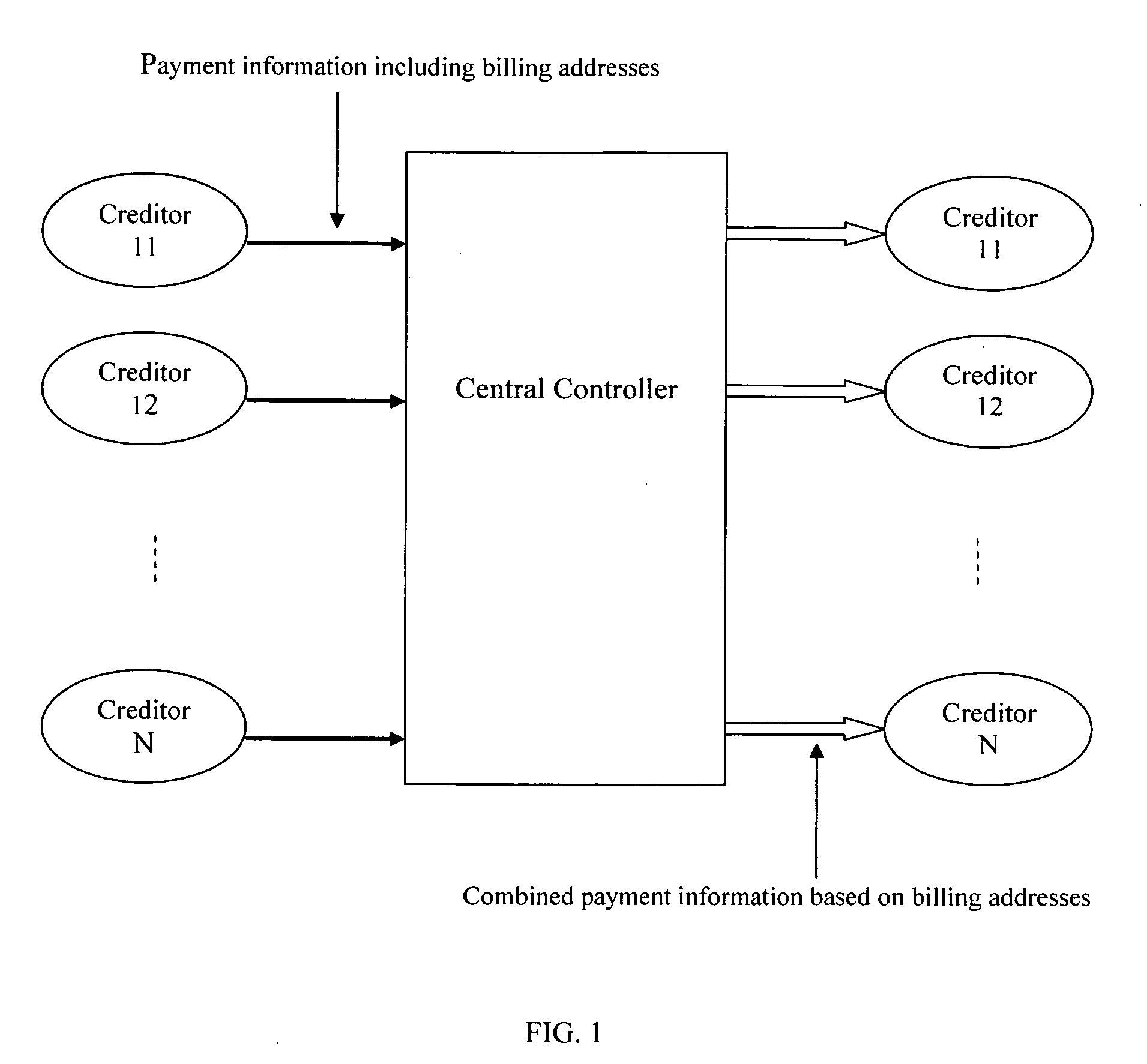

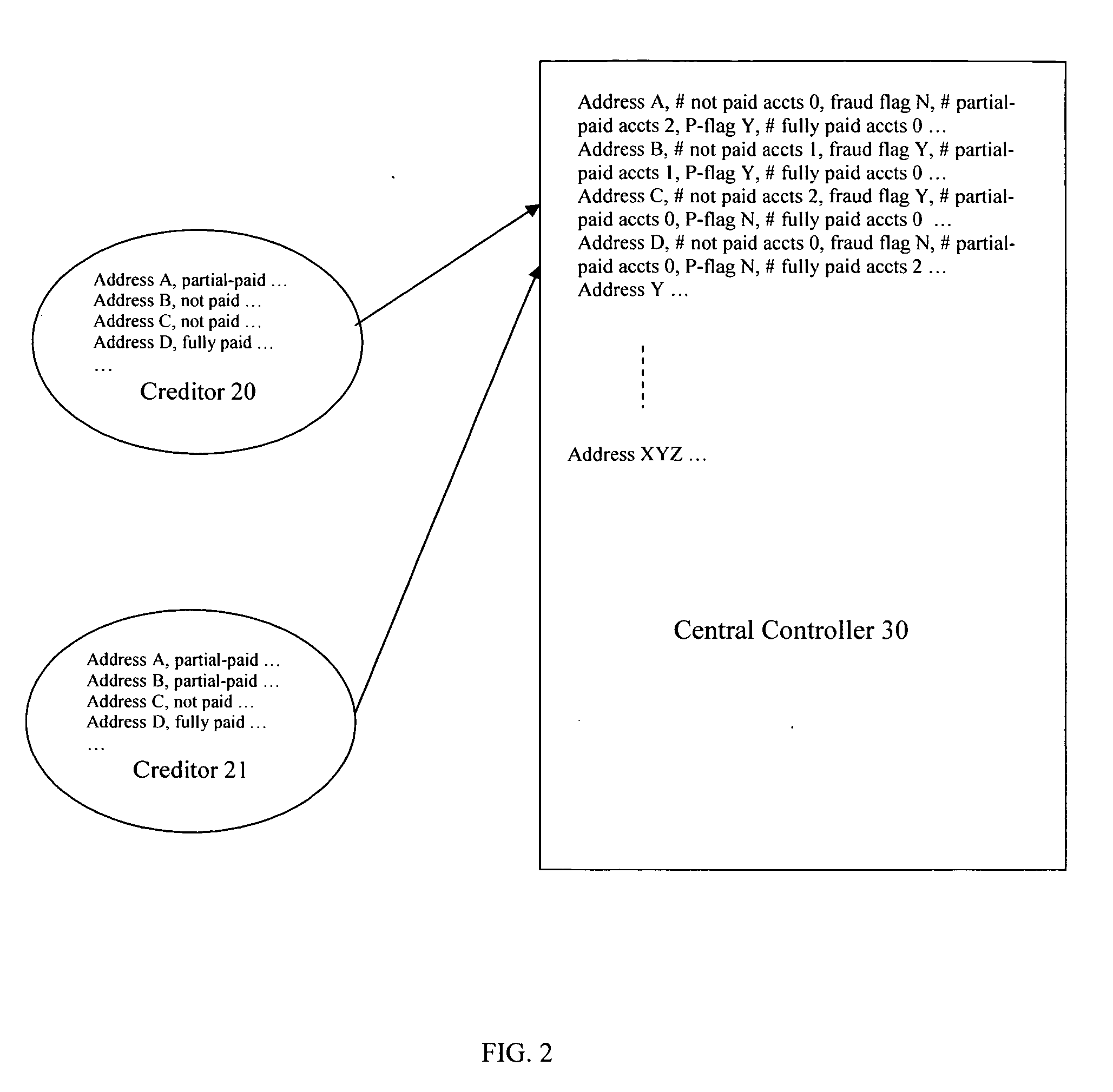

Data processing system for a billing address-based credit watch

Owner:WANG ZHIPING

Fuel delivery information system

InactiveUS20110035049A1Credit registering devices actuationLiquid transferring devicesPaymentMobile vehicle

A fuel delivery information system has a fuel pump having a first communication unit and a motor vehicle having a second communication unit. Communication between the second communication unit and the first communication unit controls fuel flow from the fuel pump to the motor vehicle. Fuel flow controls may include the price of the fuel, whether or not the fuel has been paid for, the type of fuel, and the engine of the motor vehicle being turned off. The first communication unit may be a barcode reader, an RFID tag reader, or a transceiver. The second communication unit may be a barcode, an RFID tag, and a transceiver. Communication between the first and second communication units may include a fuel usage characteristic, method of payment information, and a unique motor vehicle identifier.

Owner:BARRETT RONNIE GENE

Systems and methods for generation, registration and mobile phone billing of a music pod system

InactiveUS20080040139A1Simple and automaticEliminate needFinancePayment architectureHuman–computer interactionUser interface

A platform for supporting a network-enabled music application is configured to render the network enabled application for a user, via a user interface associated with the user, in accordance with various APIs included in the platform and used by a program developer to develop the network-enabled music application. The rendering can included recognizing that the user interface is a mobile user interface and rendering the network-enabled music application in a manner appropriate and / or optimal for the mobile user interface.

Owner:SMS AC INC

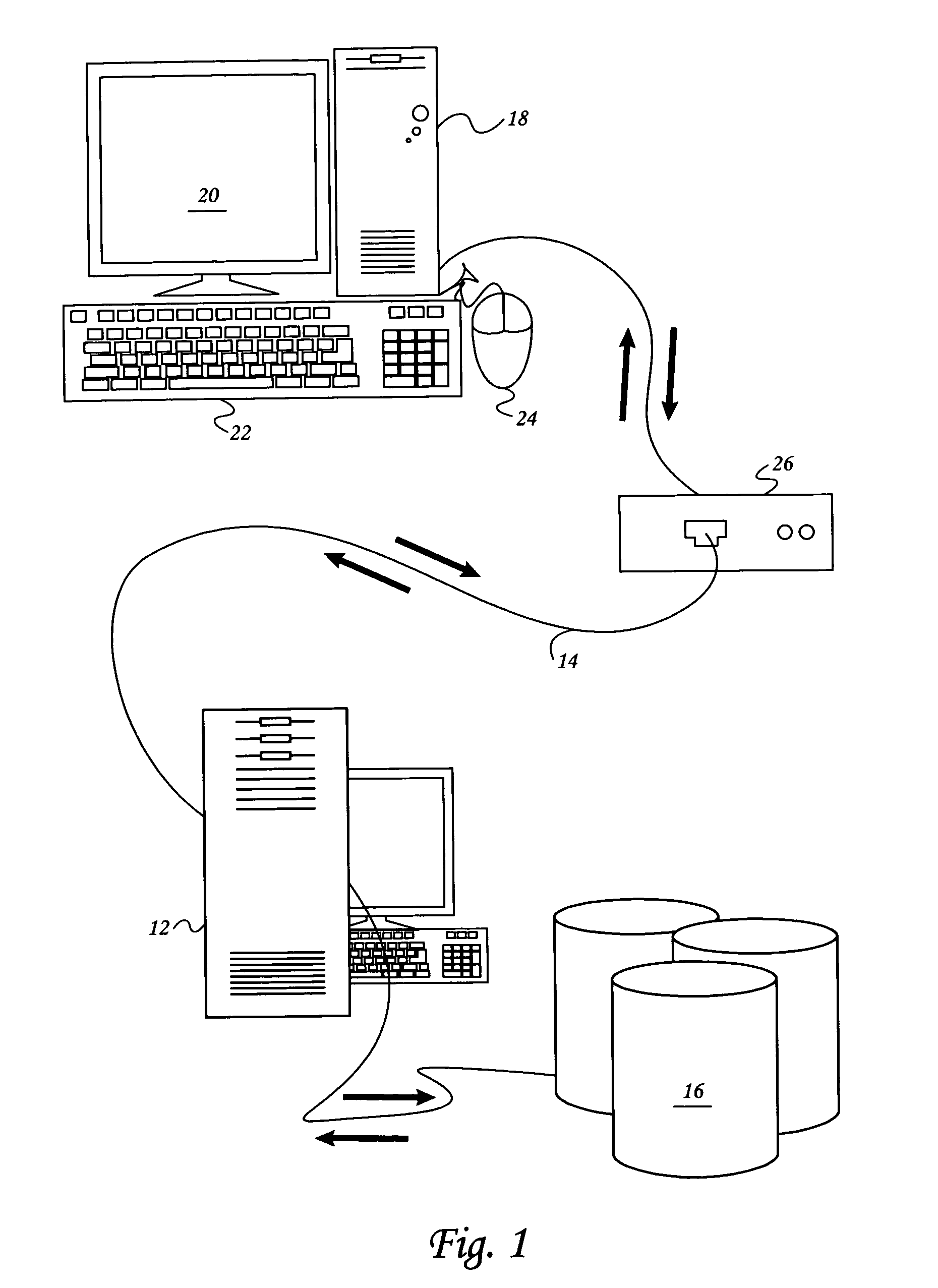

System and method for conducting secure commercial order transactions

The inventive system and method enable secure remote commercial order transactions between customers and merchants. The inventive system and method ensure that customer entire confidential financial data (CFD) is never transmitted to the merchant by keeping that CFD proprietary to the customer's exiting financial service provider (FSP) with which the customer has established a financial account, and from which the merchant is authorized to receive payments. When an order is placed, the customer provides to the merchant a partial CFD (PCFD) sufficient, along with additional data, to identify the FSP to the merchant, and to identify the customer to the FSP. The merchant then provides the PCFD, along with at least partial order data, to the FSP, and order confirmation data (OCD) to the customer. Various embodiments of a novel order verification process are also provided that enable authorization, by the customer, of the order through contact between the customer and the FSP. In this manner, the complete CFD is kept absolutely secure as it never leaves the possession of the customer and the FSP. Optionally, the FSP is given the opportunity to offer additional services and / or products to the customer during order authentication, that are related or unrelated to the order. Advantageously, the inventive system and method function equally well for interactive electronic (e.g., online) orders, telephone orders, mobile commerce orders, facsimile orders, mail-order orders, and even in-person orders.

Owner:BYZ TEK

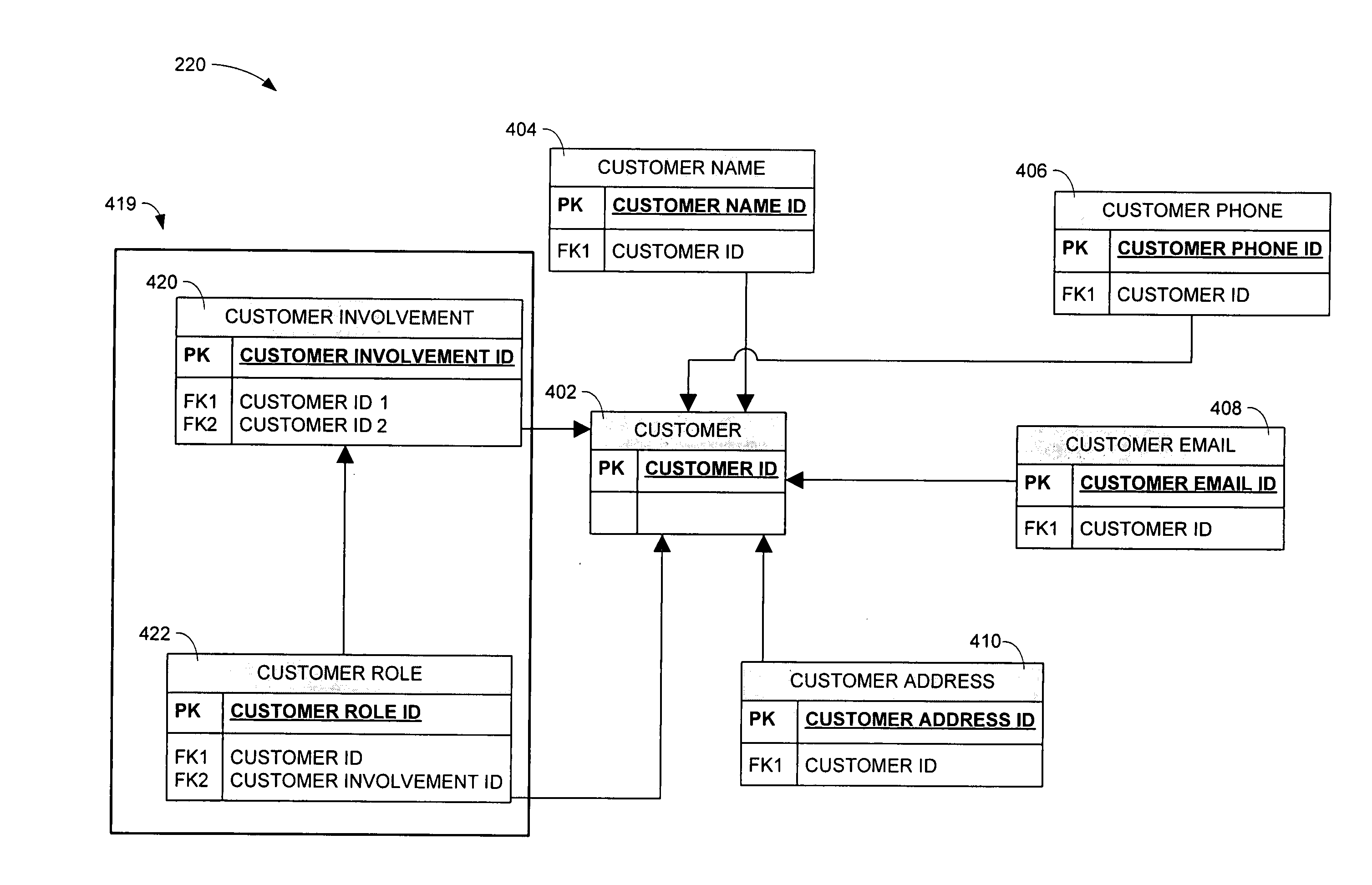

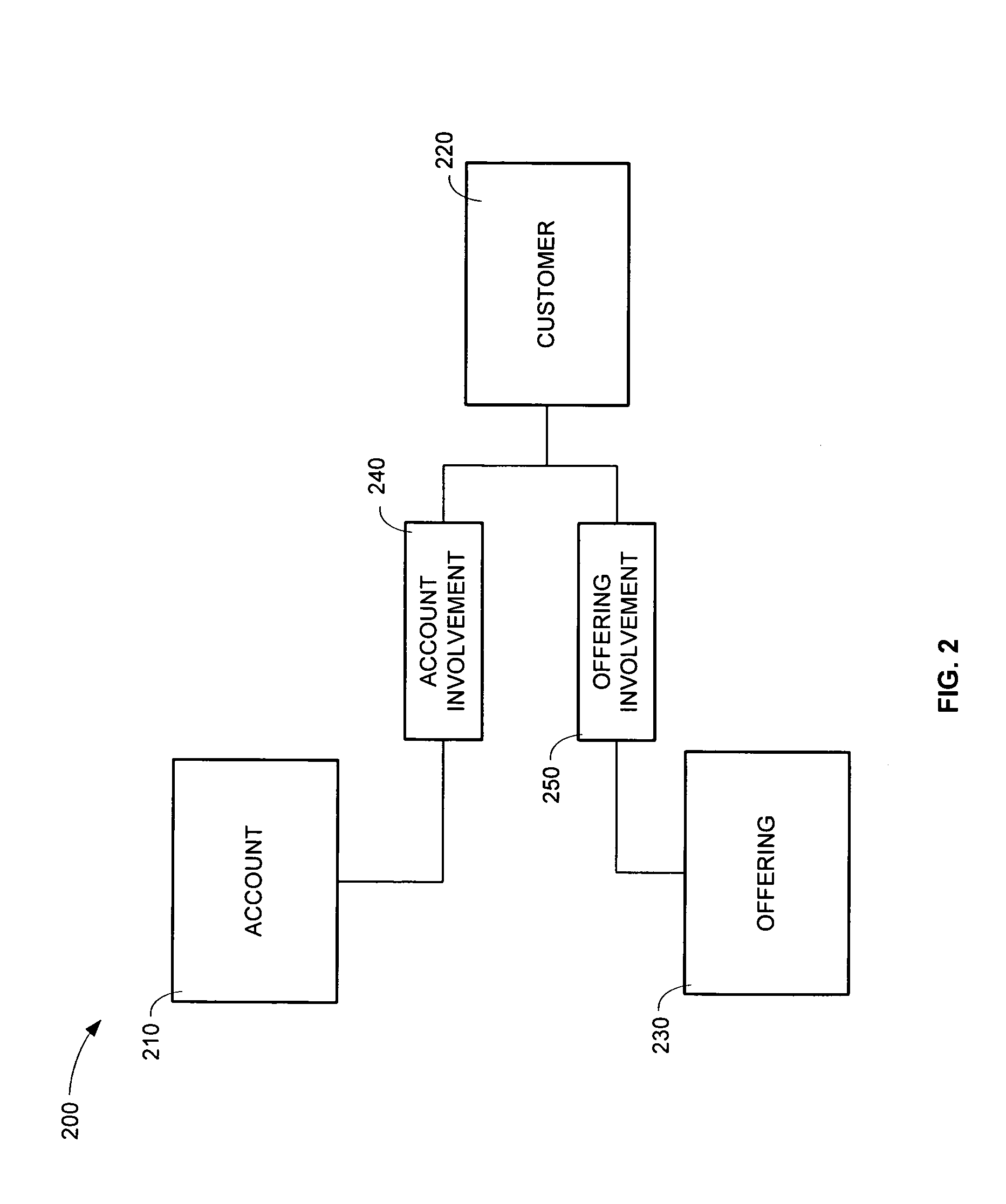

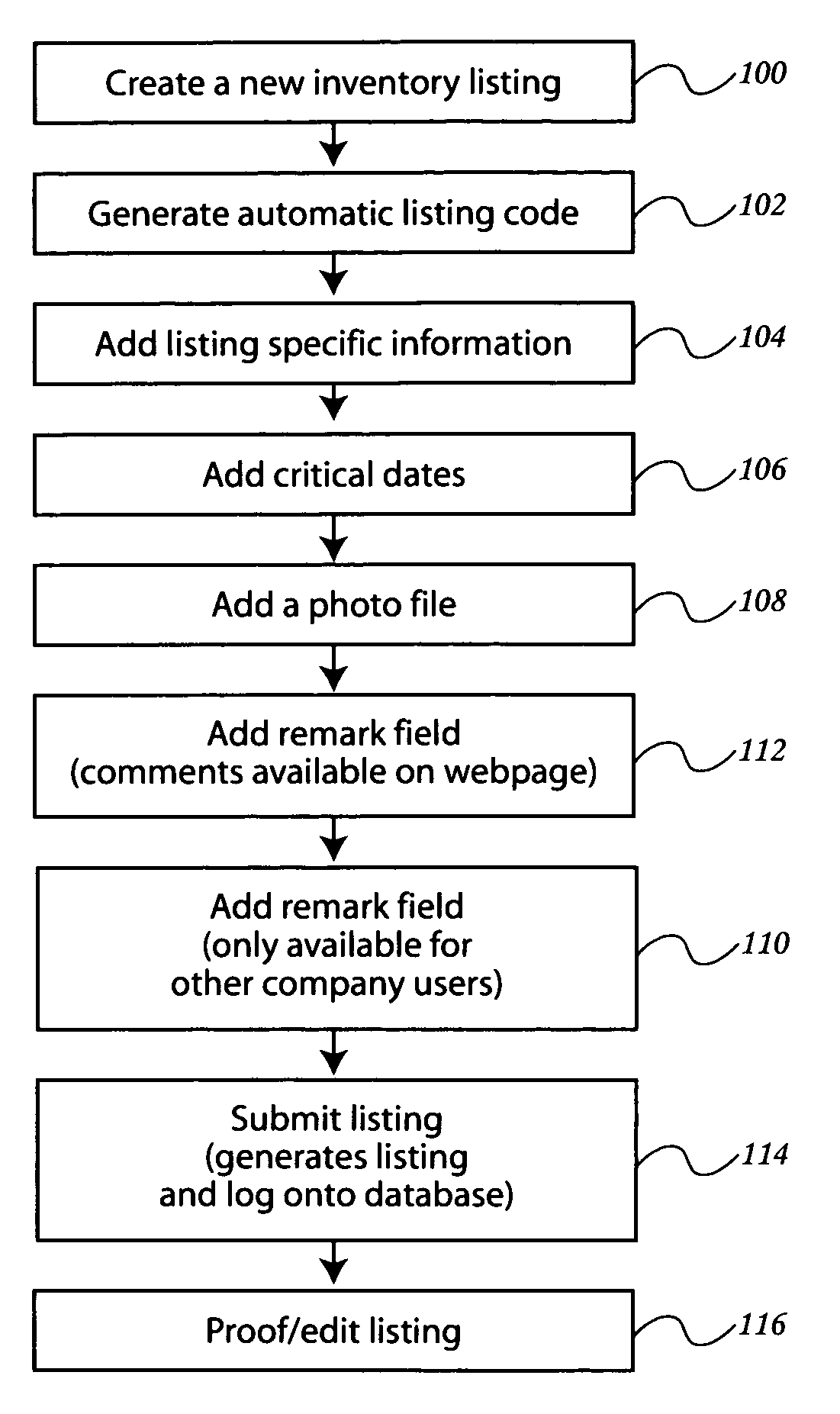

System and data structure for account management

InactiveUS20050187881A1Convenient and efficient accessPayment architectureOffice automationRelevant informationDecision taking

