Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

33results about "Protocol authorisation" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

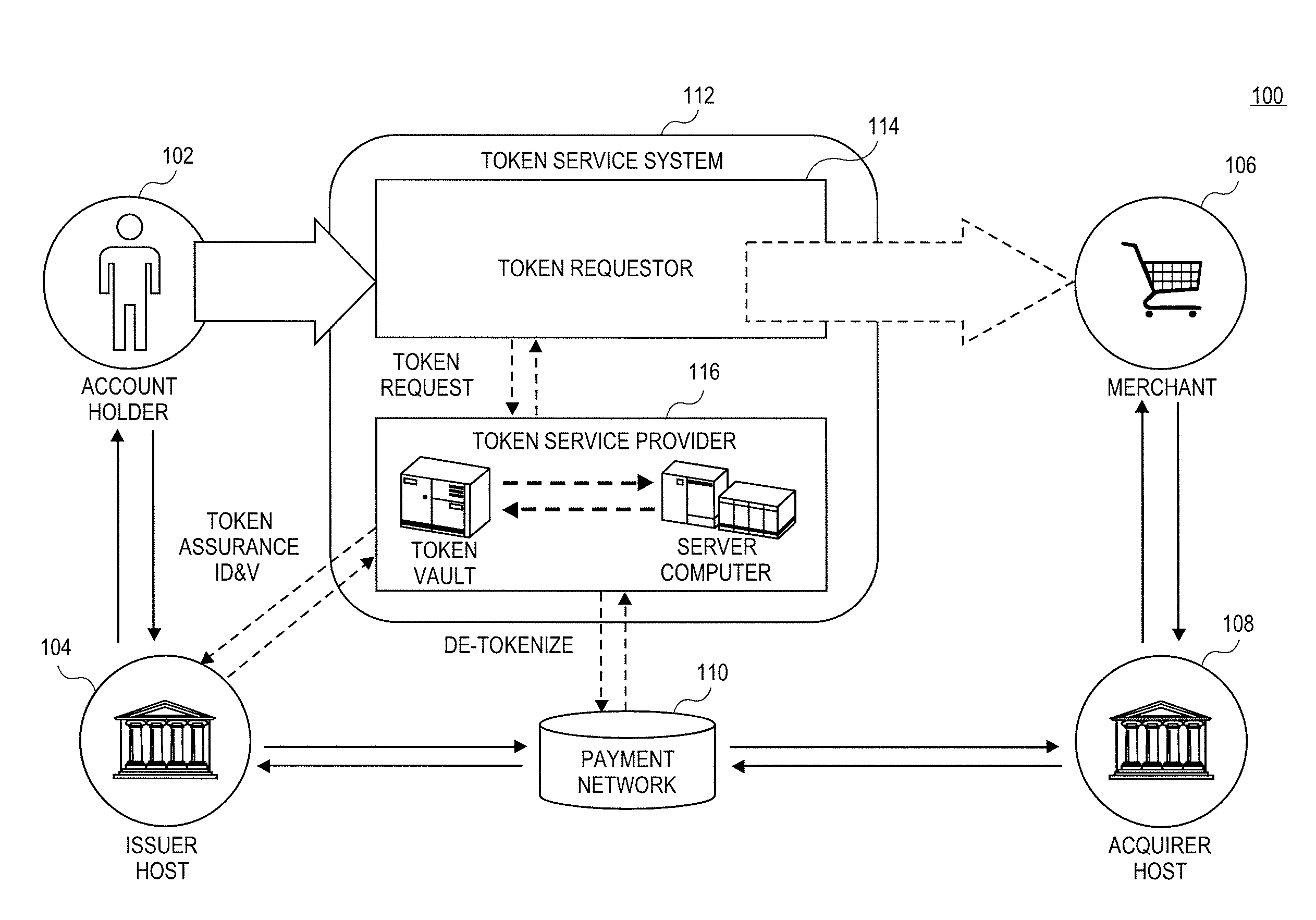

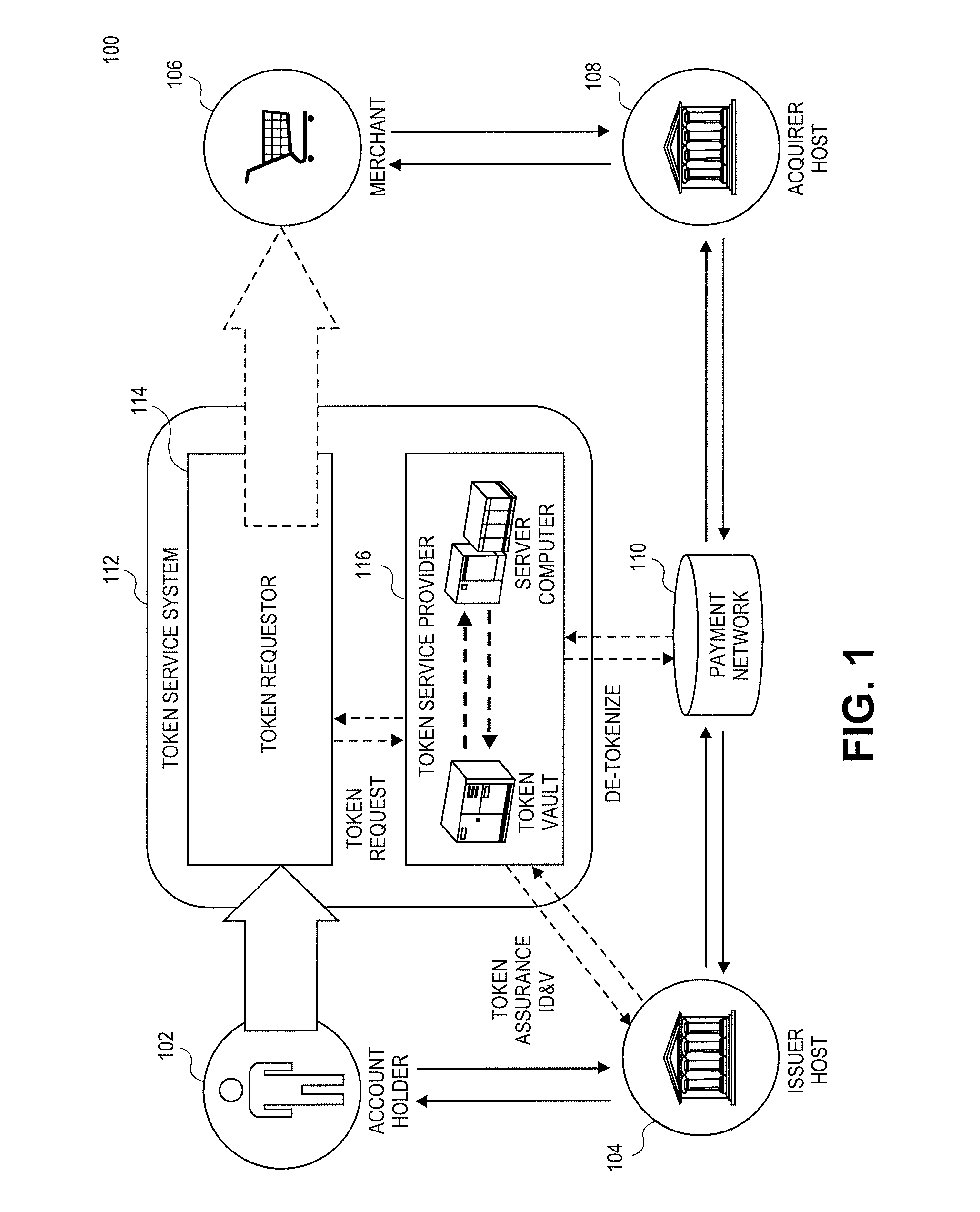