Owner:ACCENTURE GLOBAL SERVICES LTD

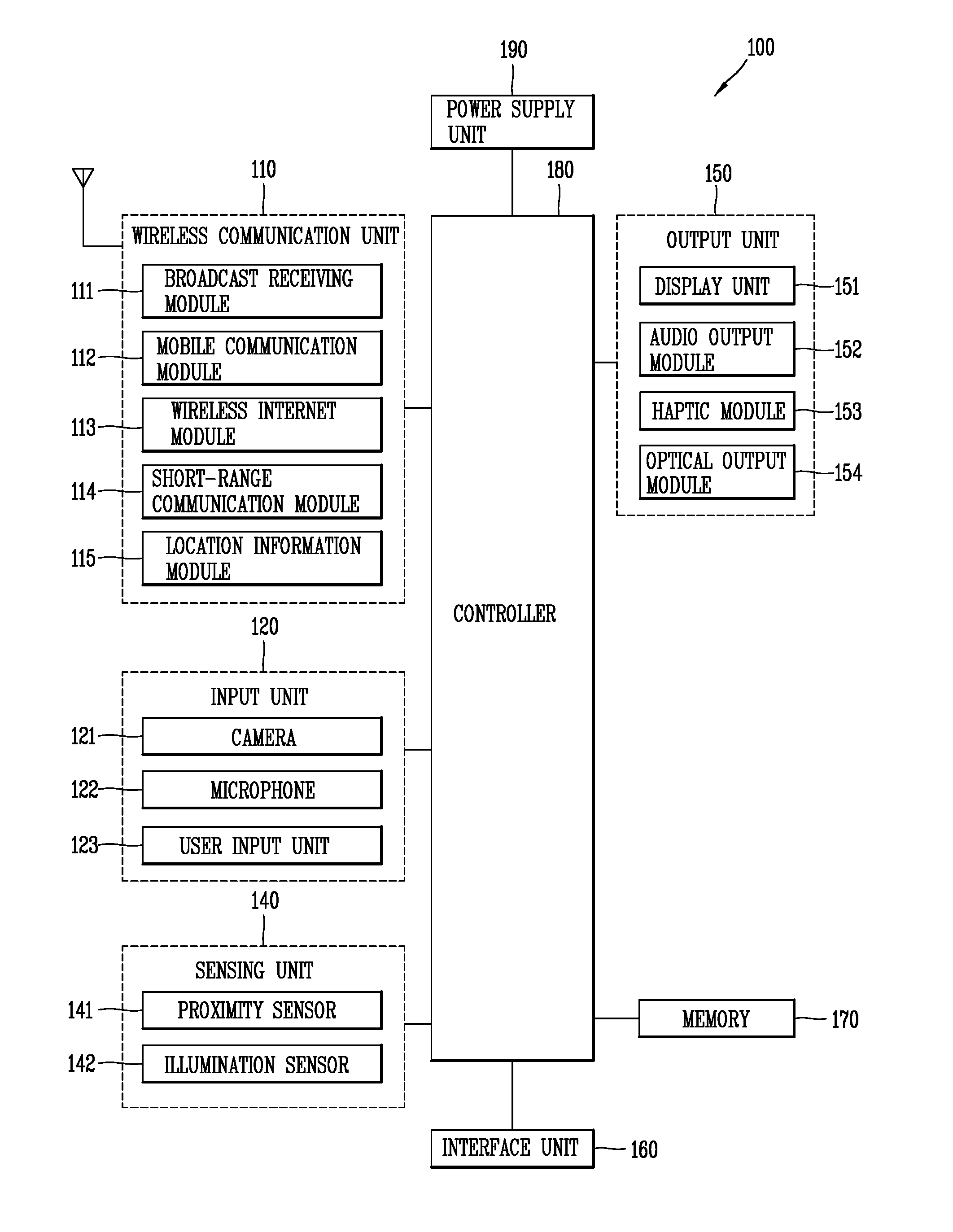

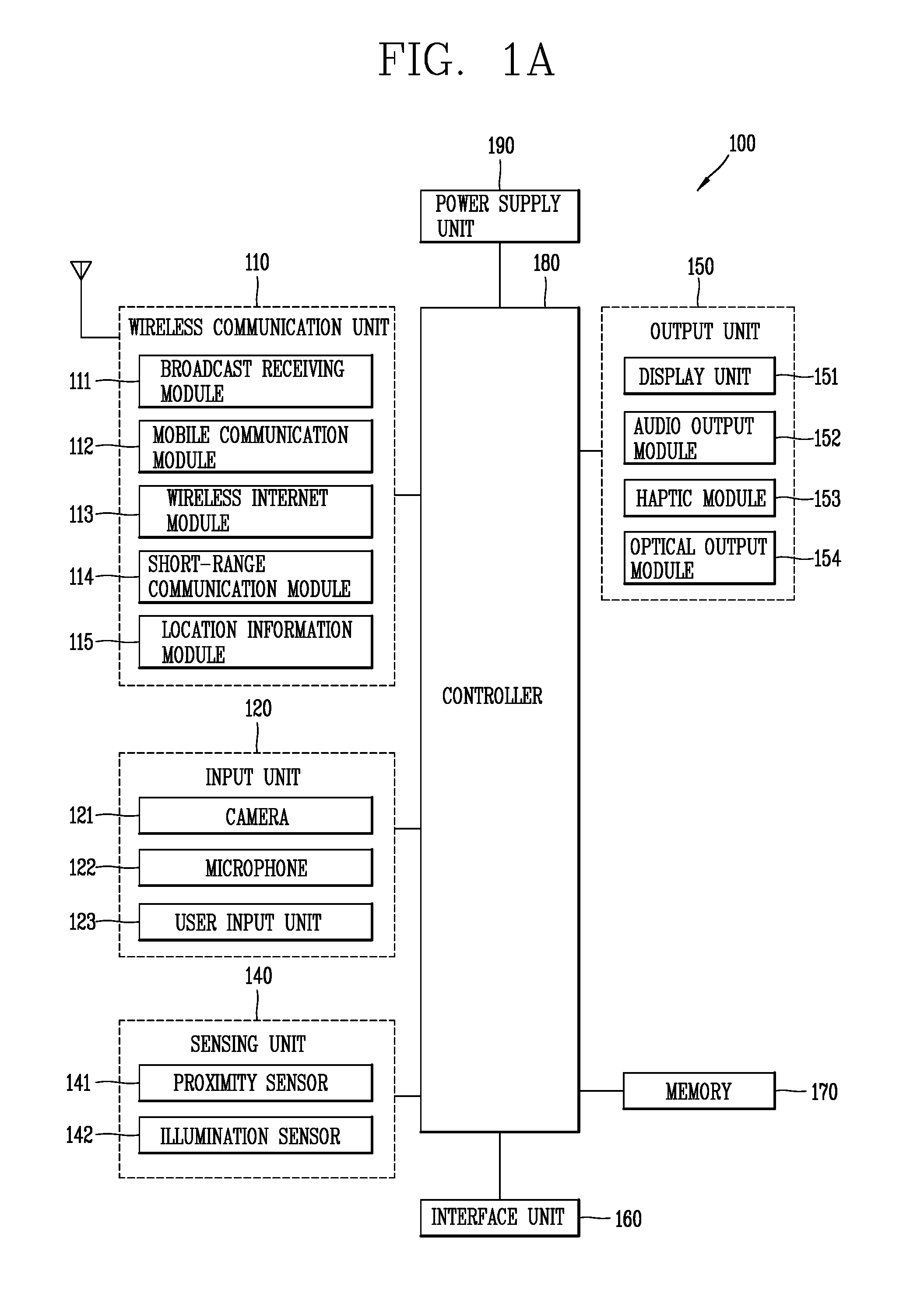

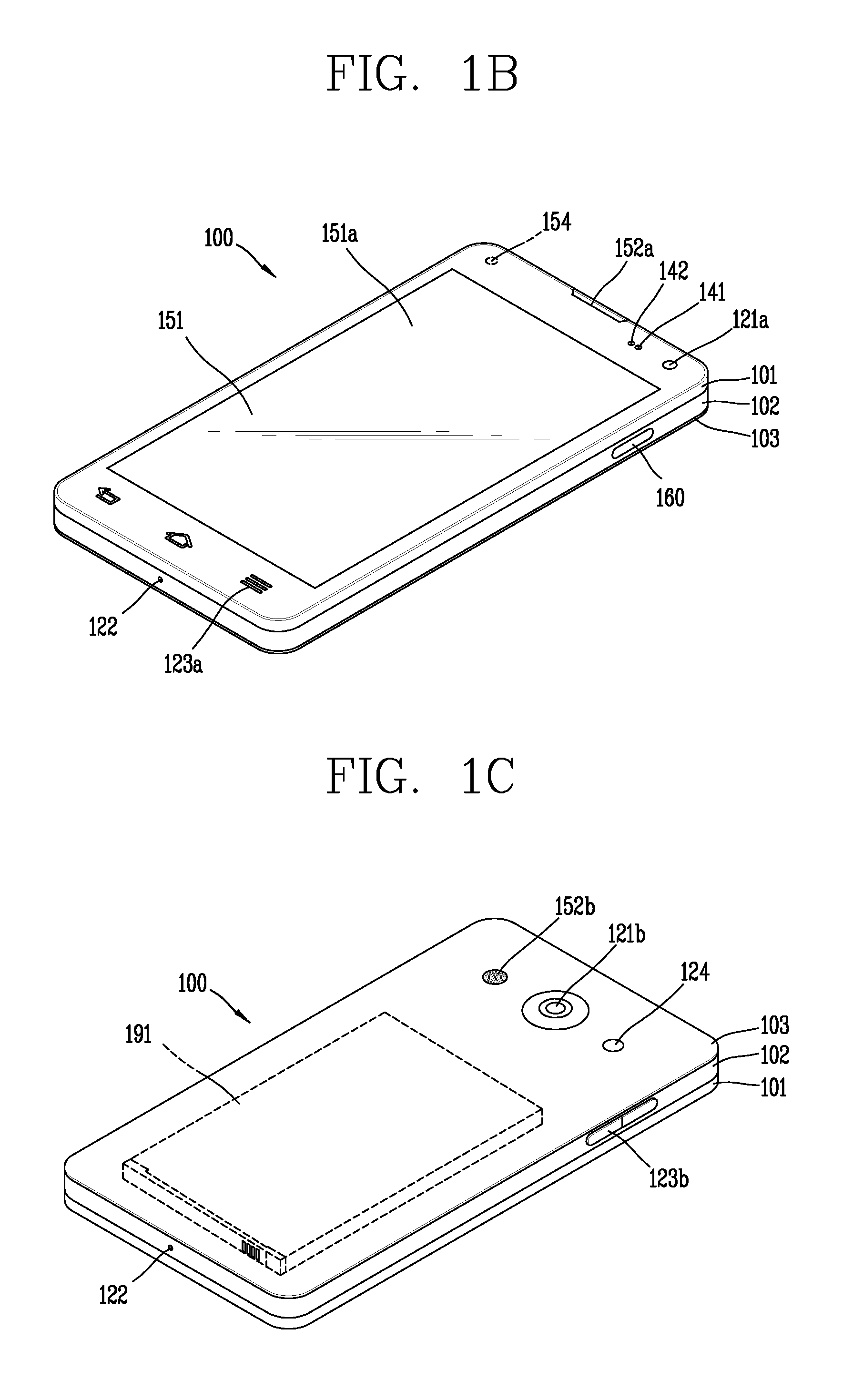

Mobile terminal and control method thereof

Owner:LG ELECTRONICS INC

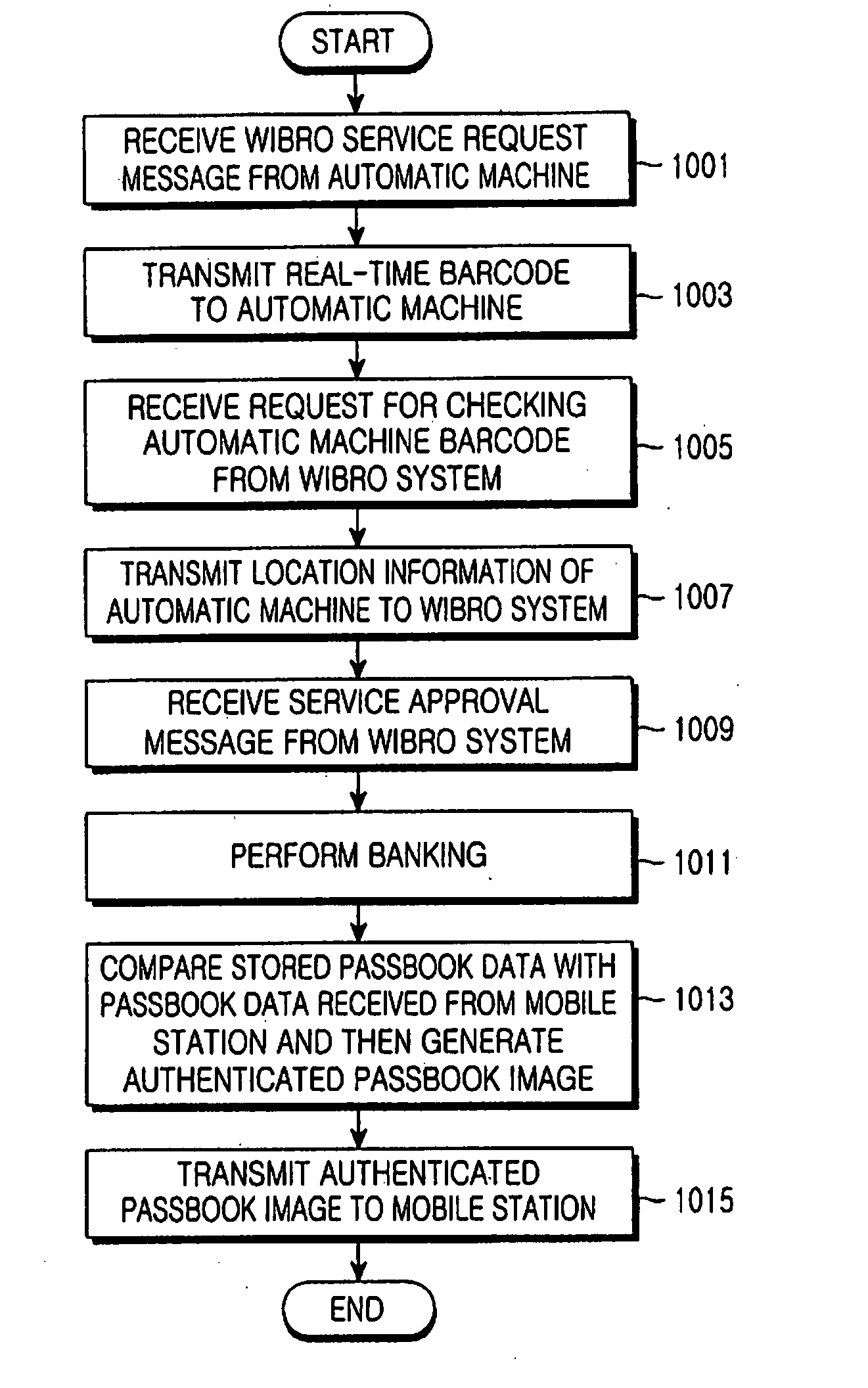

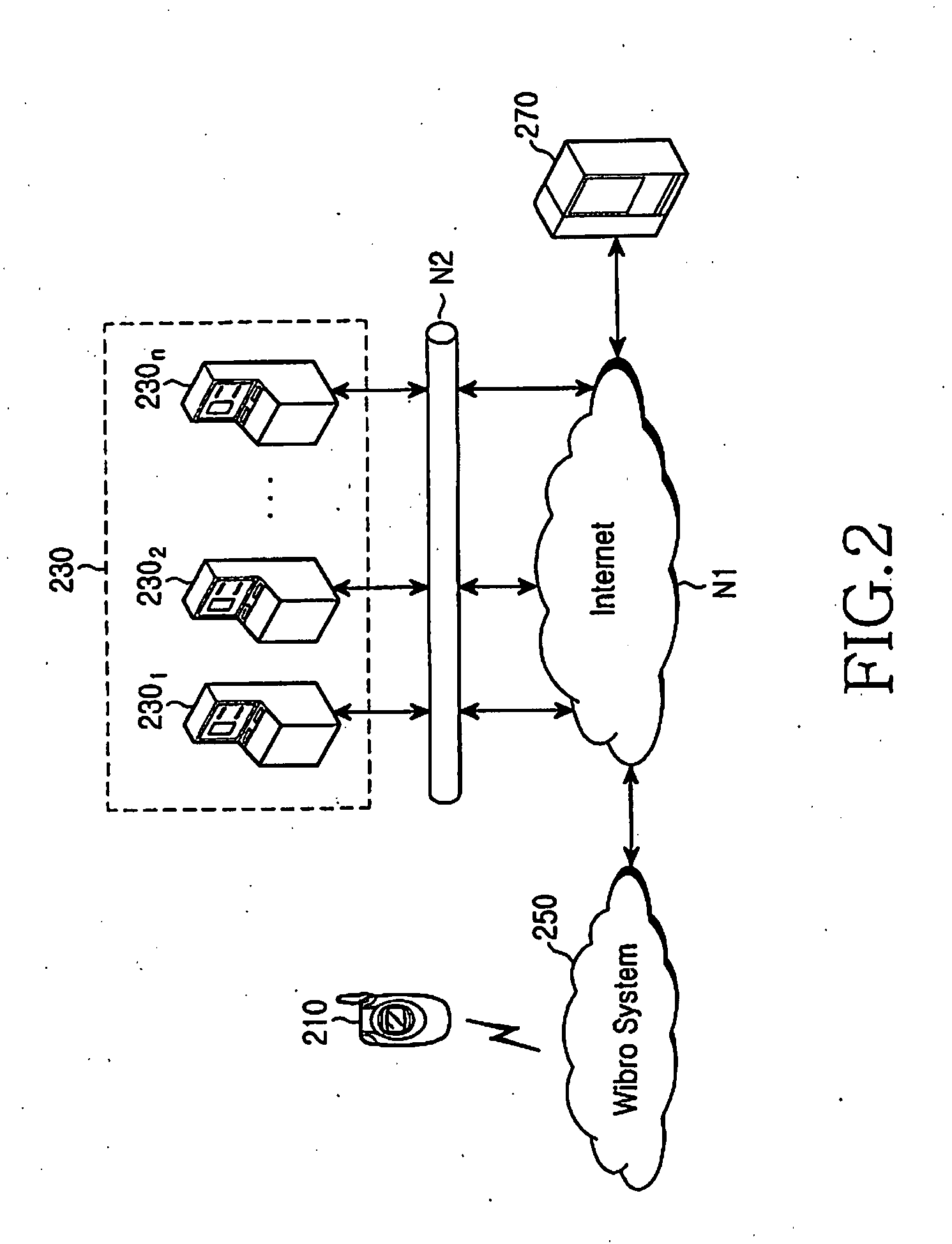

Method, apparatus and system for providing financial service by using mobile station in packet data system