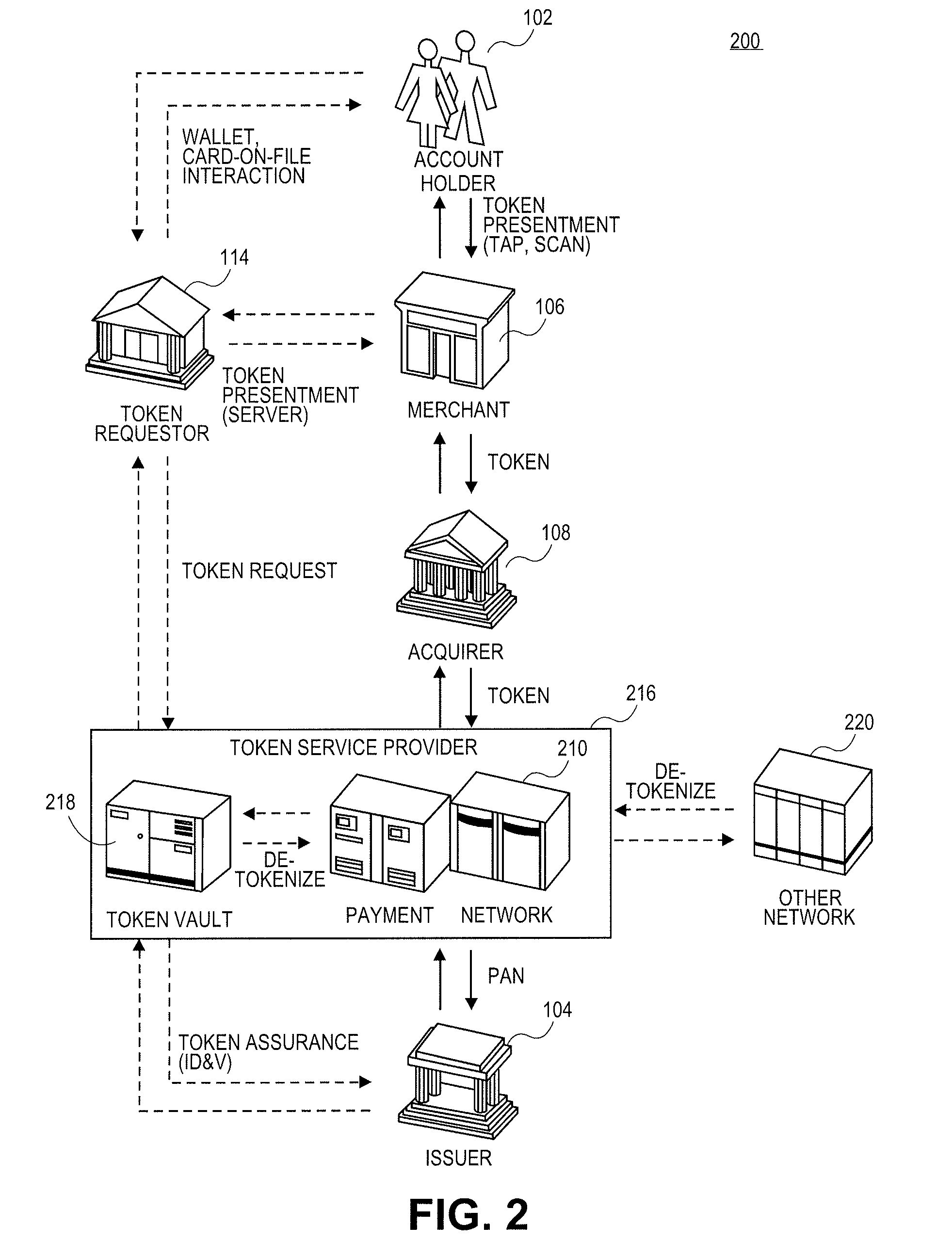

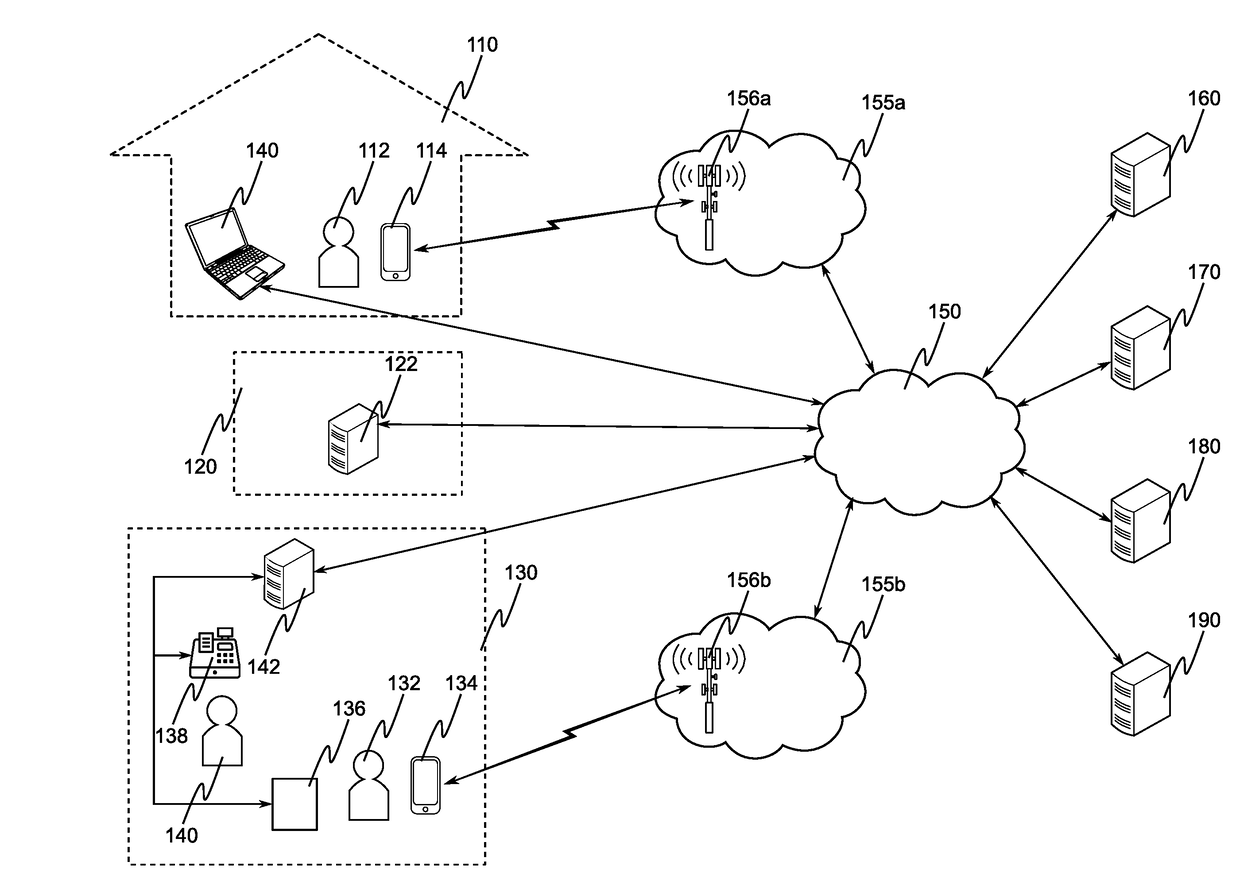

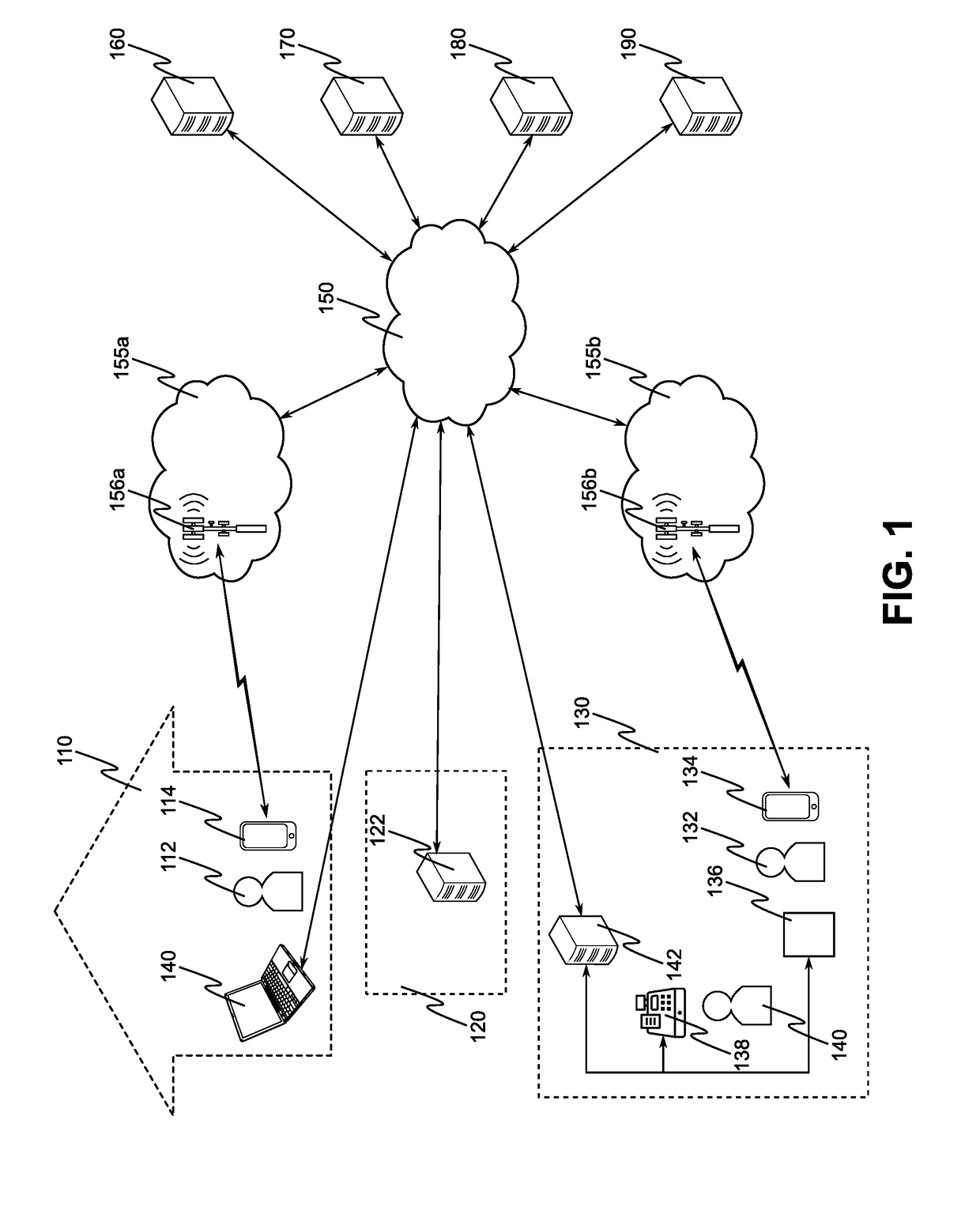

Network token system

ActiveUS20150127547A1User identity/authority verificationPoint-of-sale network systemsPayment transactionOperating system