Owner:SAMSUNG ELECTRONICS CO LTD

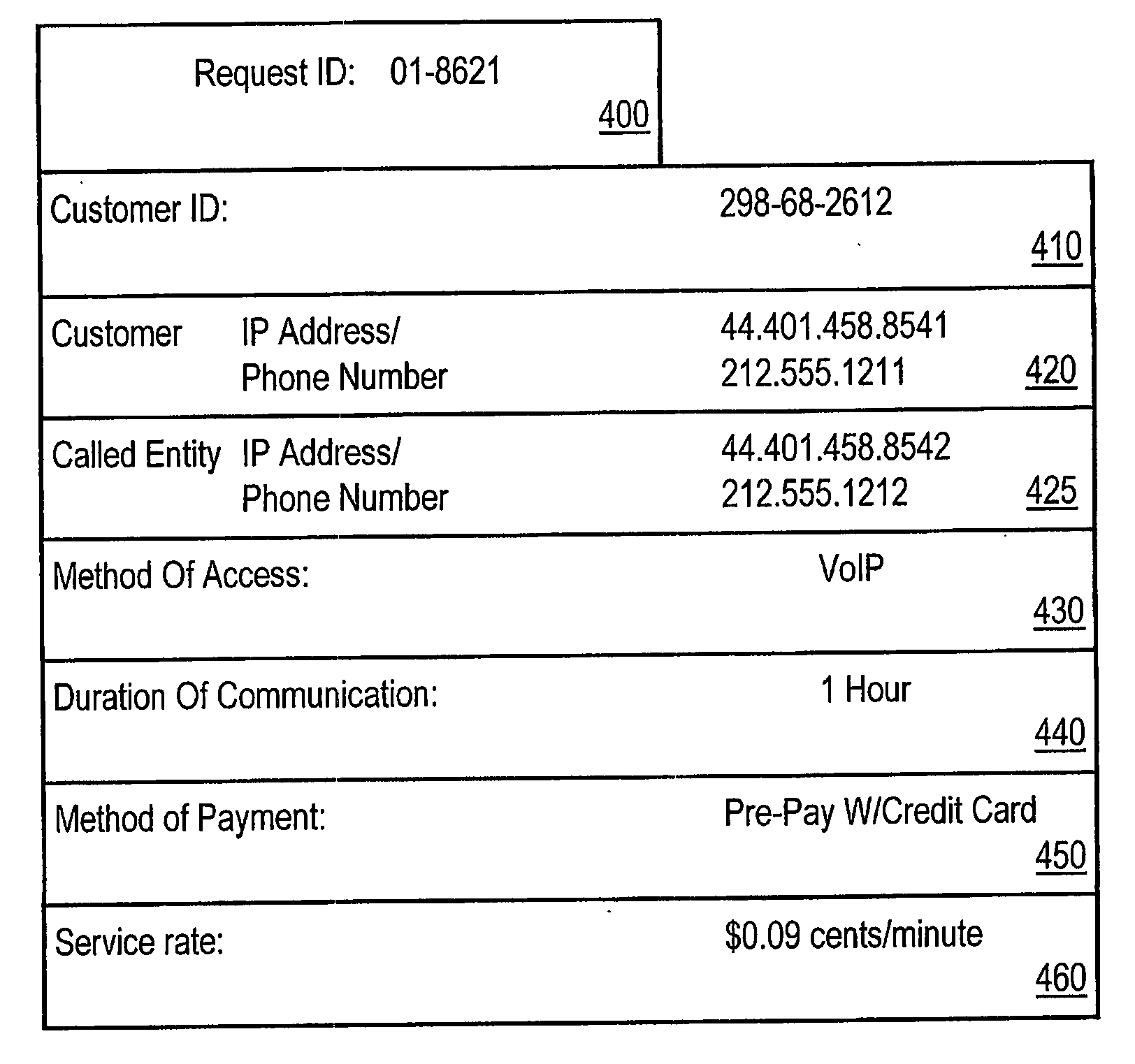

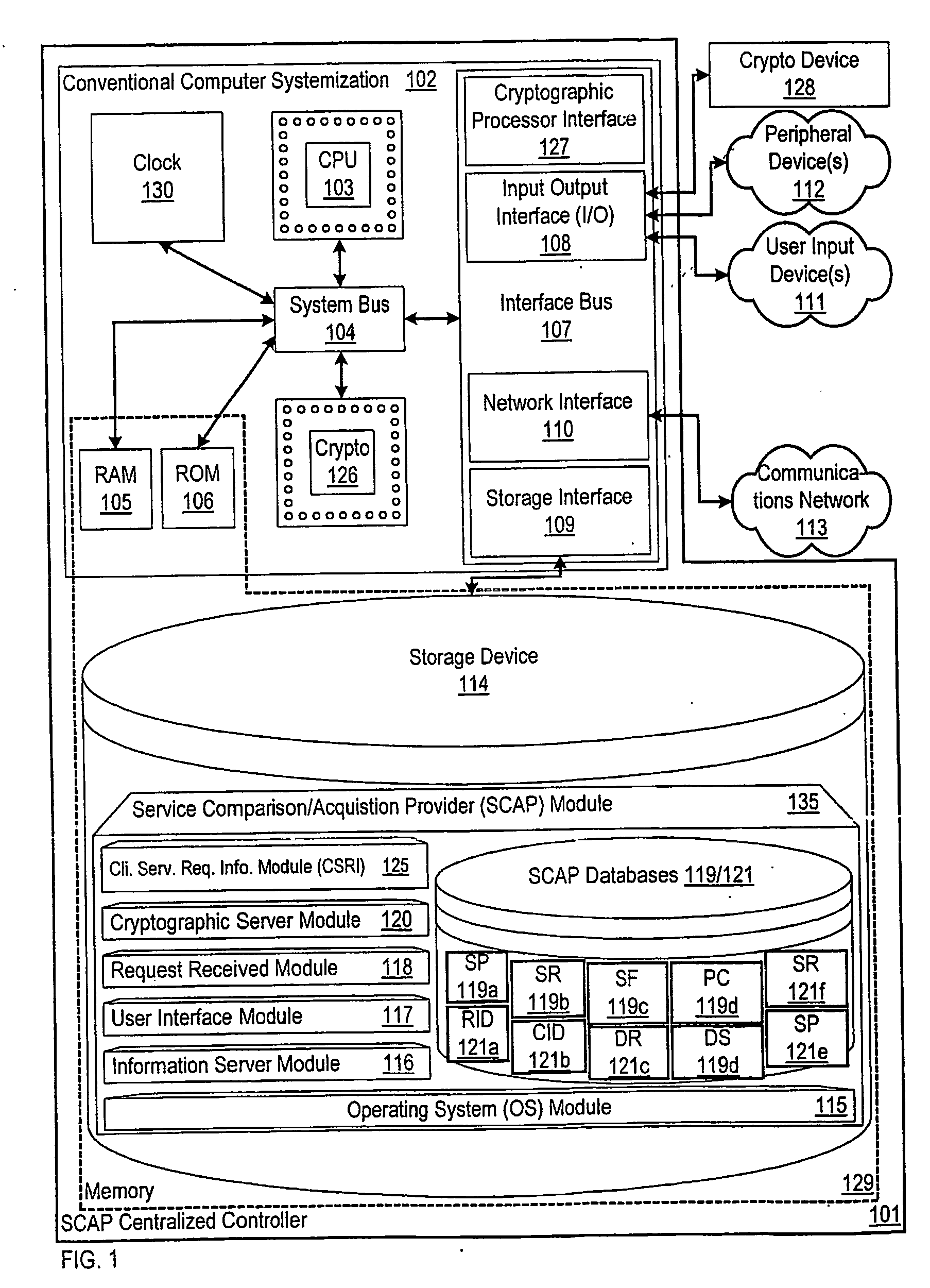

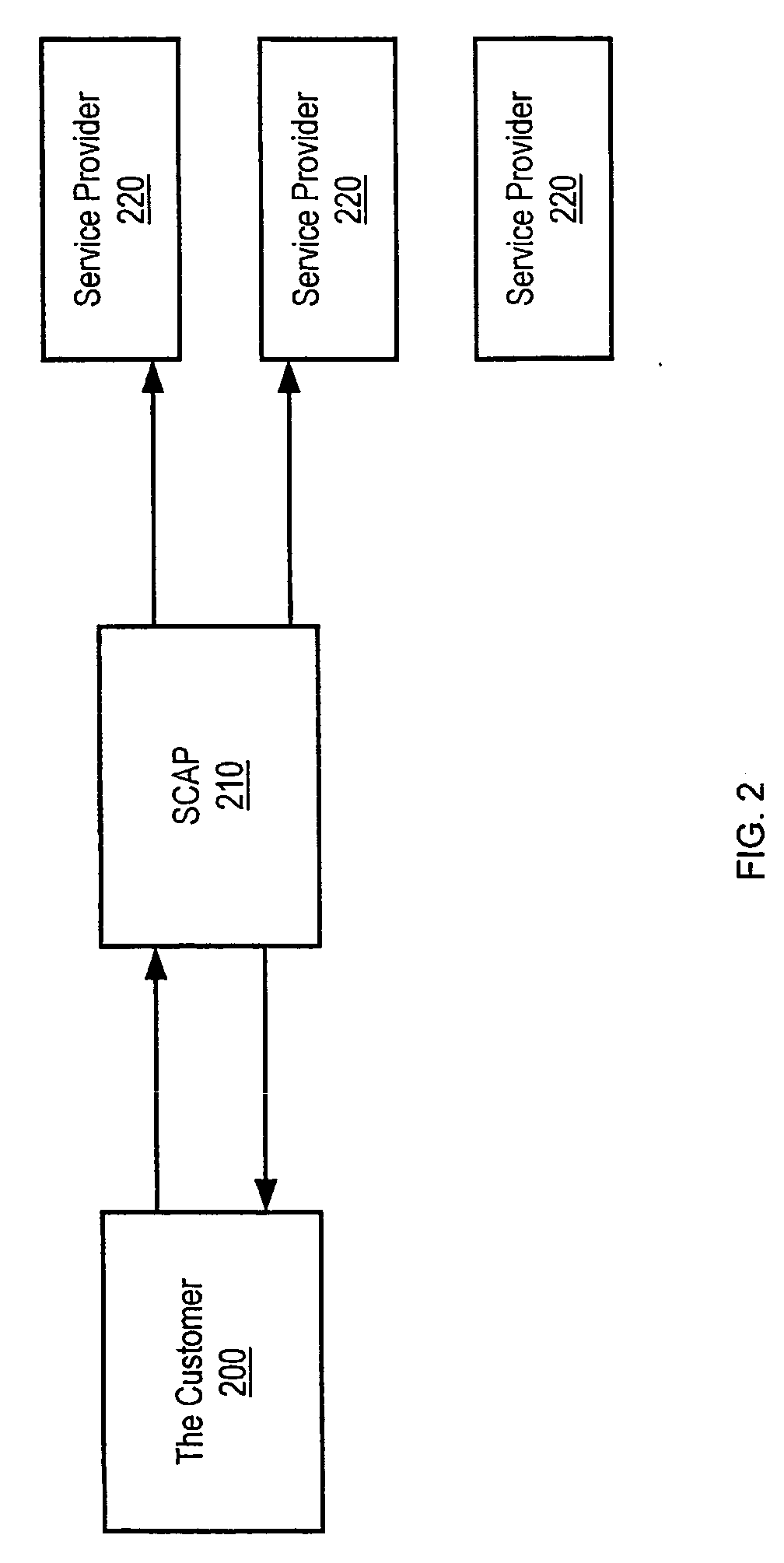

Method and system for determining and providing communications service based on a customer request

Owner:GOVERNING DYNAMICS LLC +1

Convertible financial instruments with contingent payments

A convertible financial instrument provides incentives to holders to keep the instruments outstanding so that issuers maintain flexibility and control over the maturity date of the instrument and the manner in which it is settled. The instrument may provide issuers with the ability to deduct an amount for tax purposes that approximates the true economic cost of the financial instrument. The instrument may contain a provision calling for contingent payments (which may include, for example, contingent interest, preferred distributions, contingent principal, dividends, and other pay-outs) to the holder in some circumstances, which may be based on formulae calculations. For example, this may occur when the trading value of the convertible instrument exceeds a predetermined value such as, for example, a certain percentage of the accreted value of the convertible instrument, or, for example, another circumstance that may trigger a contingent payment may be when the price of another financial instrument (e.g., the underlying security, the reference security, etc.) is below, higher than, or equal to a pre-determined value.