Owner:MASTERCARD INT INC +1

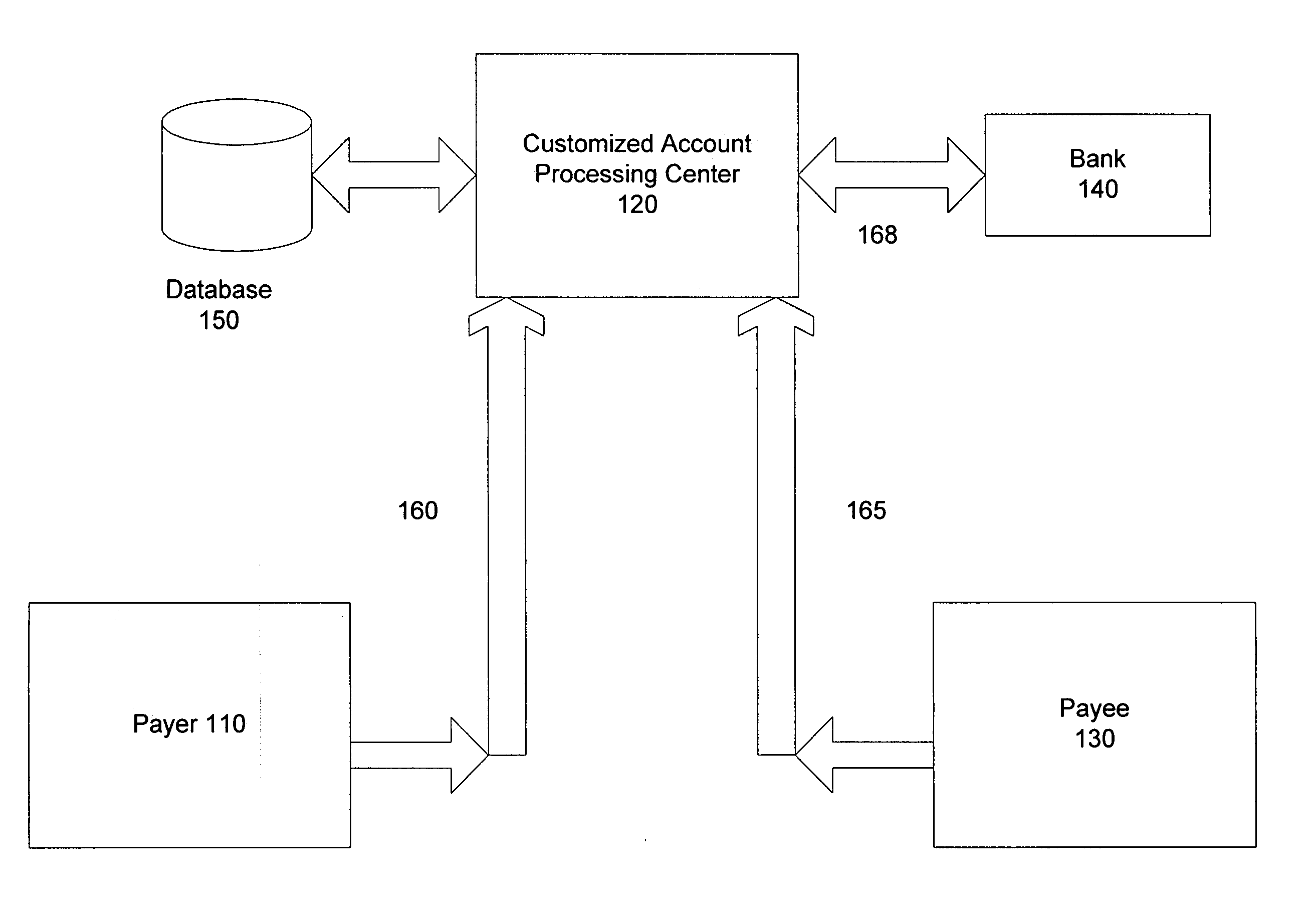

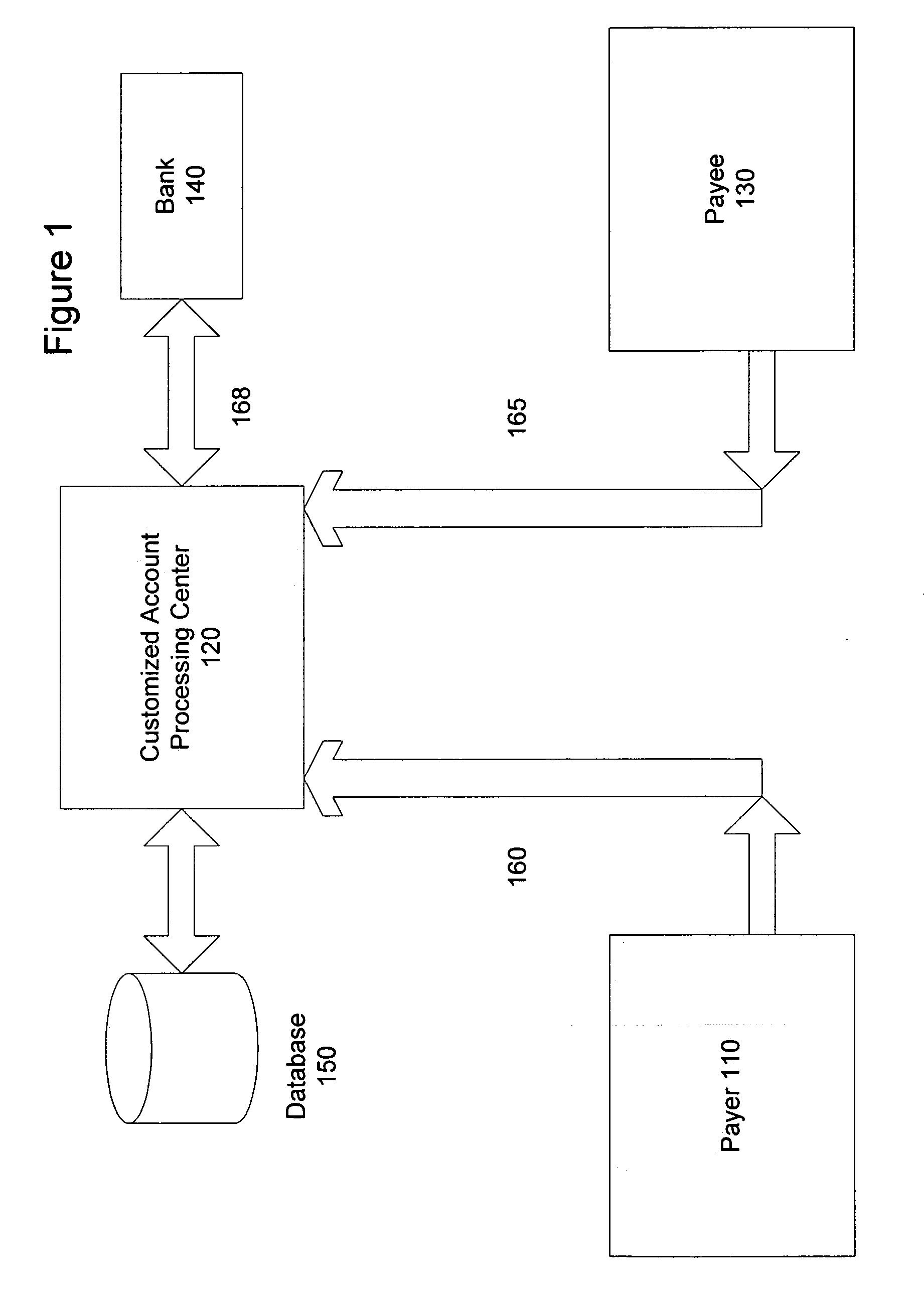

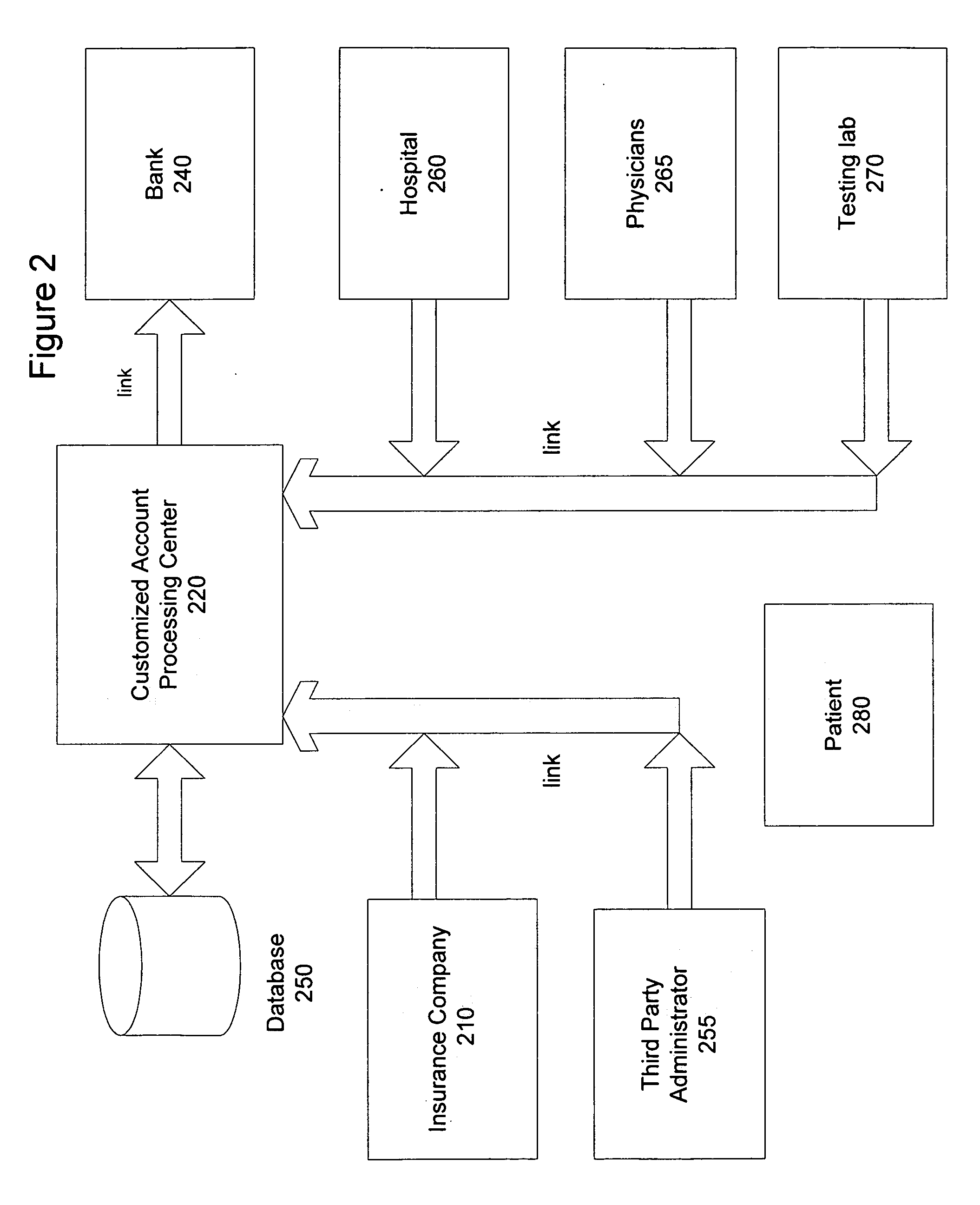

Customizable payment system and method

InactiveUS20060282381A1Avoid errorsPrevent fraudulent transactionFinanceBilling/invoicingBank accountComputer science

Owner:PAYFORMANCE CORP

Method, device and system for securing payment data for transmission over open communication networks

ActiveUS20130191290A1Minimize the numberOpportunities decreasePoint-of-sale network systemsSecuring communicationData connectionPayment

A method for securing payment data for transmission over open communication networks is disclosed. The method comprises establishing a data connection between a first and a second transceiver device, the first transceiver device configured as a merchant device and the second transceiver device configured as a customer transceiver device. The merchant device transmits a first data package which comprises a unique merchant identifier and transaction request data, to the customer transceiver device over the data connection. The merchant device receives a cryptogram from the customer transceiver device. The cryptogram having been generated from using a secret key and a counter value together with the received unique merchant identifier and the transaction request data. The method comprises forming an authorisation request comprising the received cryptogram, merchant identifier and the transaction request data and submitting said authorisation request to at least one of an issuer and an acquirer to facilitate authorisation and processing of said transaction request data.