Owner:BANK OF AMERICA CORP

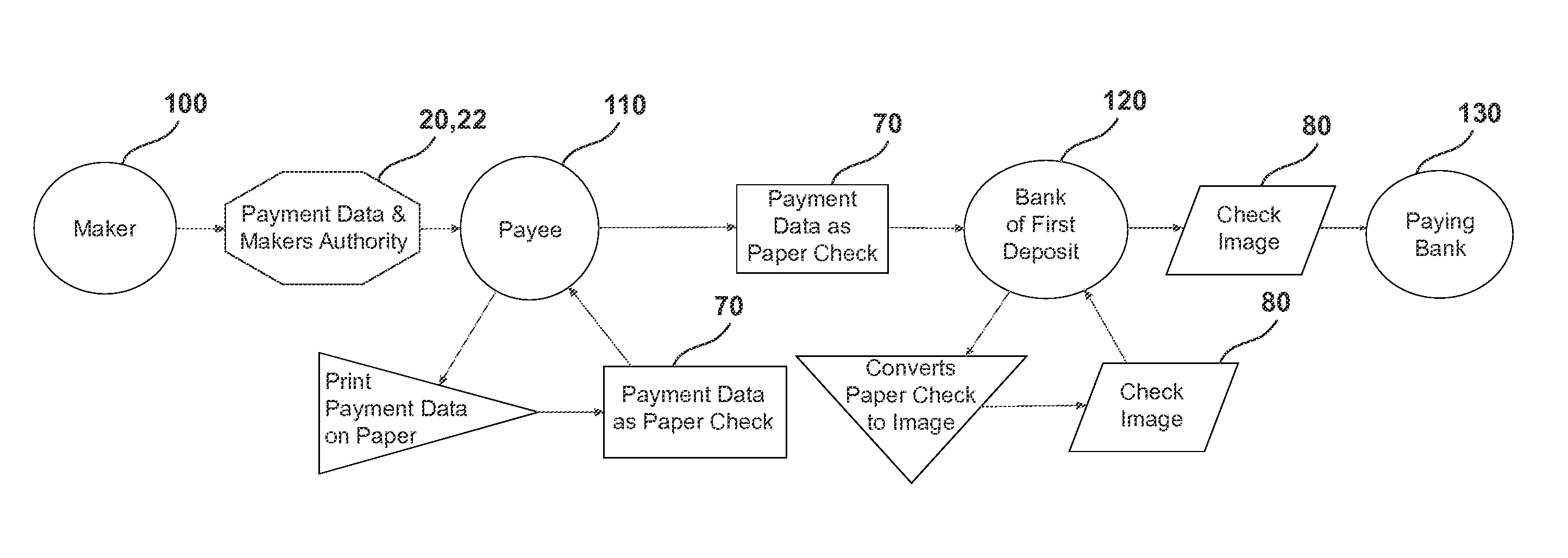

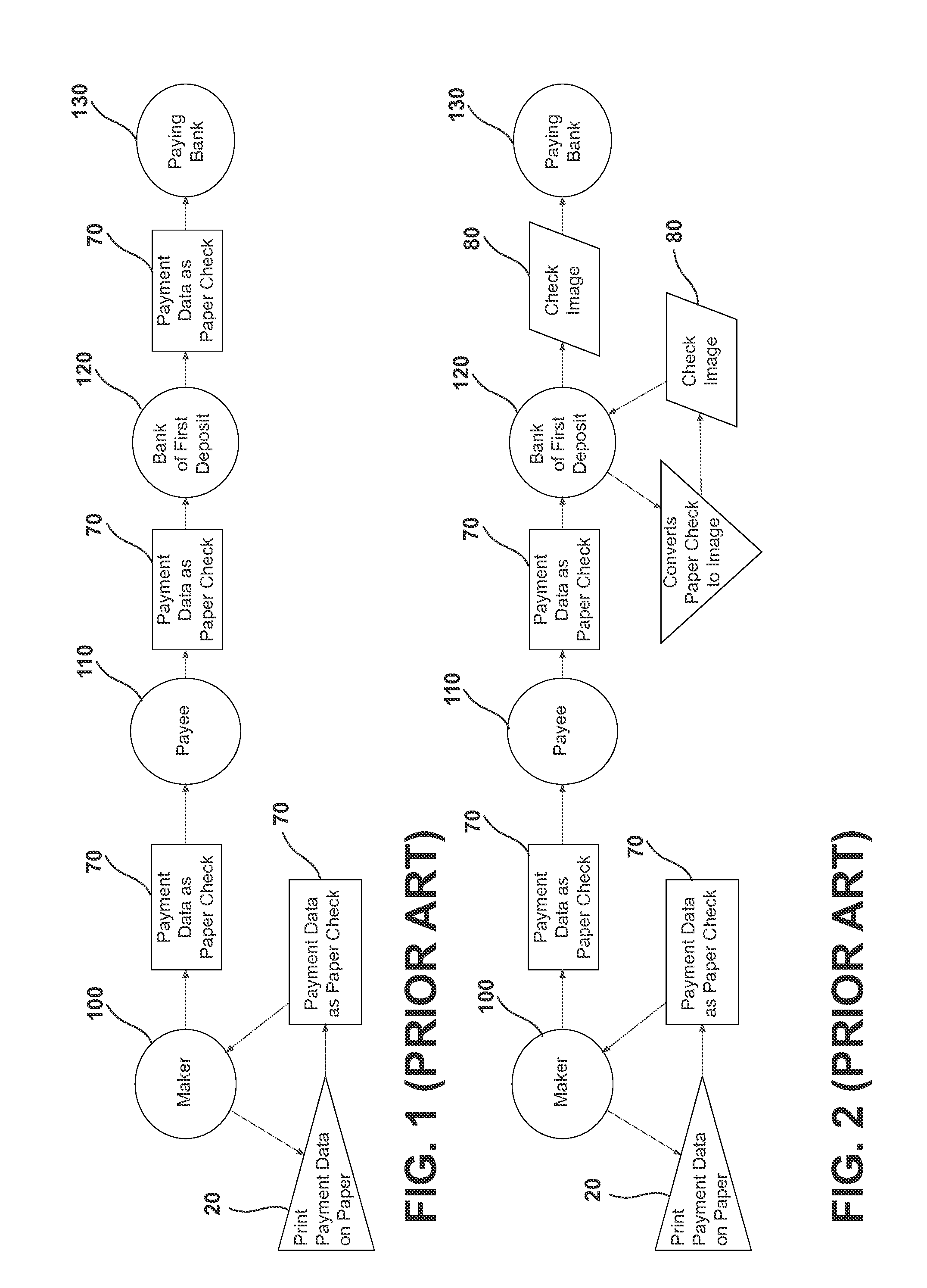

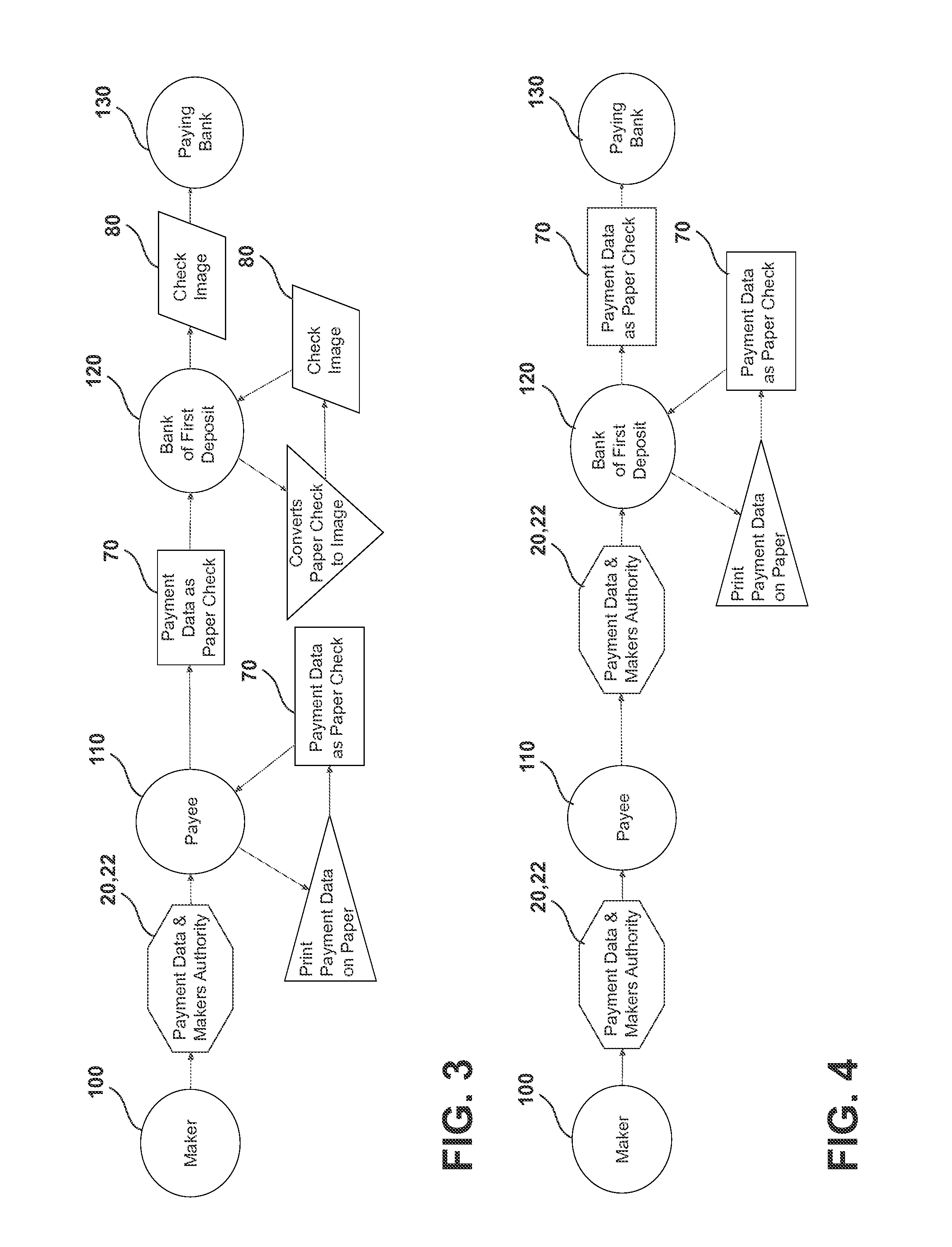

System and method for compositing items and authorizing transactions

Owner:DELUXE SMALL BUSINESS SALES INC

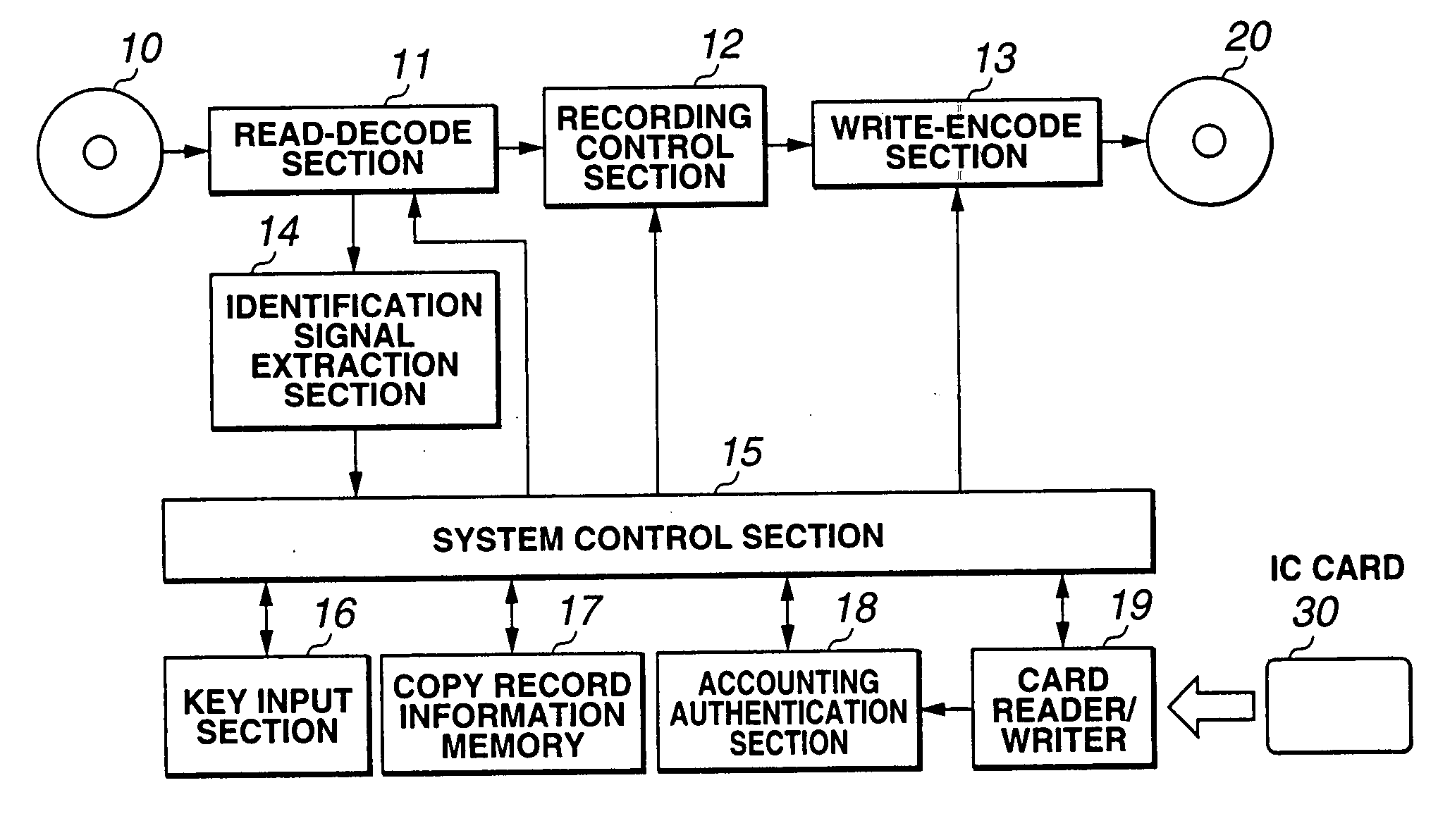

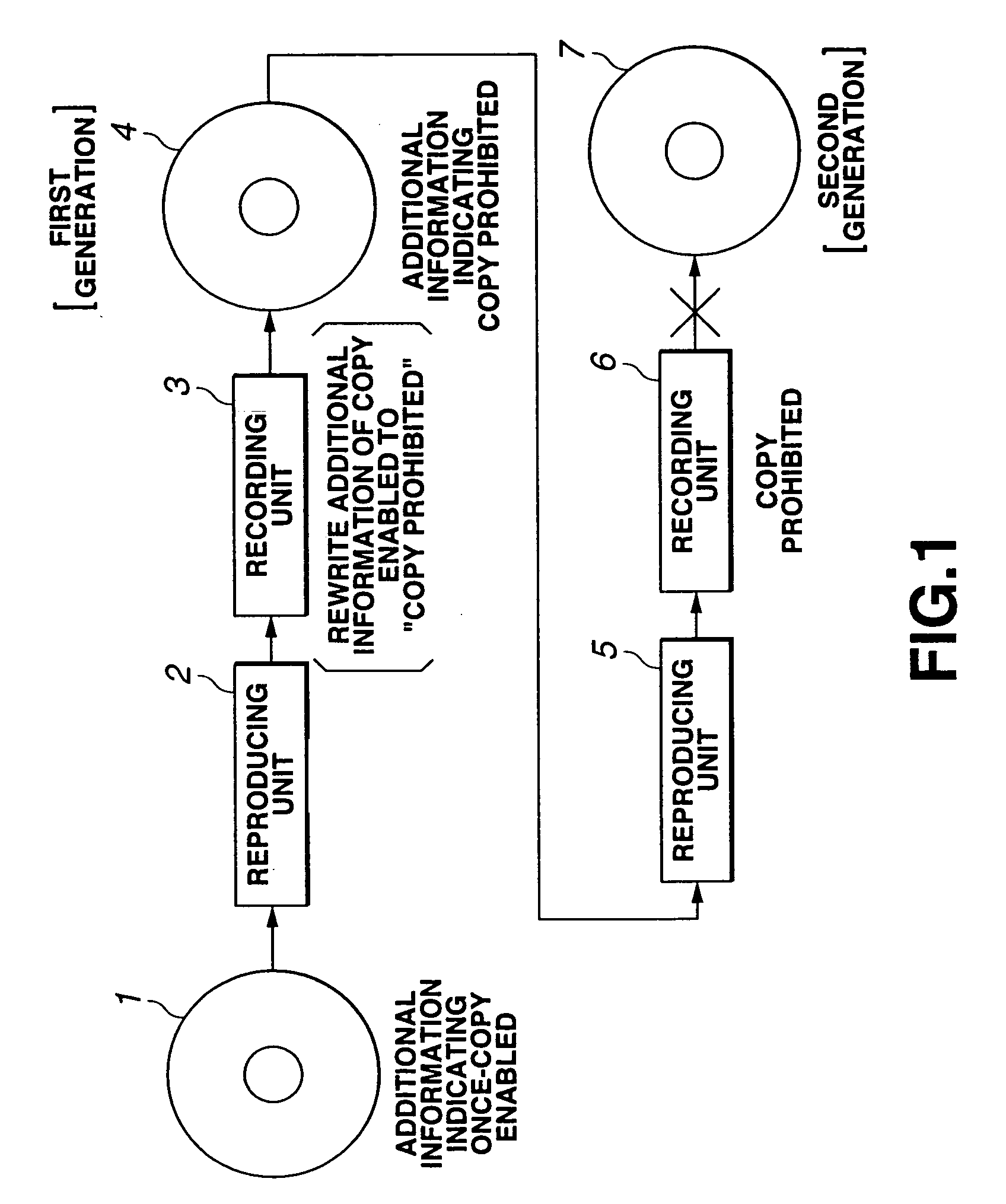

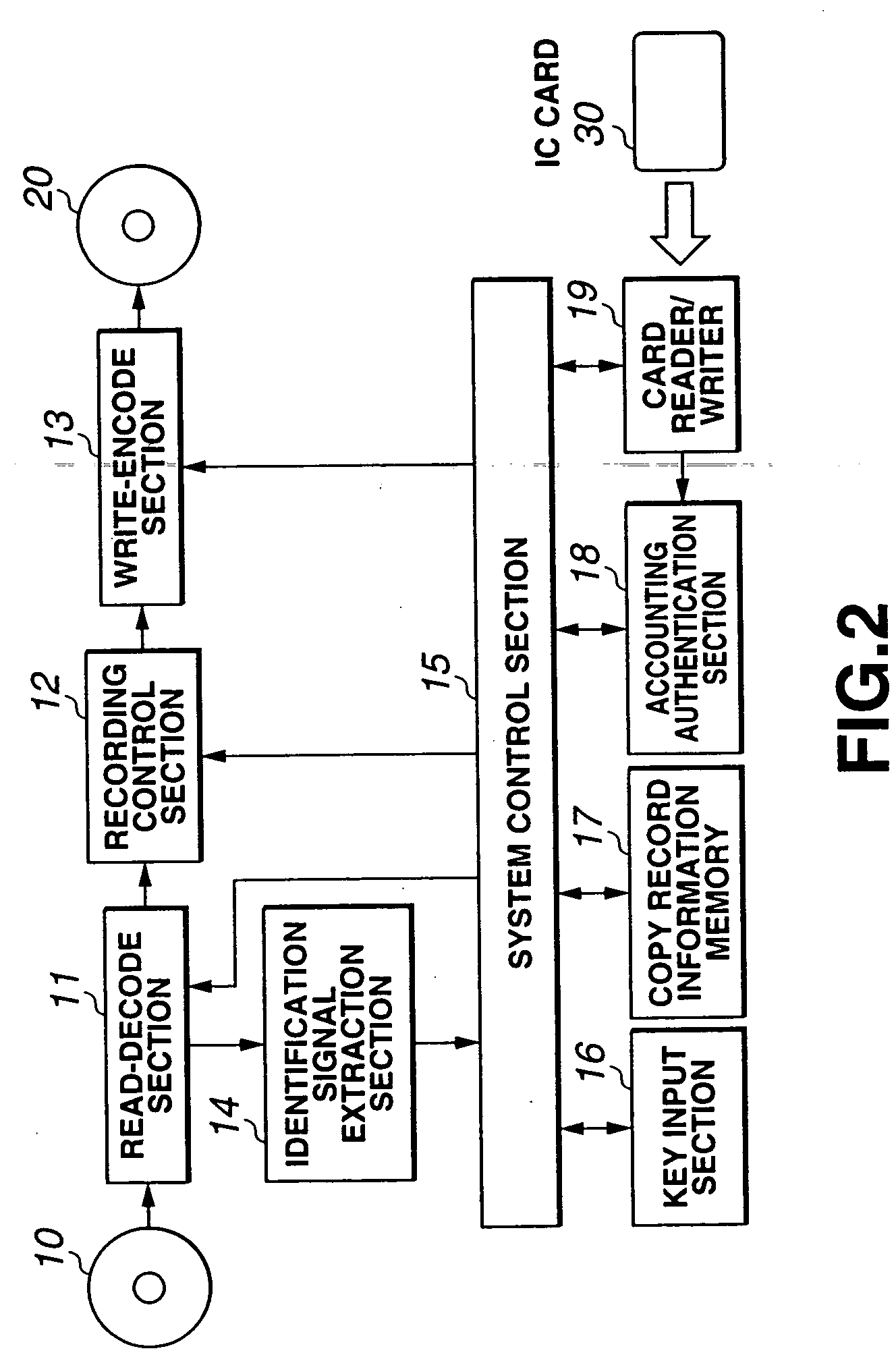

Information signal recording device having accounting function, and accounting terminal device

InactiveUS20050232595A1Television system detailsHybrid switching systemsComputer hardwareTerminal equipment

Owner:SONY CORP

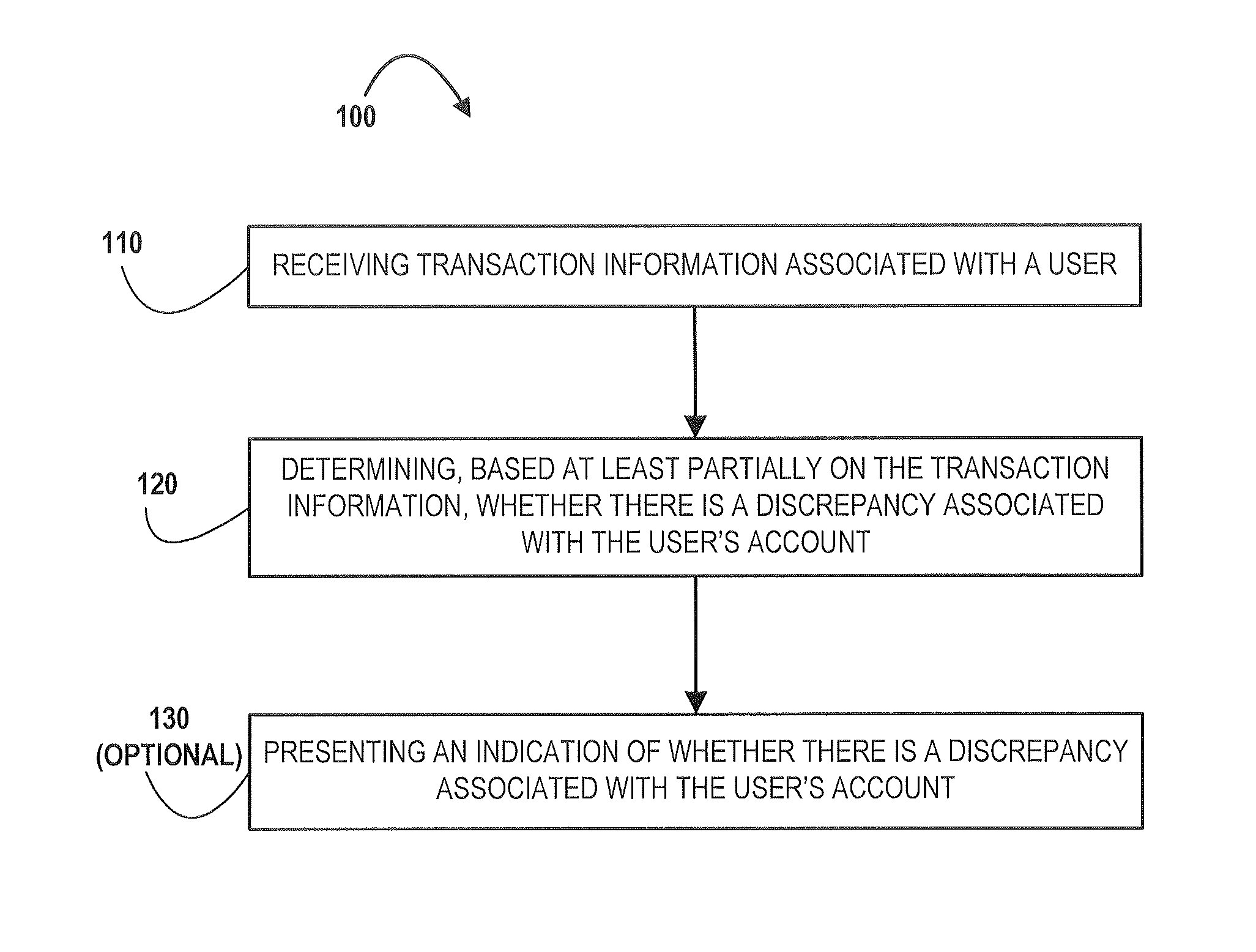

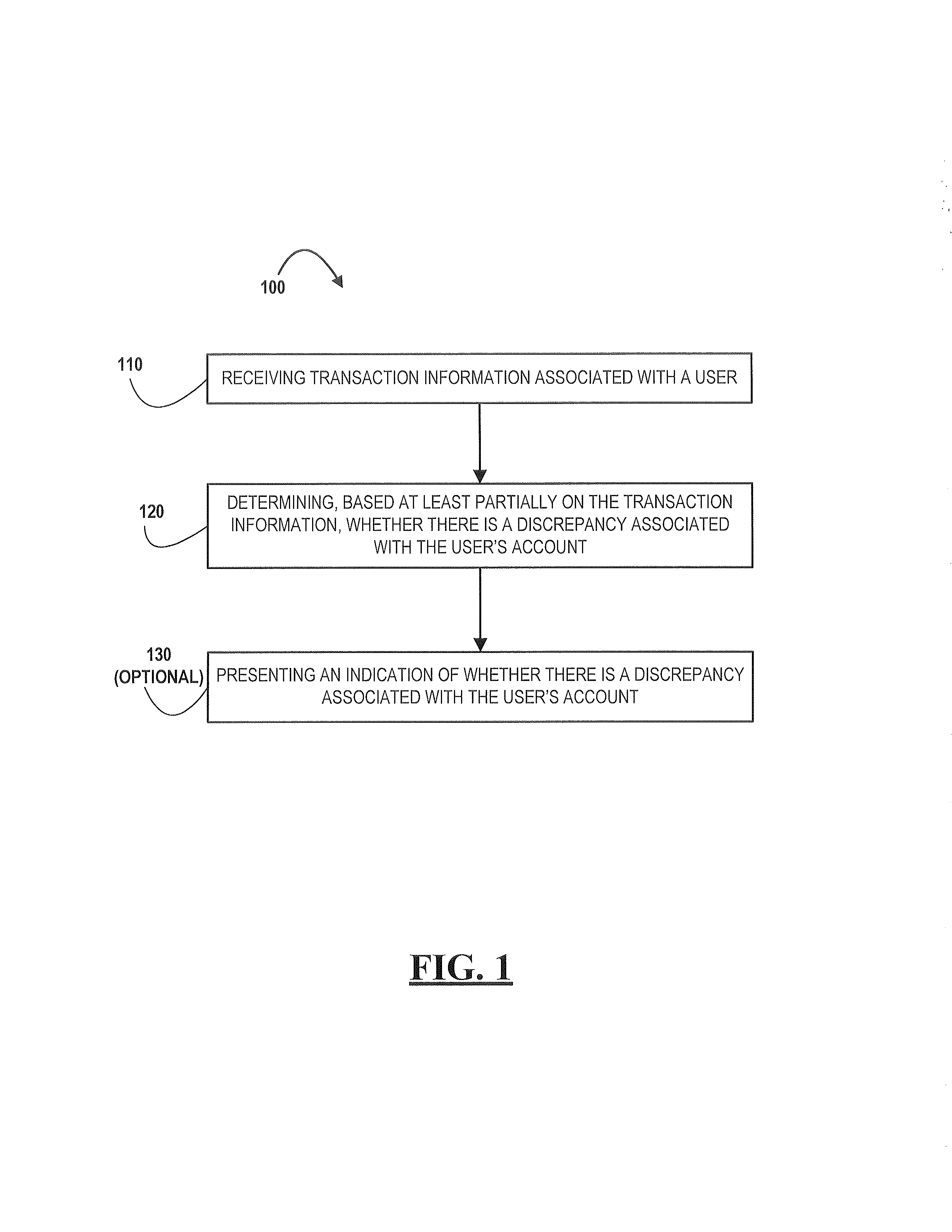

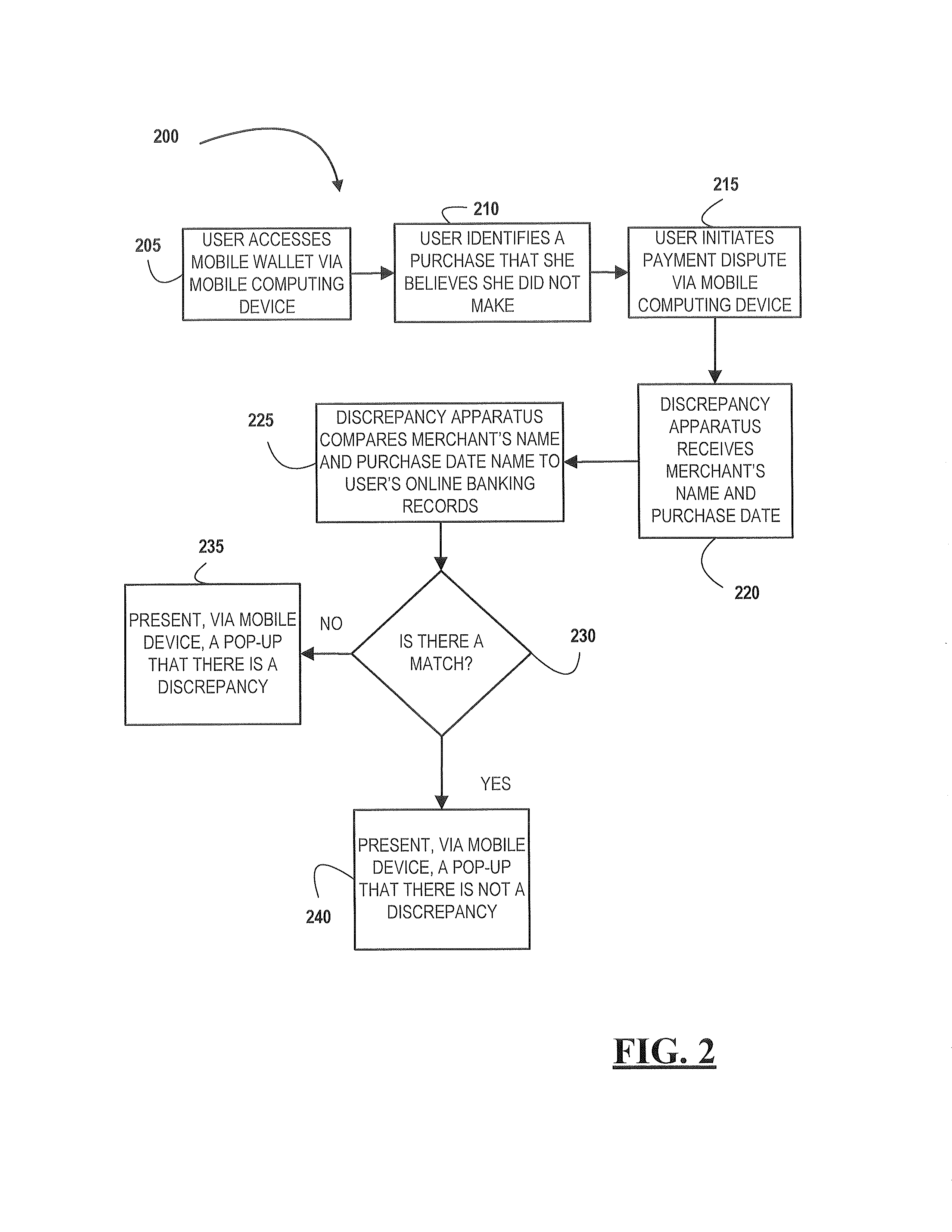

Electronic identification and notification of banking record discrepancies

Owner:BANK OF AMERICA CORP

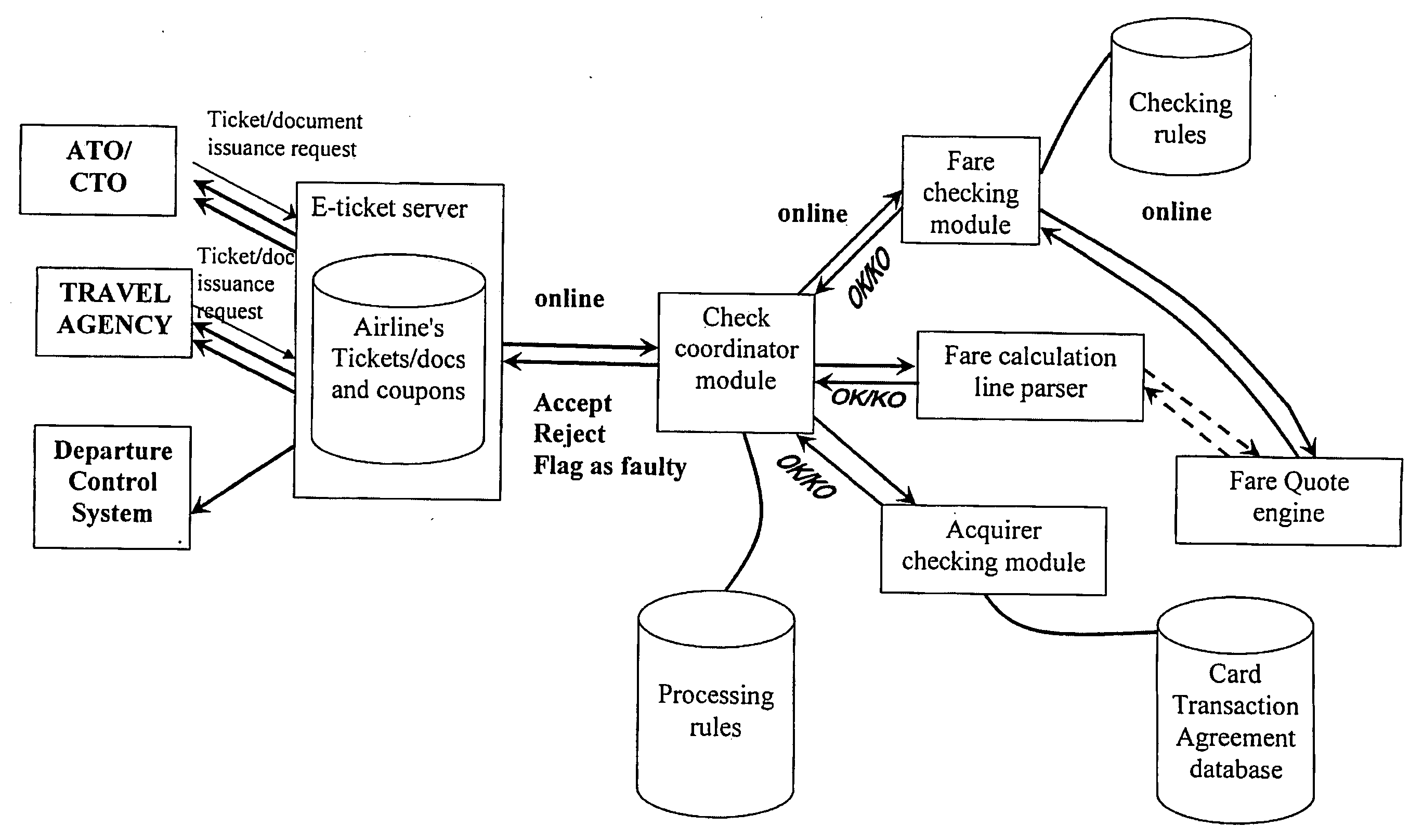

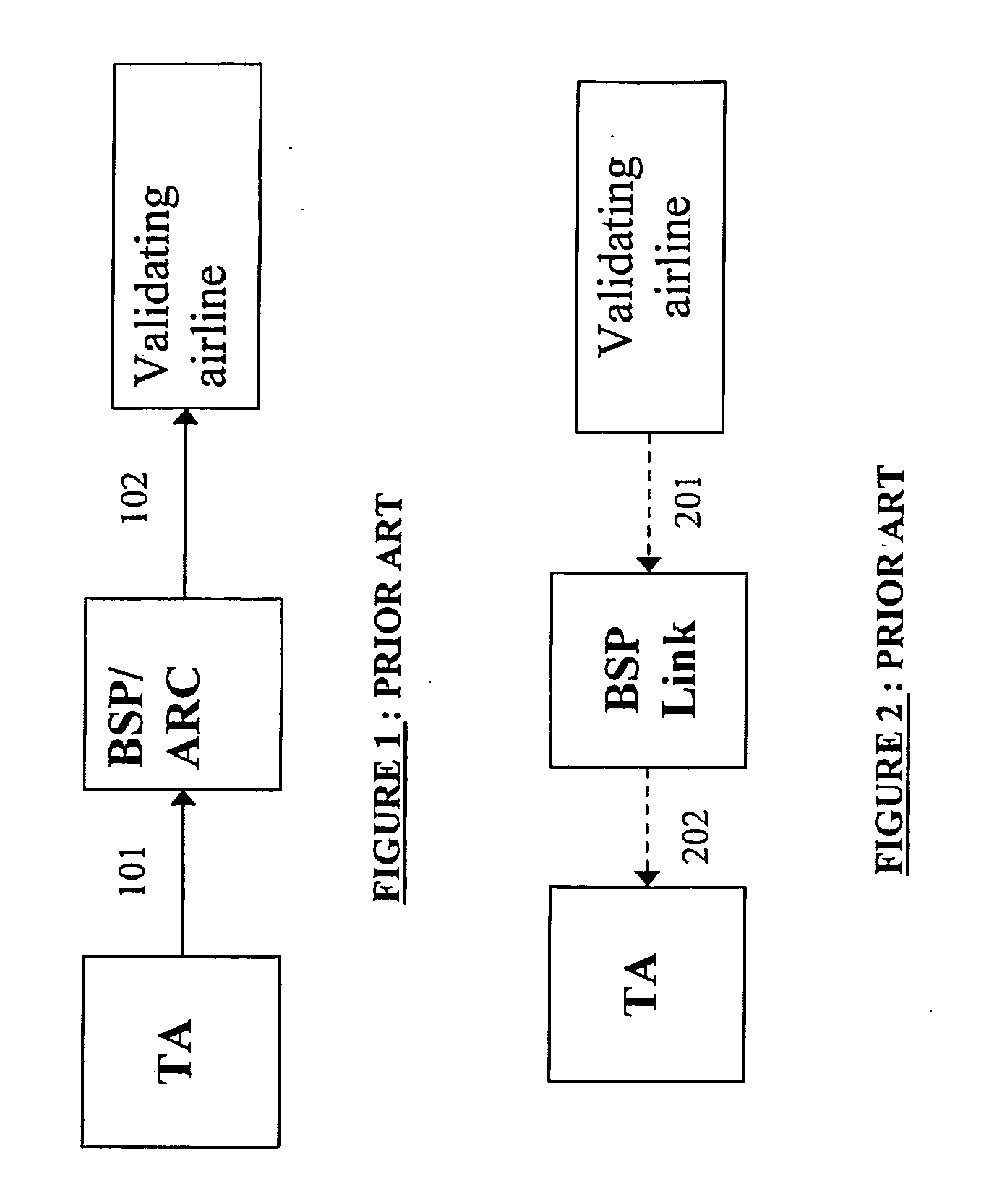

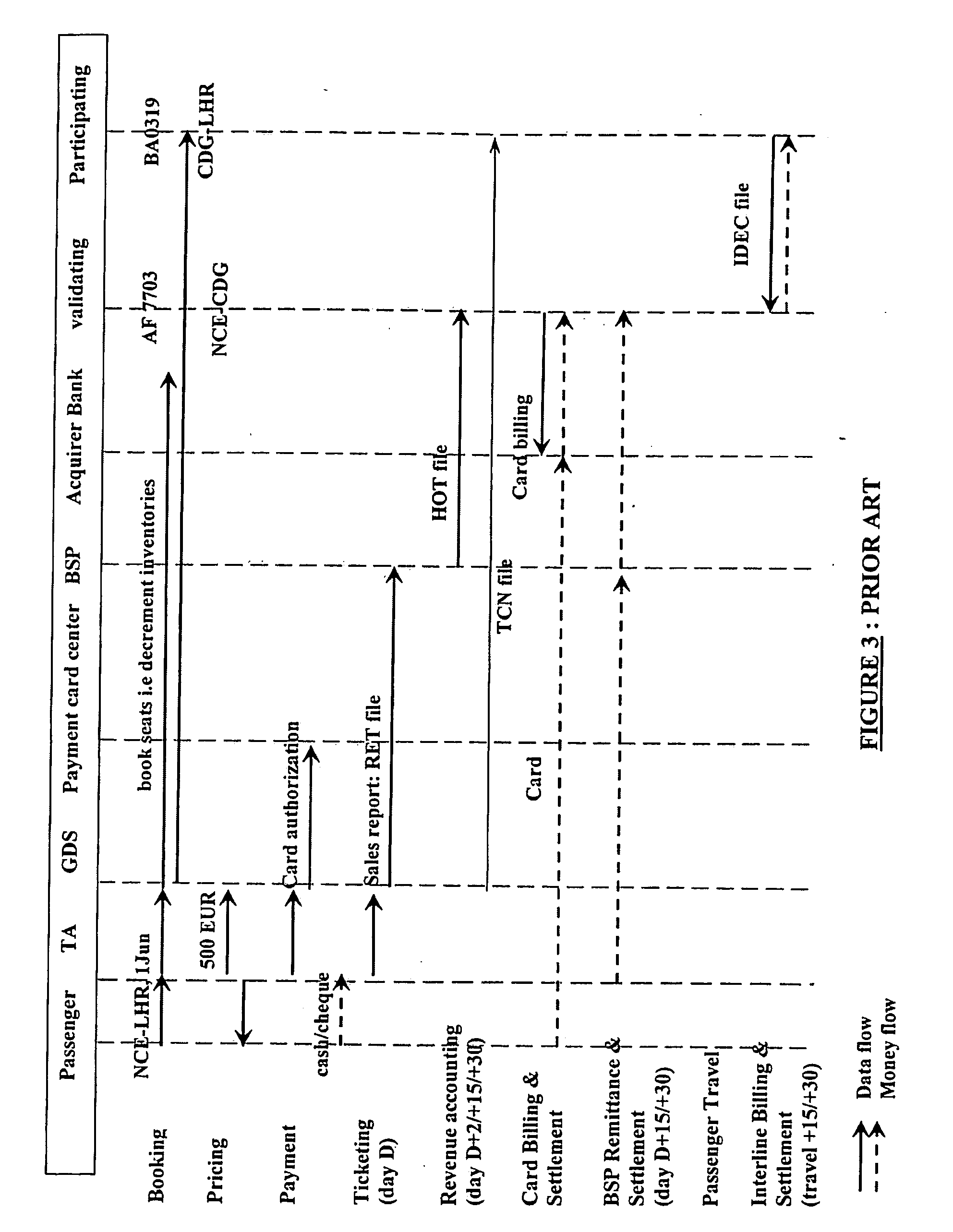

Guaranteed revenue at electronic ticket issuance and modification

InactiveUS20090216568A1Short response timeGood synergyTicket-issuing apparatusReservationsComputer scienceAirline ticket

Owner:AMADEUS S

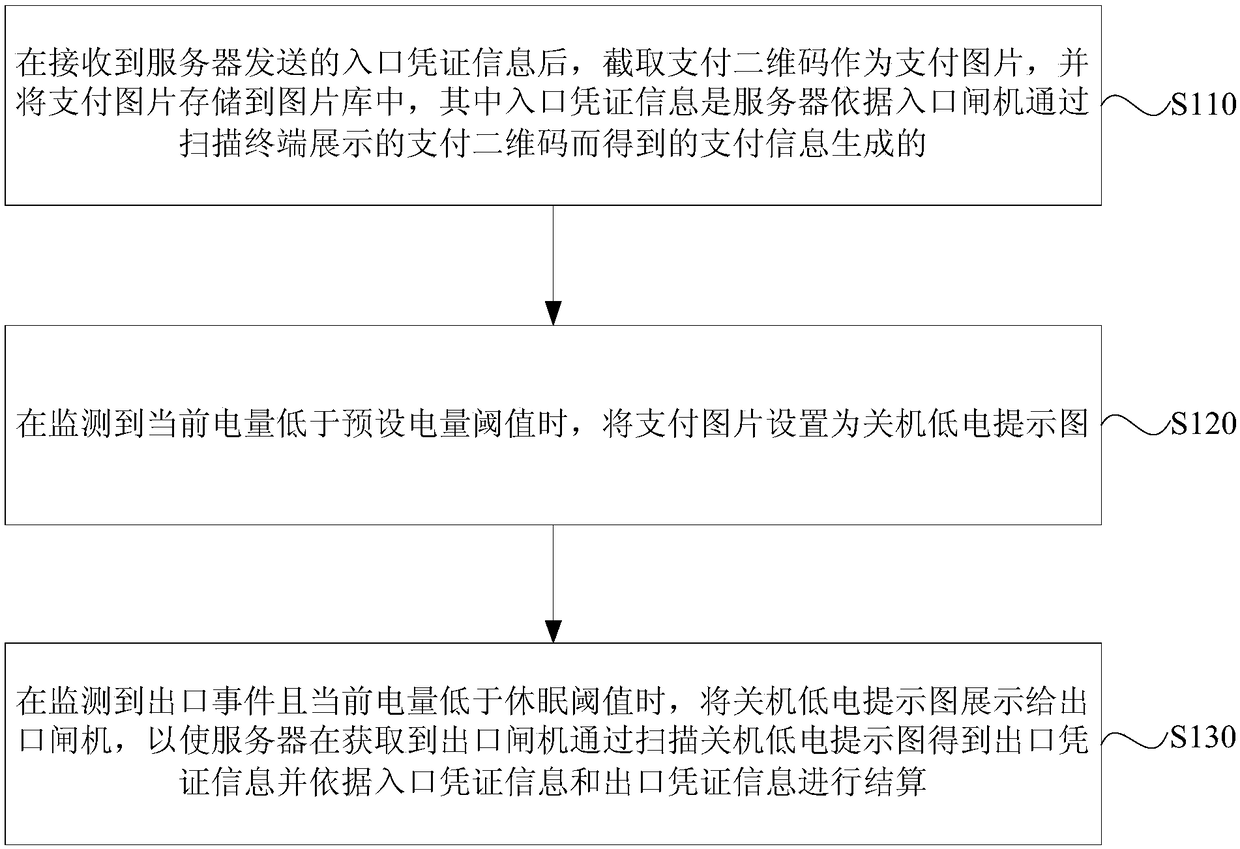

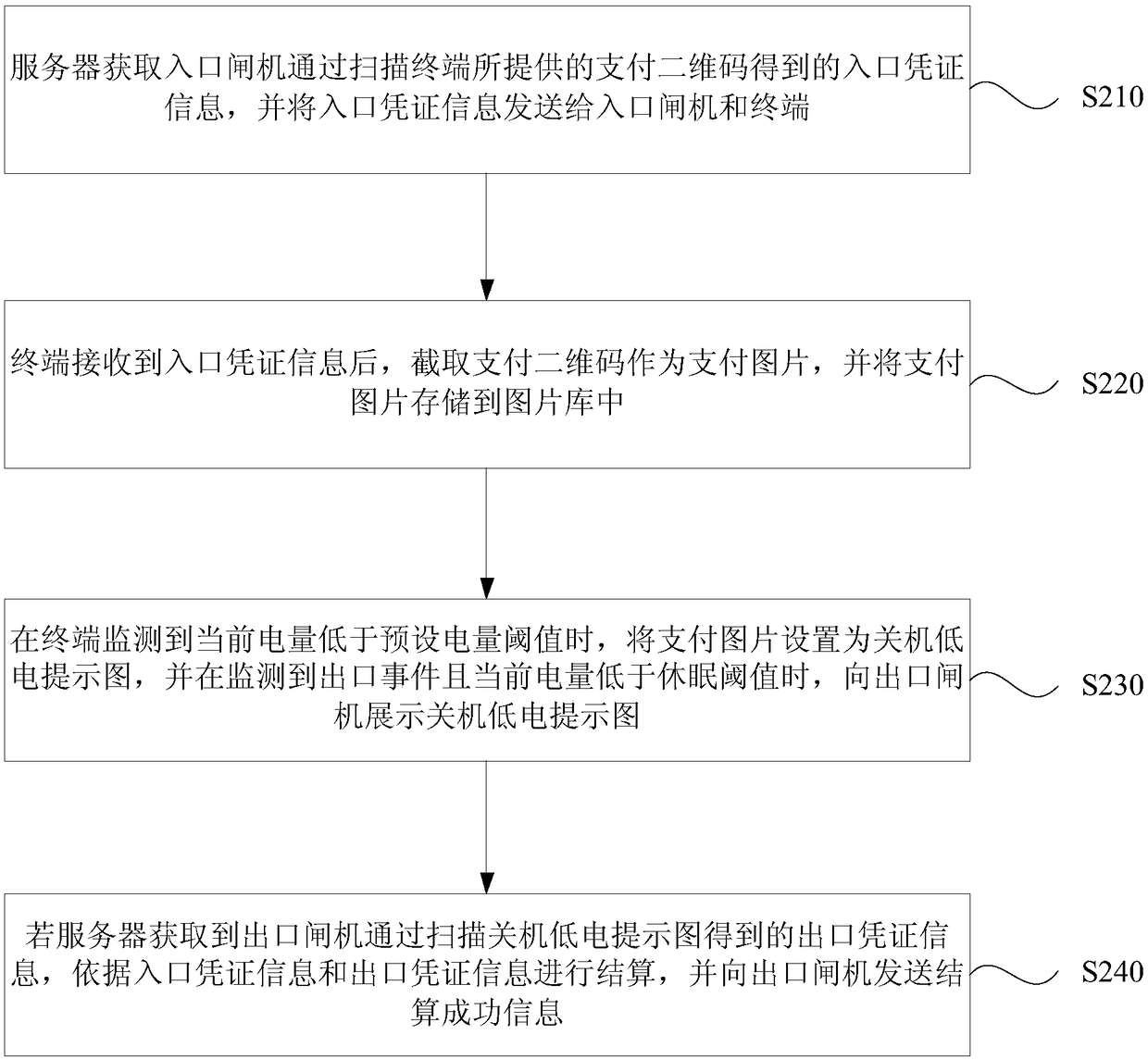

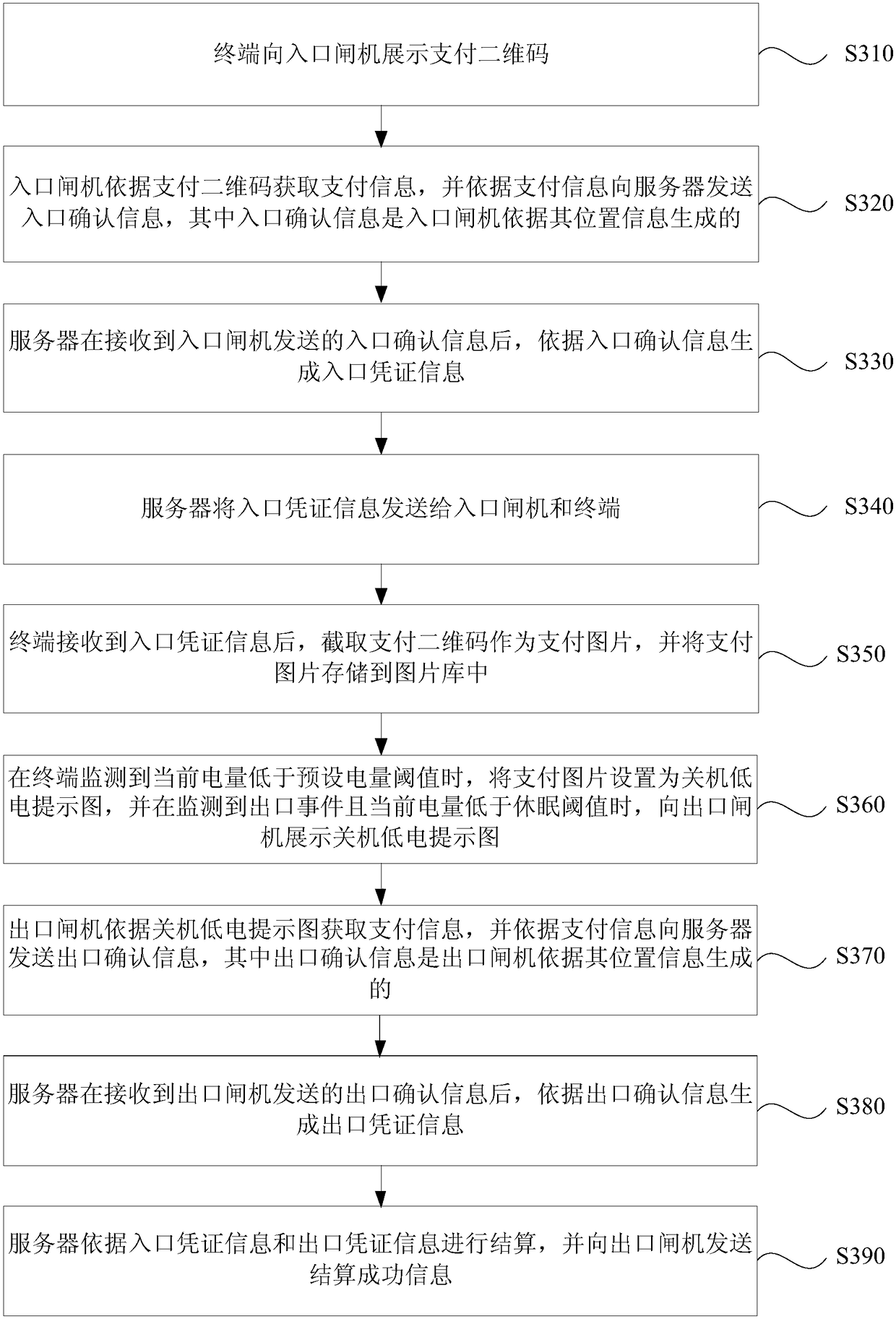

QR (quick respond) code settlement method and system and terminal

InactiveCN108257227AAvoid the phenomenon of being unable to scan the QR code to settle out of the stationImprove experienceTicket-issuing apparatusPayment architectureElectricityPayment