Owner:BLUECHAIN PTY LTD

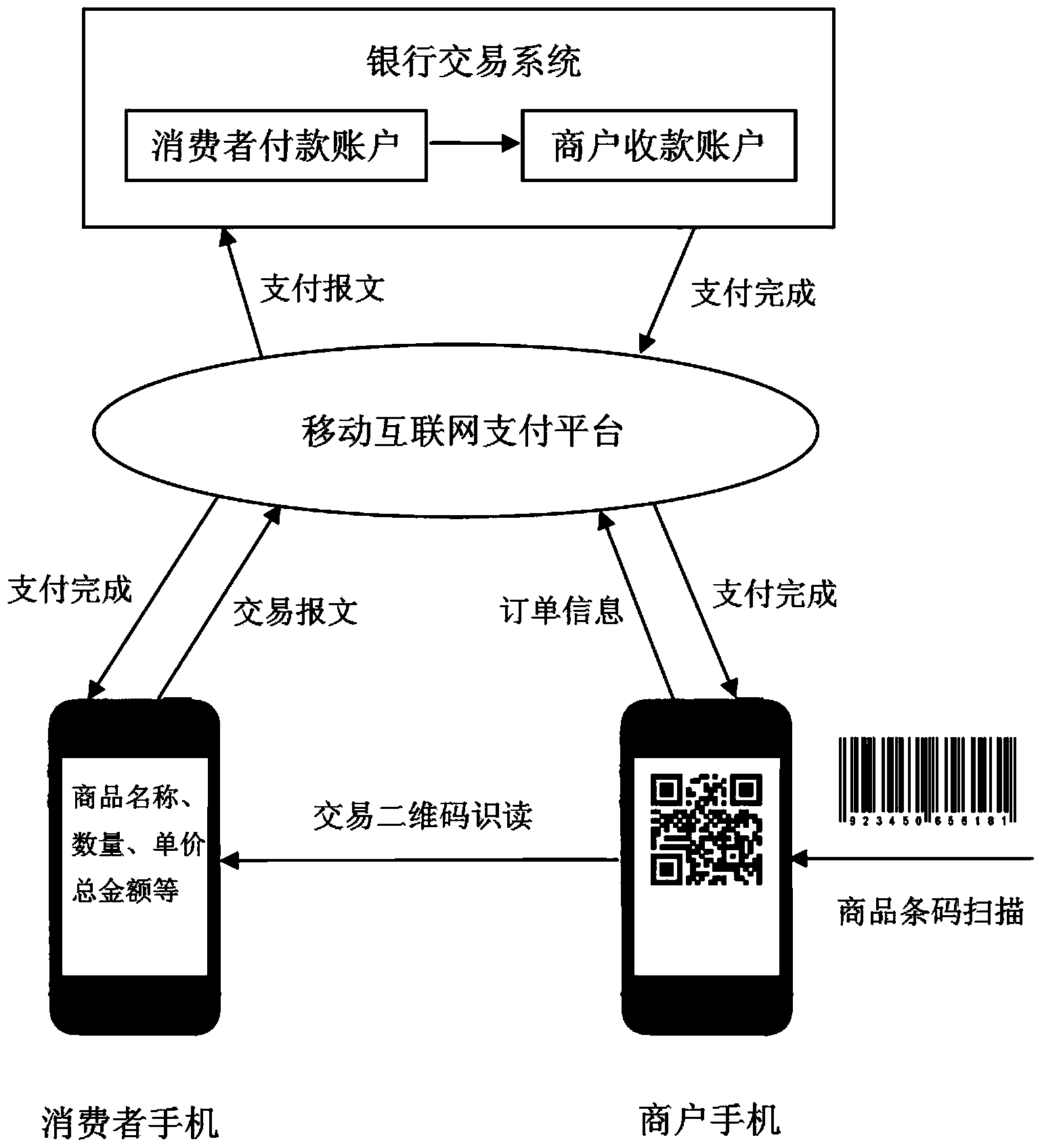

Mobile payment method for field shopping

InactiveCN103854173ASolve the problem of being easily stolenEliminate human input errorsProtocol authorisationThe InternetComputer science

Owner:UNISPLENDOUR CO LTD +2