Owner:SHANGHAI YUDE TECH CO LTD

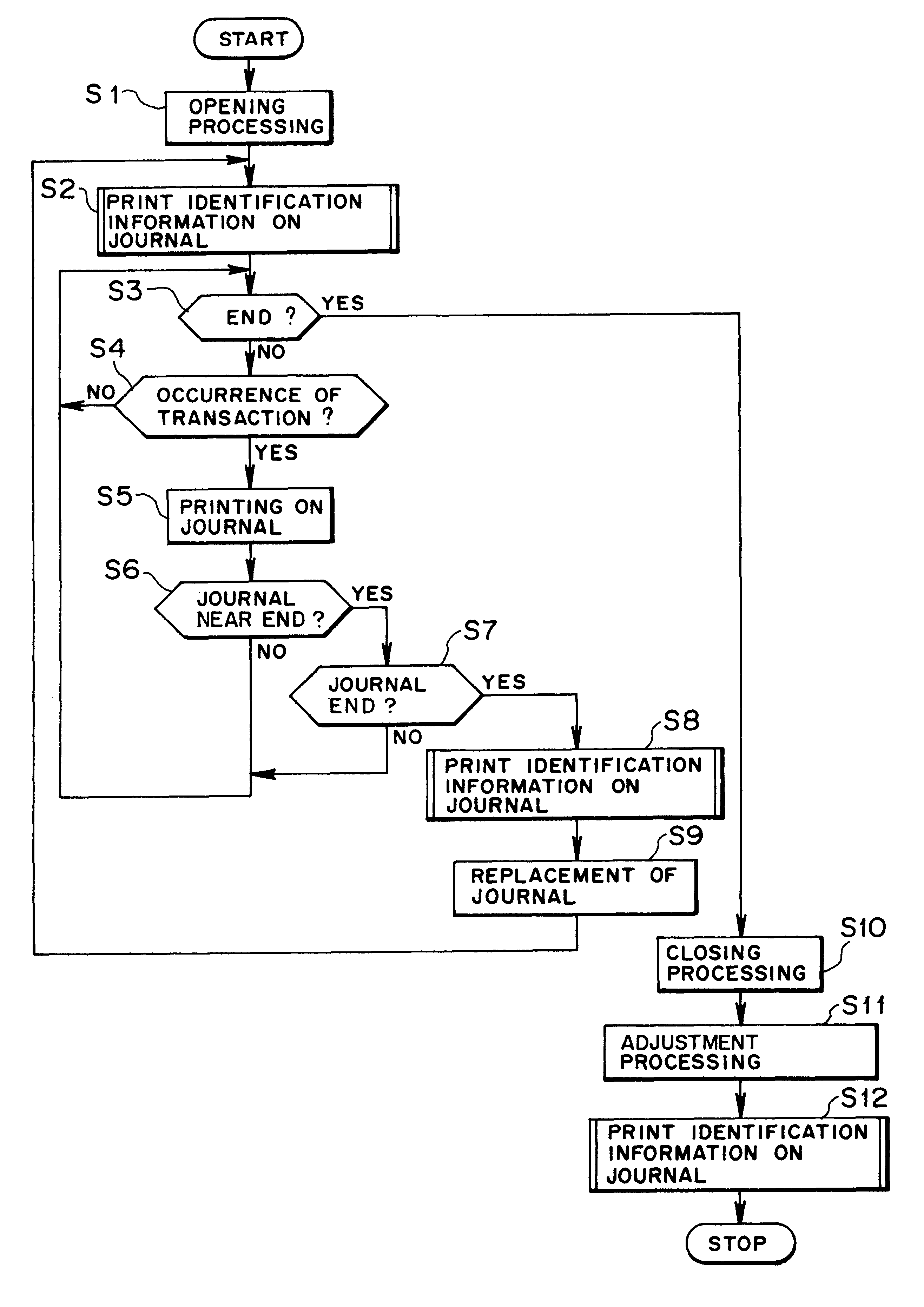

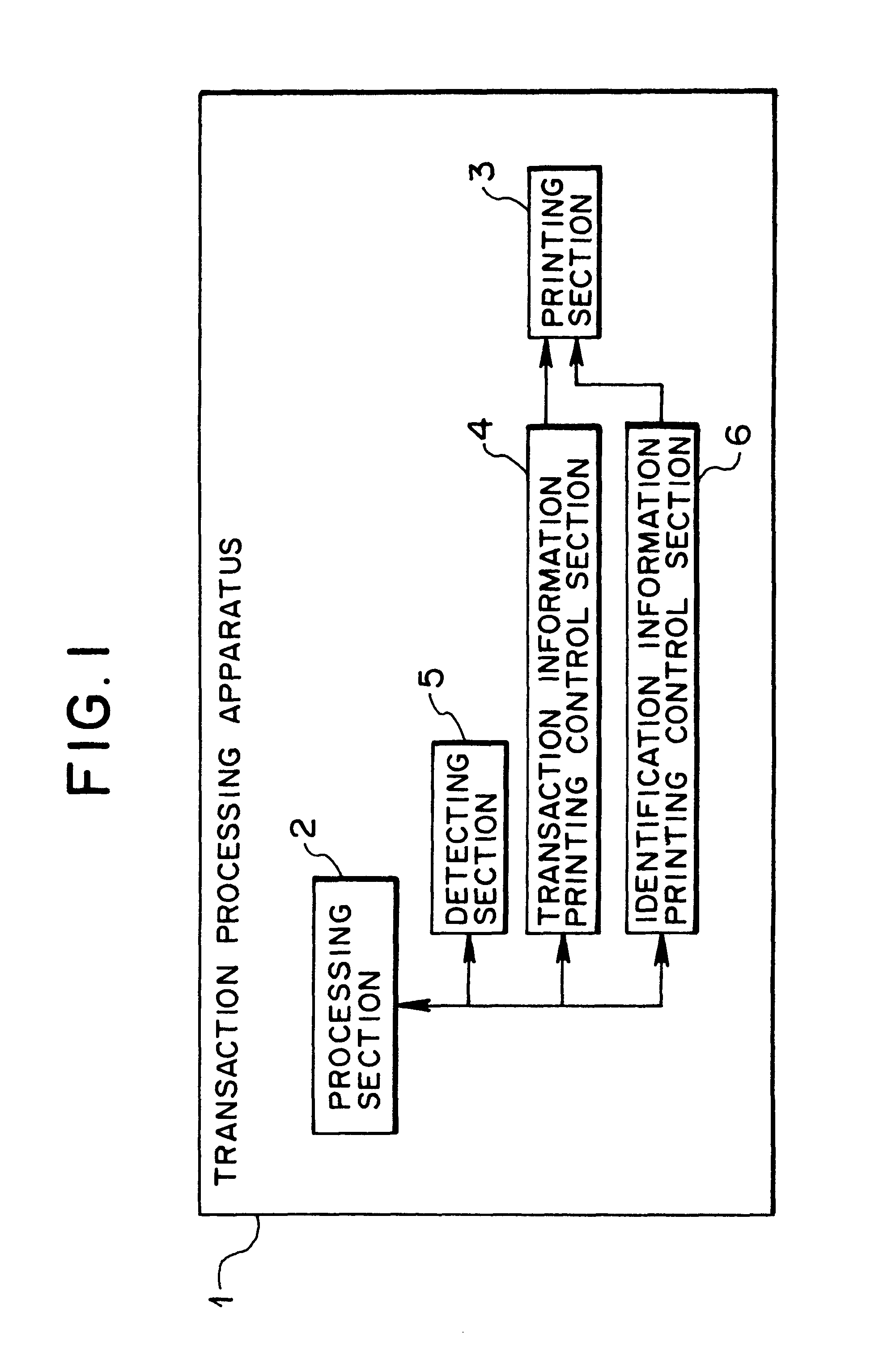

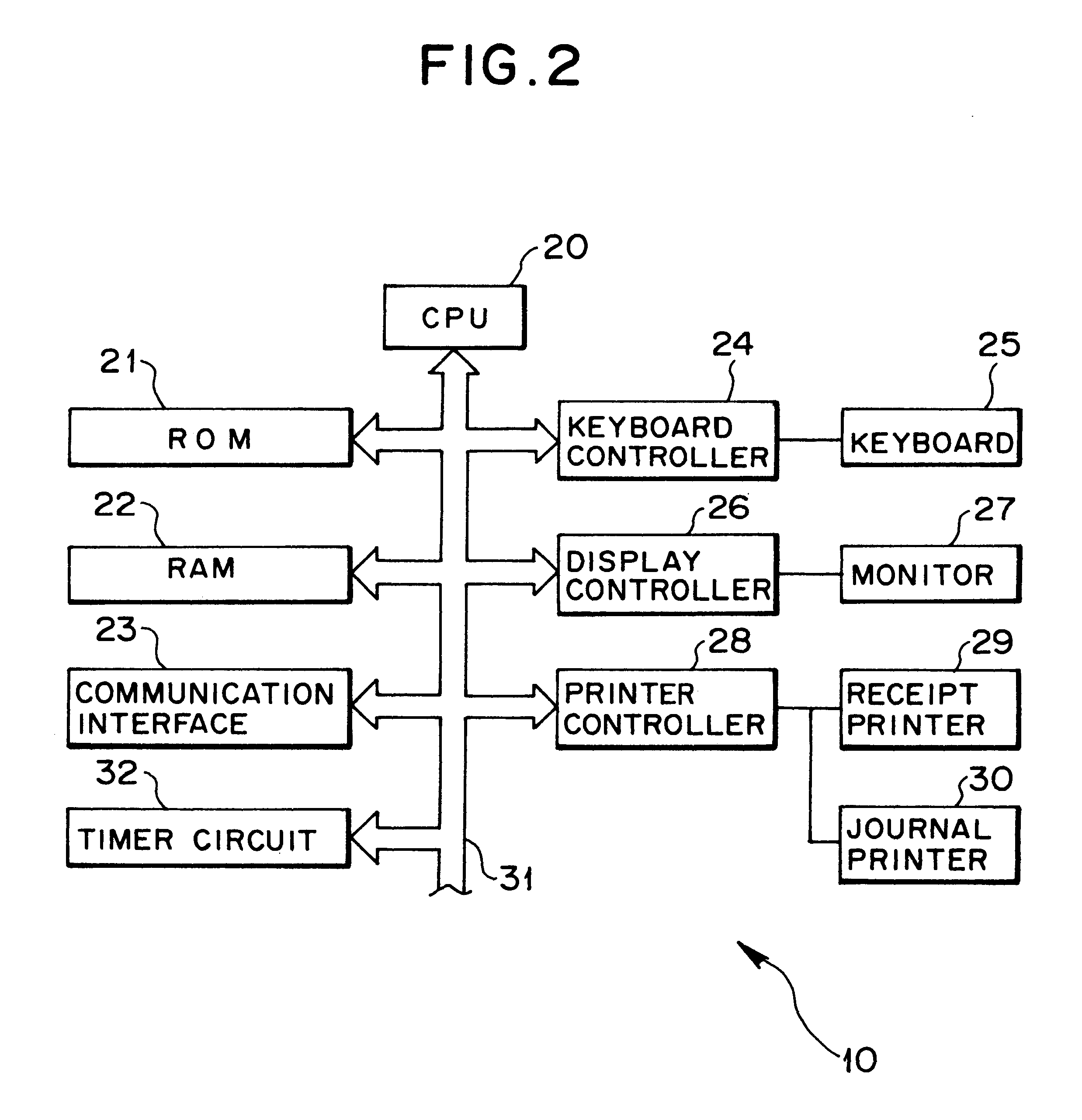

Journal form managing method, transaction processing apparatus, and transaction record journal form

InactiveUS6721613B1Shorten the timeReduce laborCoin countersPayment architectureTransaction dataDatabase

Owner:FUJITSU LTD

Credit card verification system and method

InactiveUS6912312B1Accurate comparisonElectric signal transmission systemsImage analysisCredit cardCommunication unit

The invention provides a credit card verification system, including a credit card company data storage and communication unit (4) for recording and storing data concerning authorized credit card holders, including an electronically reproducible image of each credit card holder, means (6) for introducing the image into the company data storage unit, and at least one remotely positioned credit card reader (10) and image display meants (12) communicating with the company data storage unit, for selectively retrieving data from the storage unit to be displayed on the image display means, to be viewed and approved by the person providing sales services. The invention also provides a method for verifying the identity of a credit card holder effecting a tansaction and a method enabling credit companies to monitor and verify credit card holder identity when a payment transaction is performed at a sales terminal.

Owner:CALLAHAN CELLULAR L L C

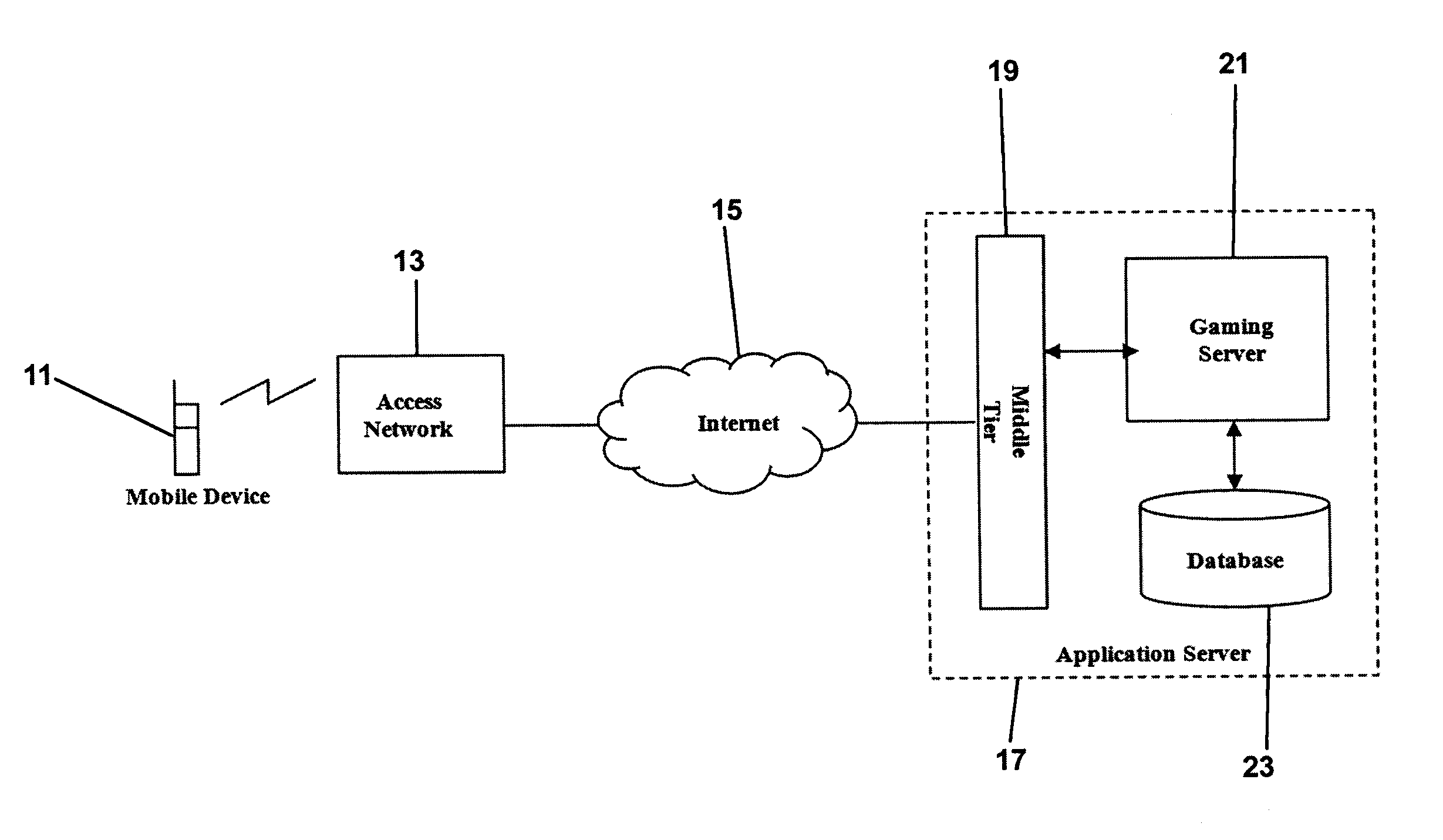

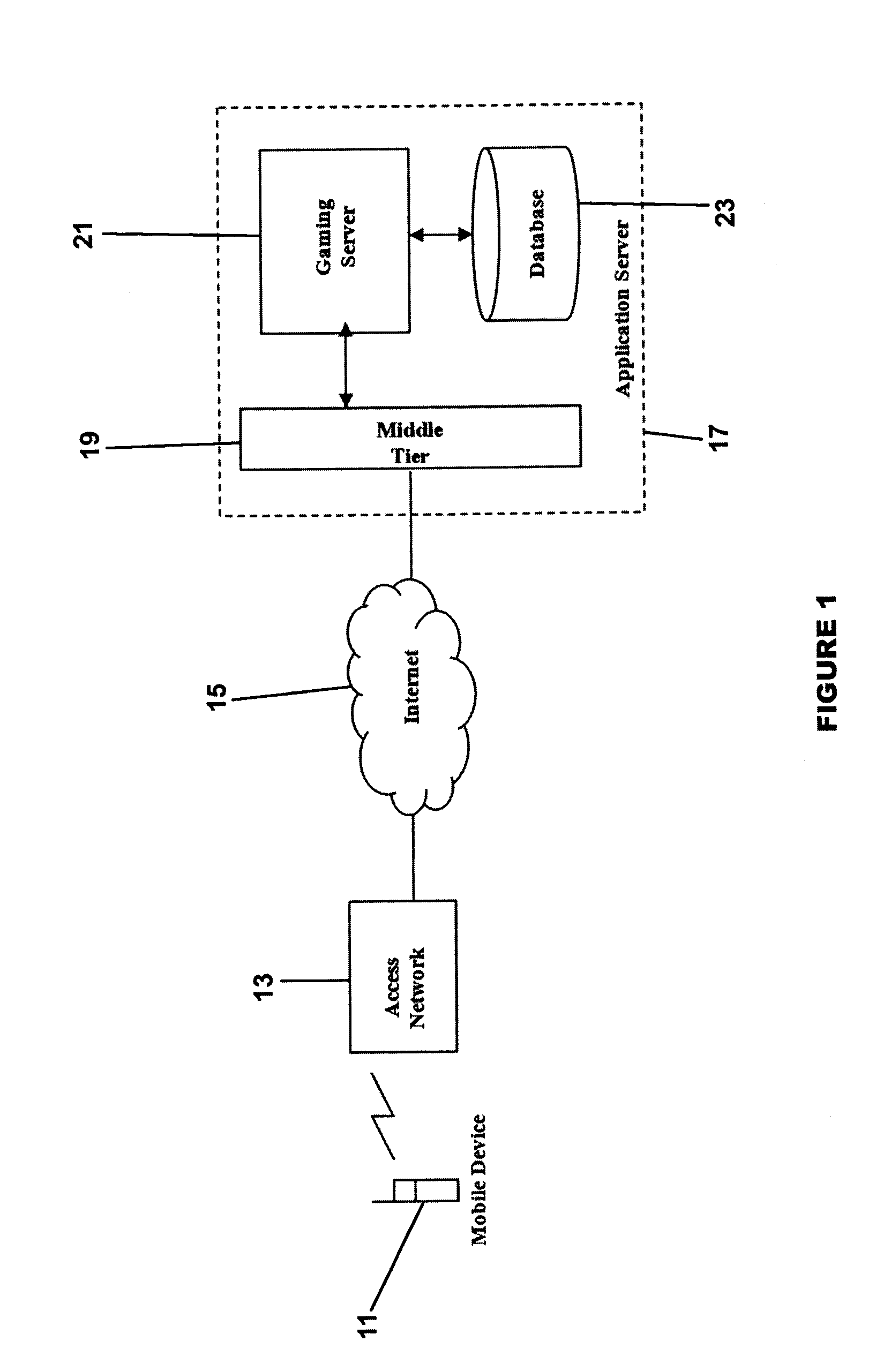

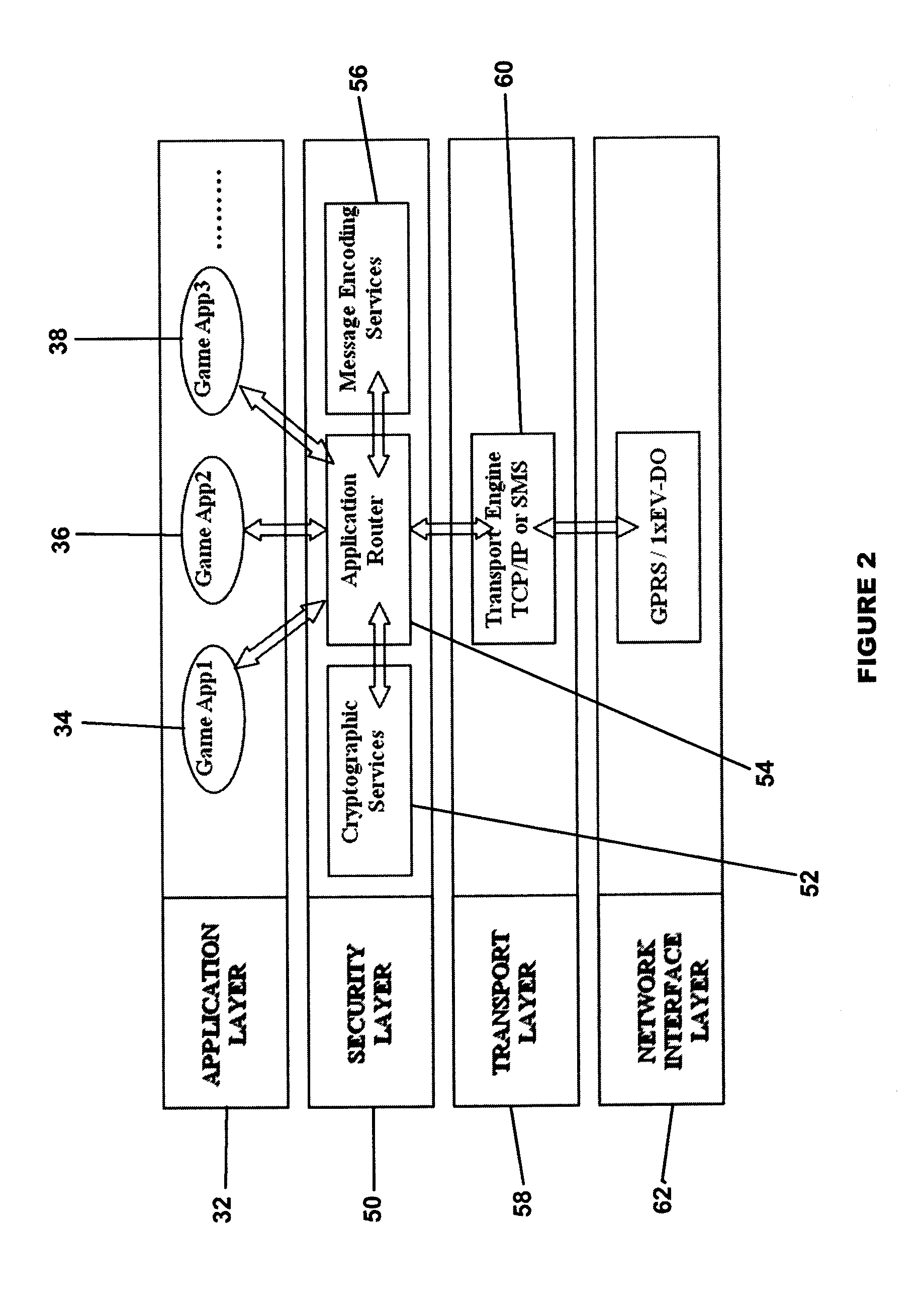

Mobile gaming system

InactiveUS20090258691A1Simple patternPayment architectureApparatus for meter-controlled dispensingMobile wirelessElectronic mail

Owner:W2BI

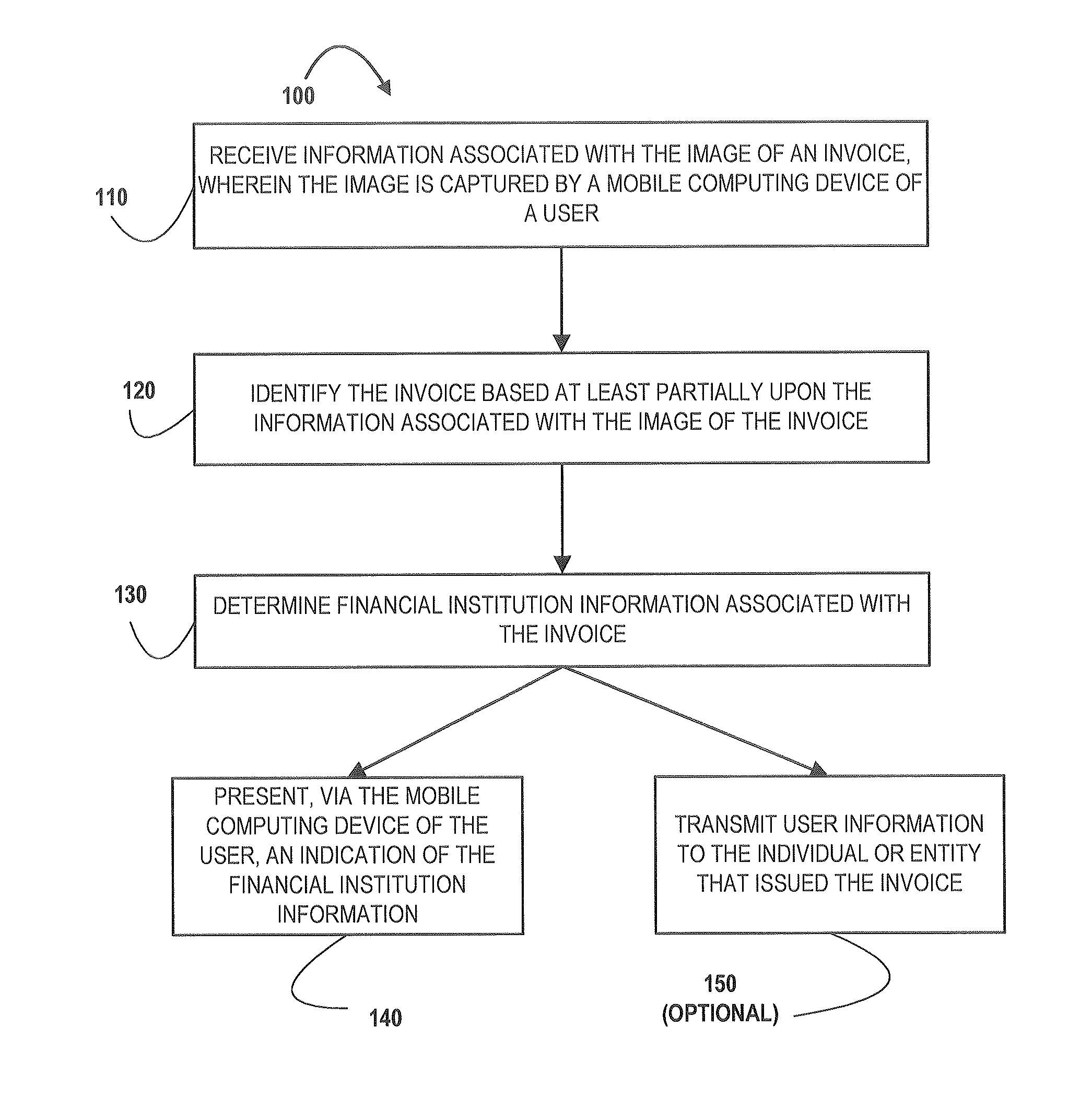

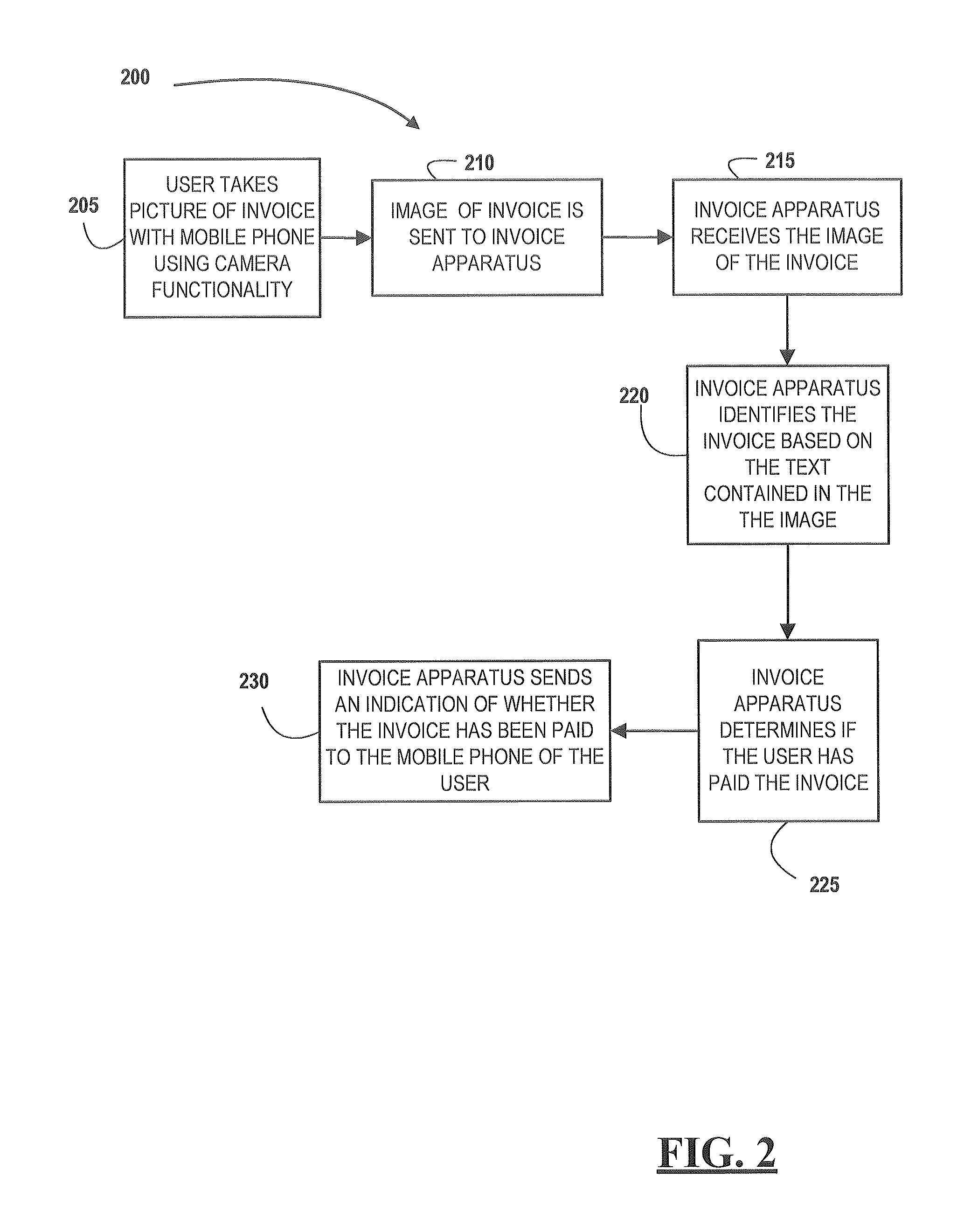

Electronic processing of paper invoices

Owner:BANK OF AMERICA CORP

Sale platform based on Internet and implementing method thereof

Owner:JINAN NEW GIGANANO LONG DISTANCE MEASURING & CONTROL

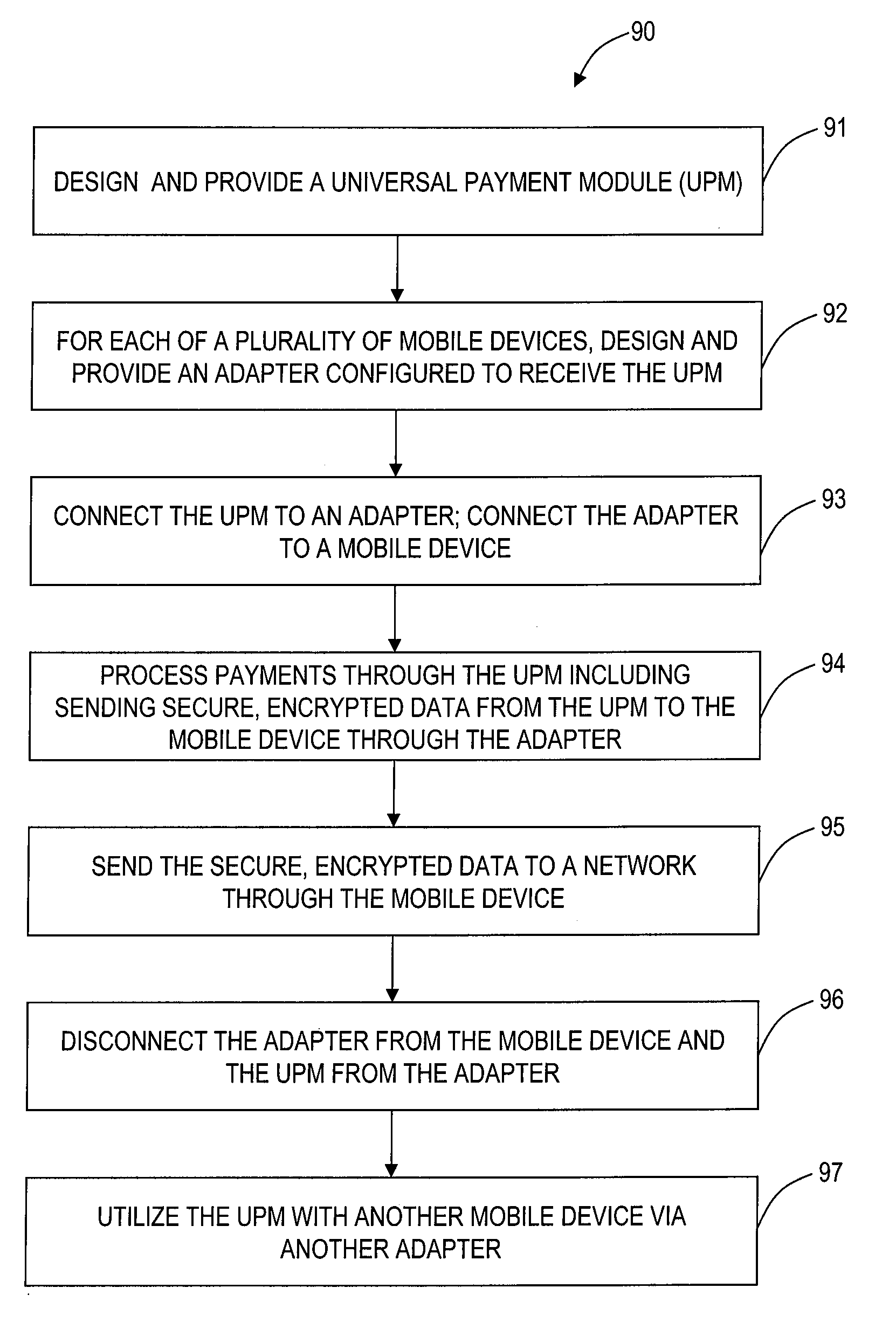

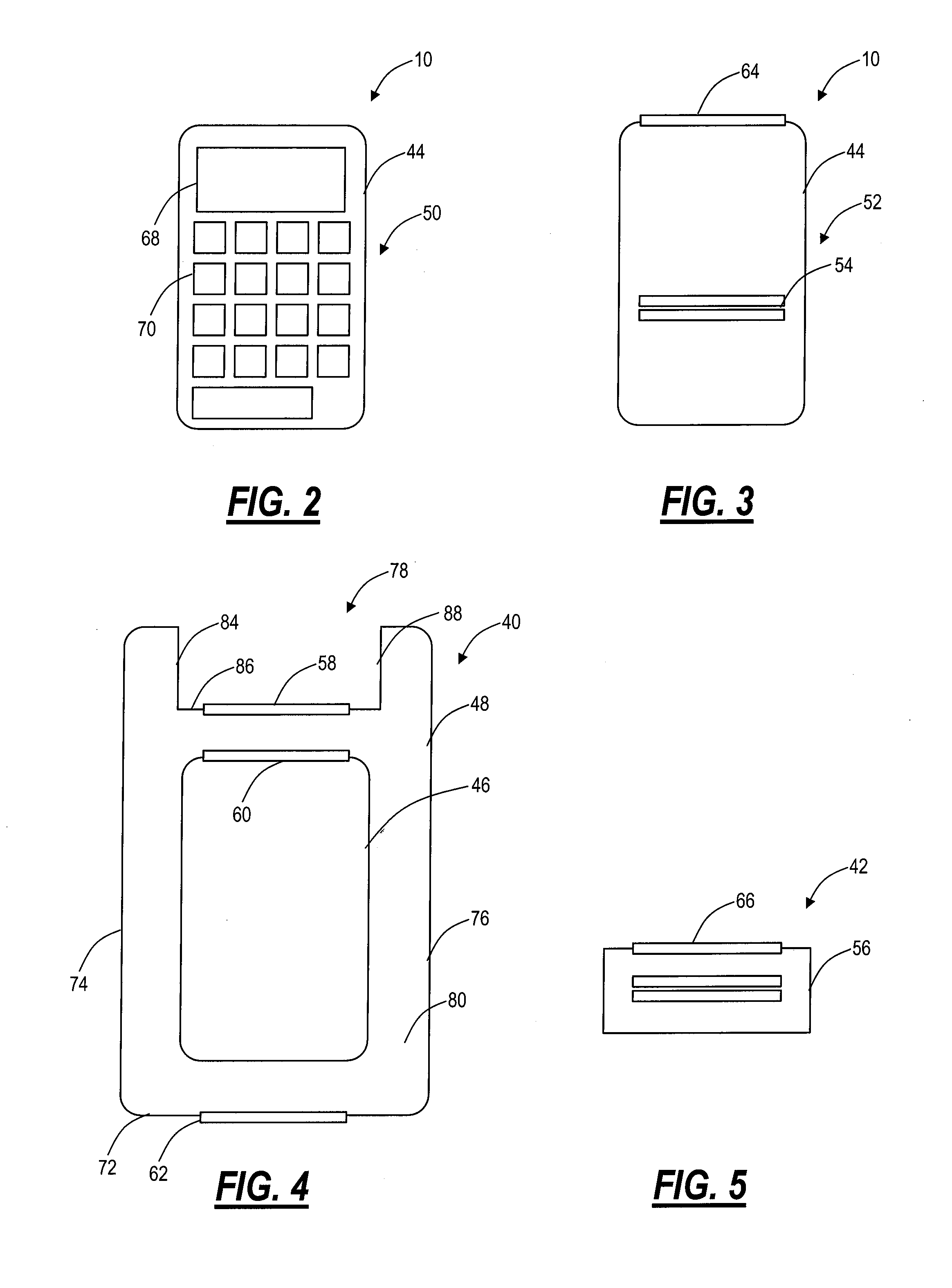

Universal payment module systems and methods for mobile computing devices

Owner:SYMBOL TECH LLC

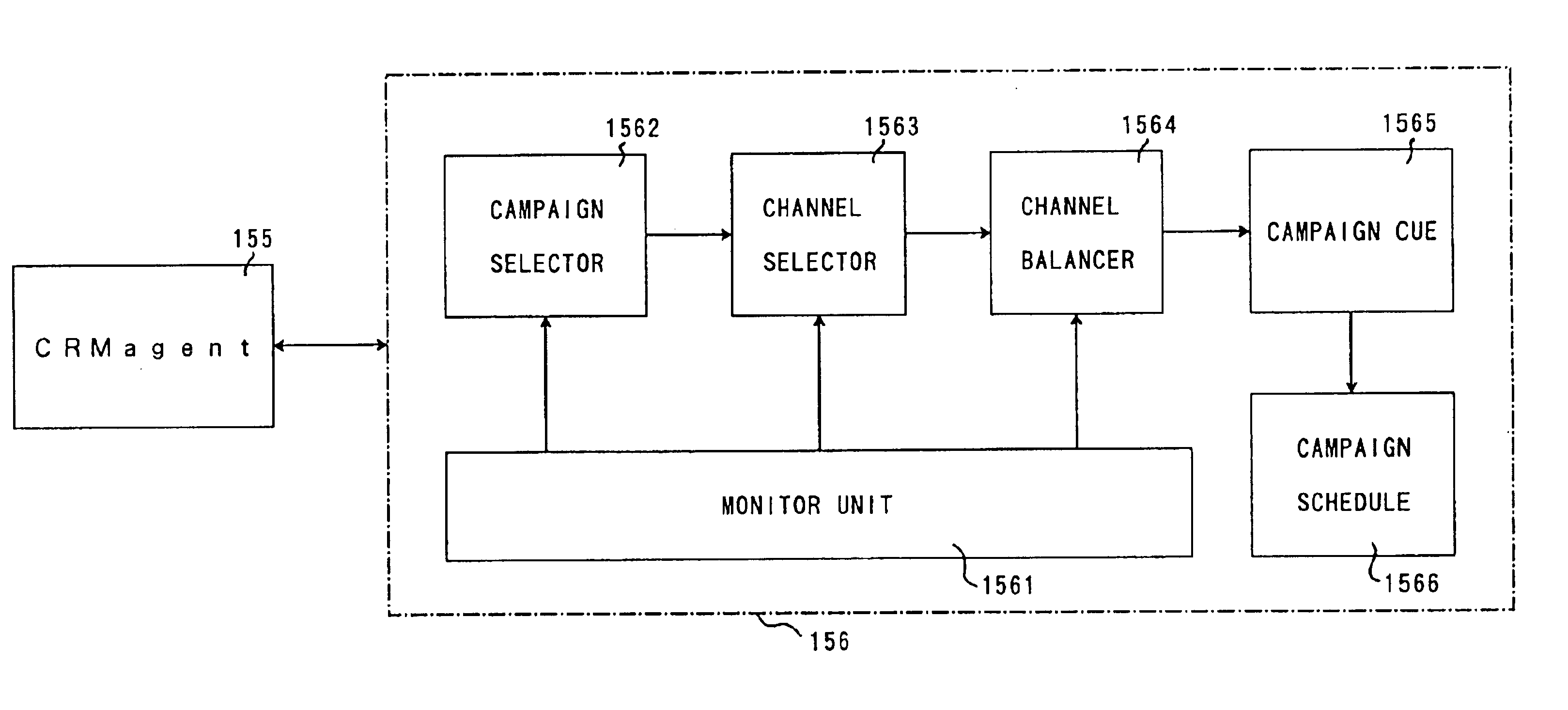

Method and apparatus for creating custom advertisements

ActiveUS8234174B1Hand manipulated computer devicesPayment architectureDomain nameInformation networks

Owner:UNITED BANK +1

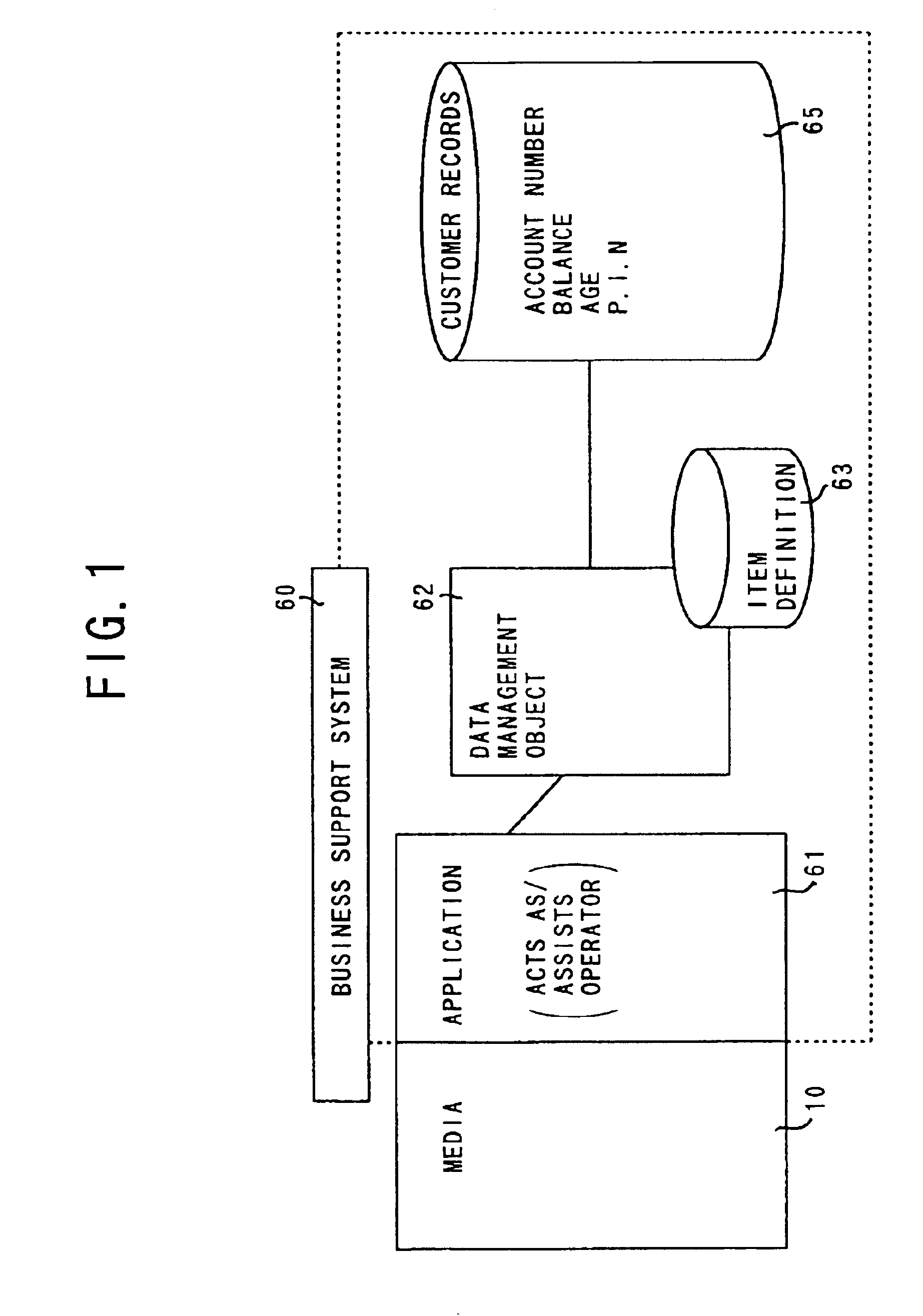

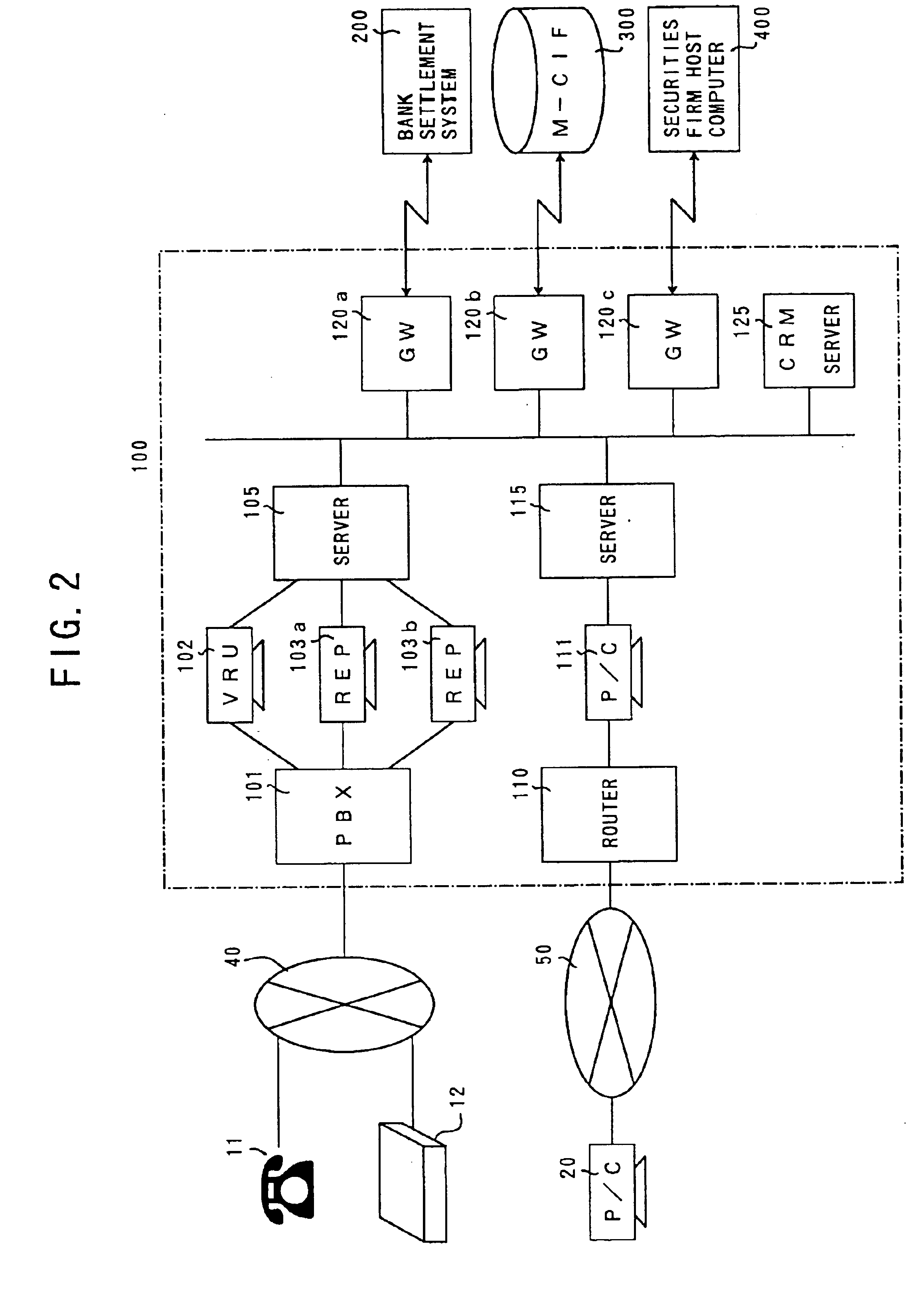

Business support system

InactiveUS6868390B1Eliminate disadvantagesFinancePayment architectureComputer terminalService information

Owner:FUJITSU LTD

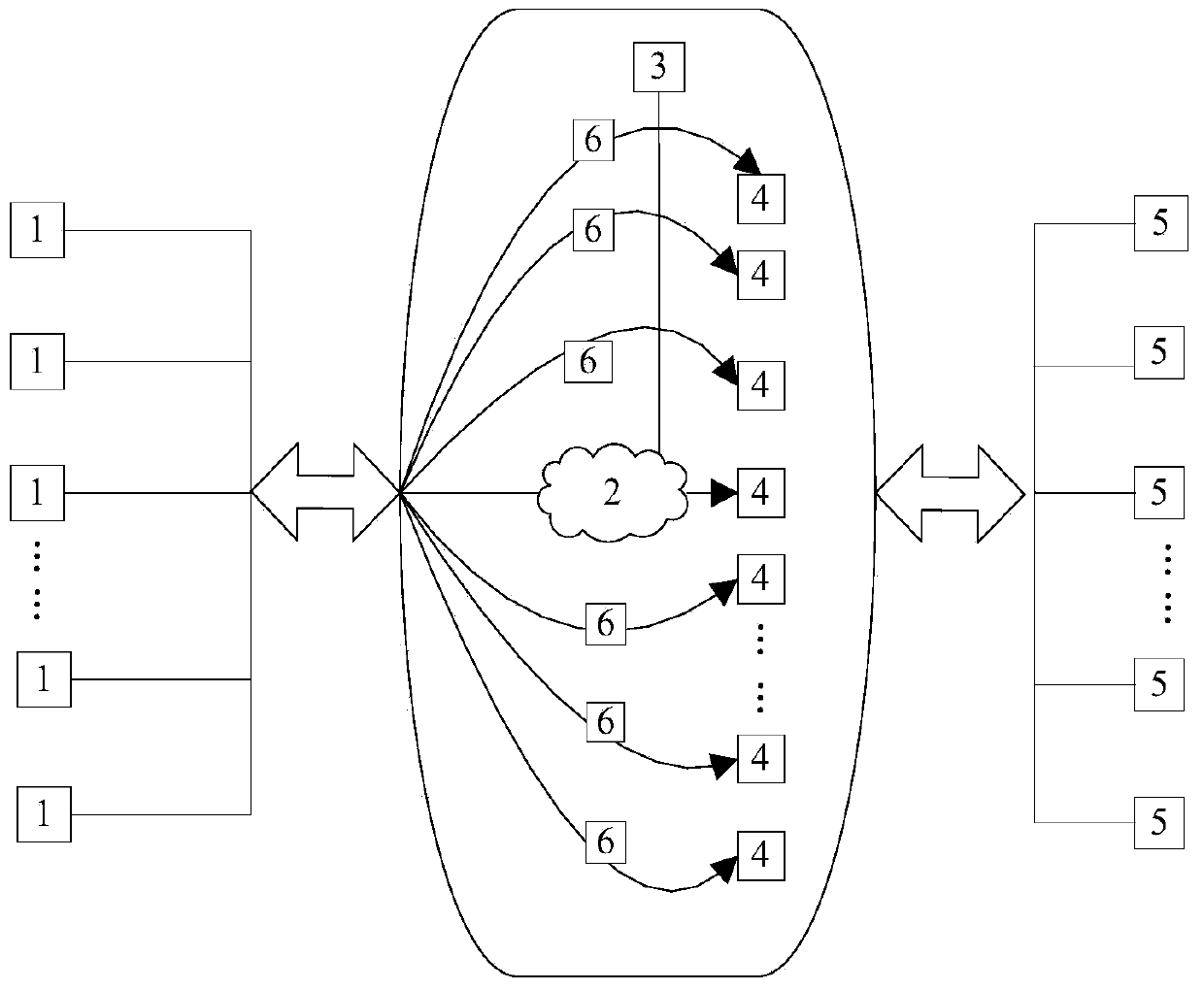

Digital currency exchange method, digital currency payment method and digital currency systems

ActiveCN107230077AAchieve securityRealize unified managementPayment architectureDigital currencyComputer terminal

The invention provides a digital currency exchange method, a digital currency payment method and digital currency systems, and aims at enhancing the operation experience of digital currency users and carrying out online payment flexibly and conveniently. The digital currency exchange method comprises the following steps of: selecting a to-be-exchanged digital currency with an amount appointed by a change exchange instruction by a user terminal according to the change exchange instruction, and sending a first request to a commercial bank digital currency system; exchanging the to-be-exchanged digital currency into a change digital currency by the commercial bank digital currency system according to the first request, and sending a second request to a central bank digital currency system; executing an operation of a preset project by the central bank digital currency system according to the second request, and returning an operation success instruction to the commercial bank digital currency system; and sending the change digital currency to the user terminal by the commercial bank digital currency. Moreover, the invention discloses a method for carrying out payment by using the exchanged digital currency.

Owner:THE PEOPLES BANK OF CHINA DIGITAL CURRENCY INST

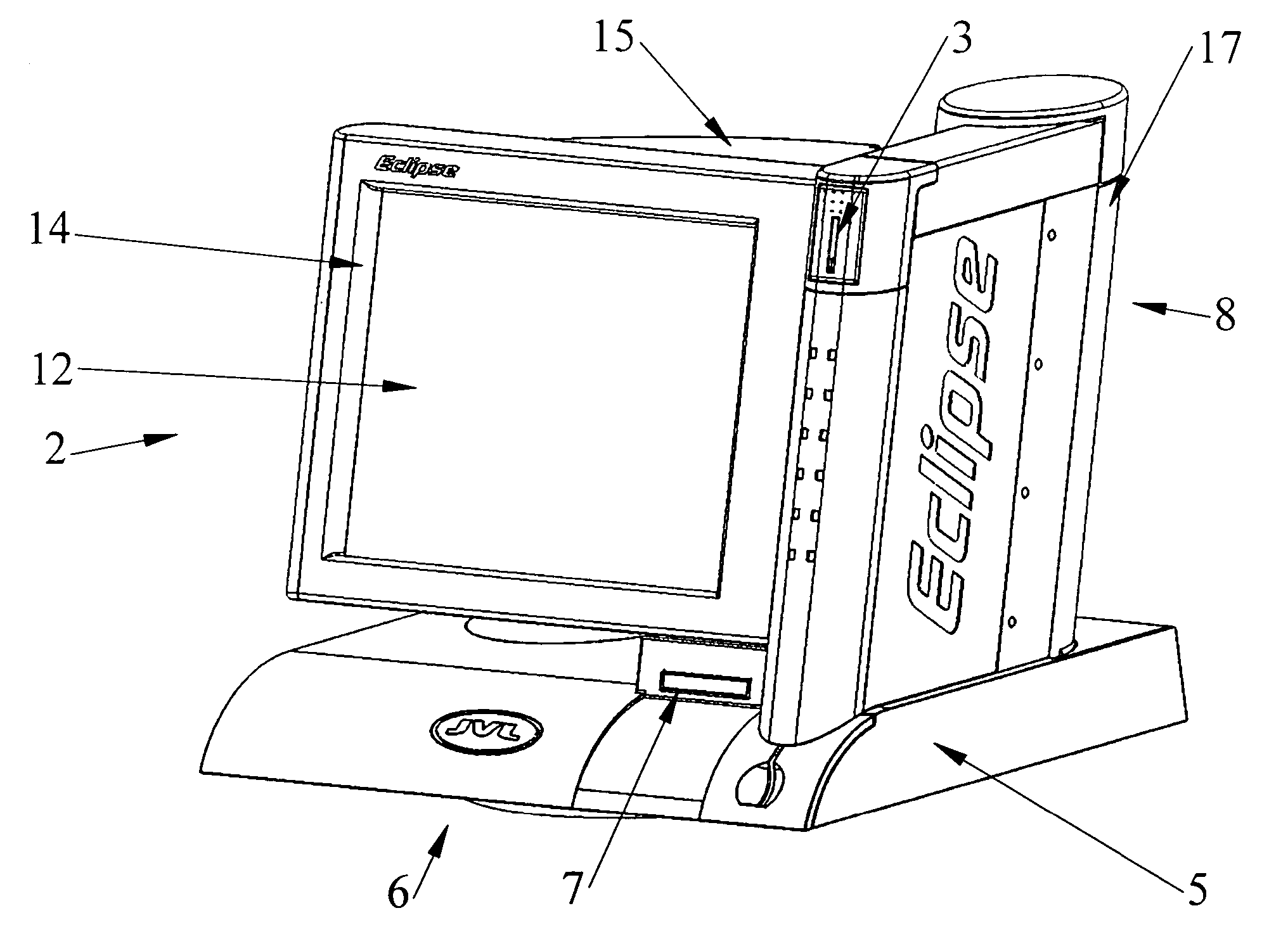

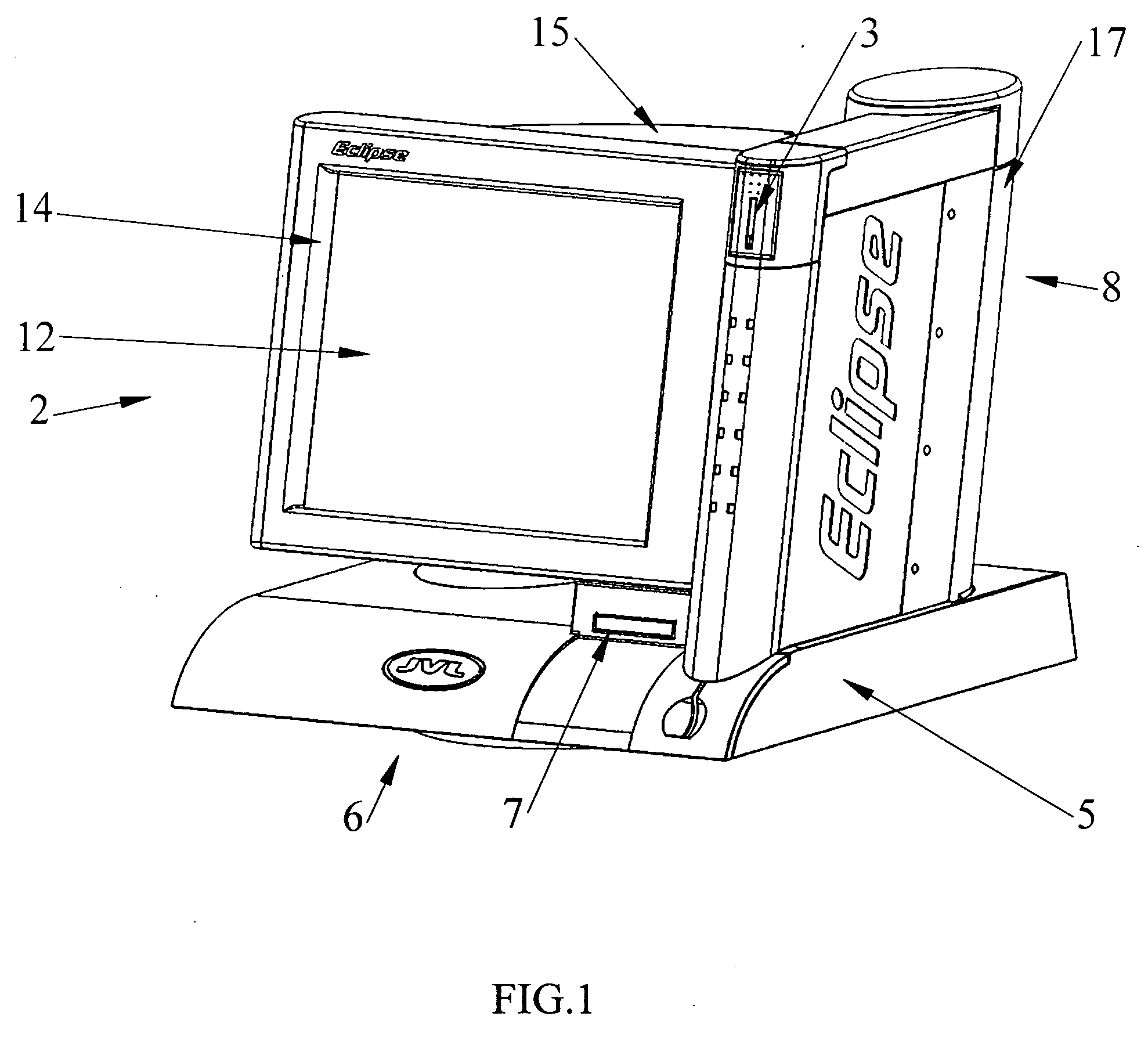

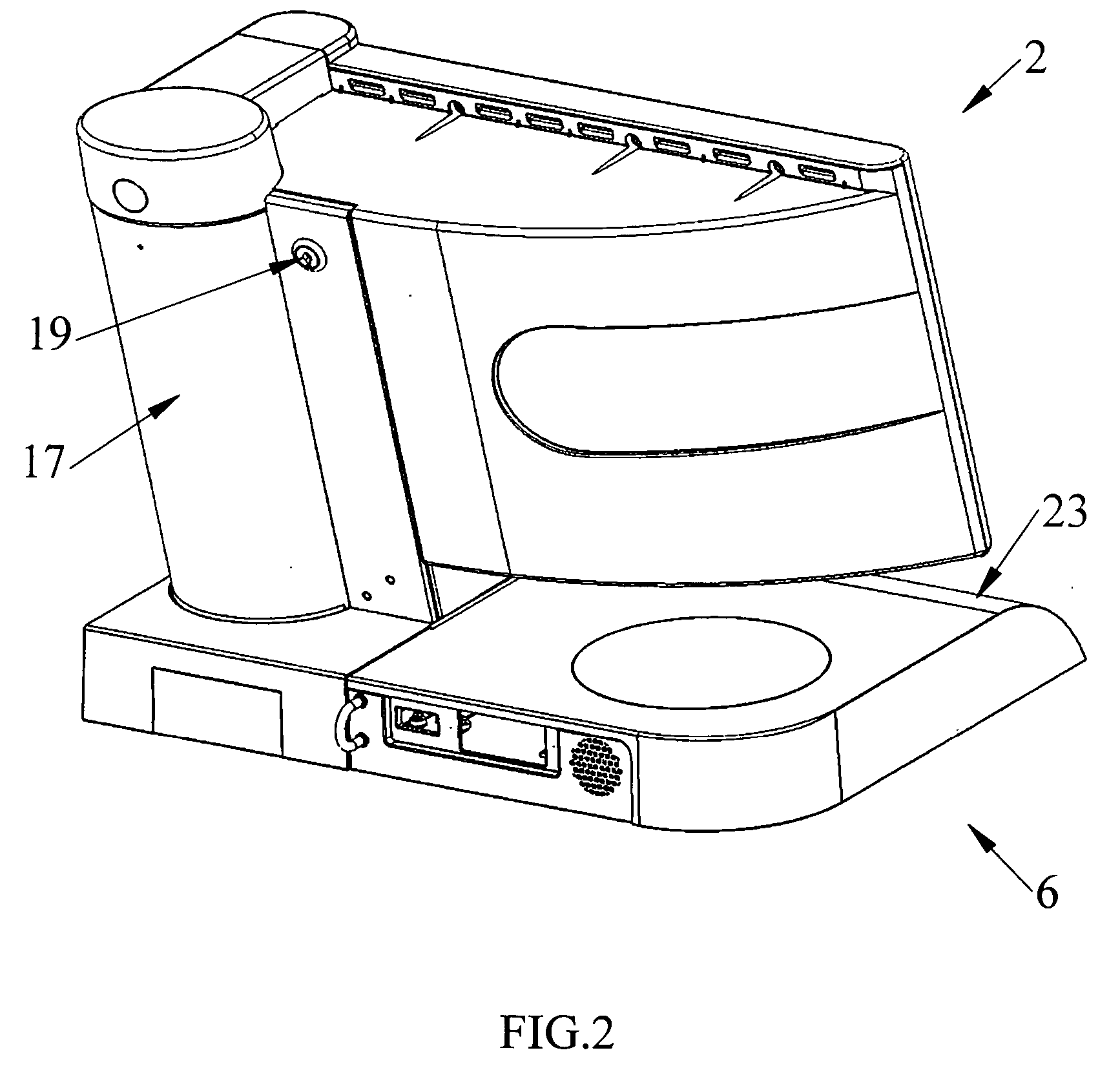

Countertop video terminal

Owner:JVL CORP

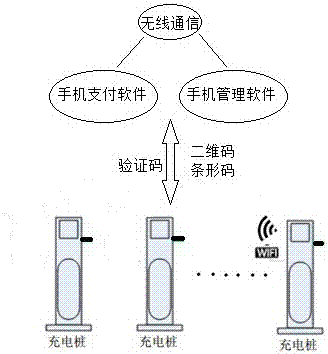

Electric charge settlement system without direct data interaction between charging pile and public communication network

Owner:NANJING JIETAI ELECTRIC POWER EQUIP

Intelligent food ordering system based on graphic code

InactiveCN104867068AEnhance sensory experienceConvenient orderingPayment architectureGraphicsComputer terminal

The invention relates to an intelligent food ordering system based on a graphic code. The intelligent food ordering system comprises at least one set of mobile equipment, a server, at least one intelligent mobile phone terminal and the graphic code arranged on a dining table. The mobile equipment scans the graphic code and transmits the graphic code to the server. Authority verification is performed on the mobile equipment by the server. The authority is an authority that a mobile terminal requests the server to mark the graphic code transmitted by the mobile terminal. The server marks the graphic code transmitted by the mobile terminal. The intelligent mobile phone terminal acquires the graphic code and transmits the graphic code to the server. The graphic code transmitted by the intelligent mobile phone terminal and the marked graphic code are compared by the server. After the graphic code transmitted by the intelligent mobile phone terminal is marked in the server, the server transmits food ordering page information corresponding to the graphic code to the intelligent mobile phone terminal, and the intelligent mobile phone terminal and the graphic code are bound in a one-to-one way by the server.

Owner:QUANZHOU ZHENMEI INTELLIGENT TECH CO LTD

Who we serve

- R&D Engineer

- R&D Manager

- IP Professional

Why Eureka

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Social media

Try Eureka

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap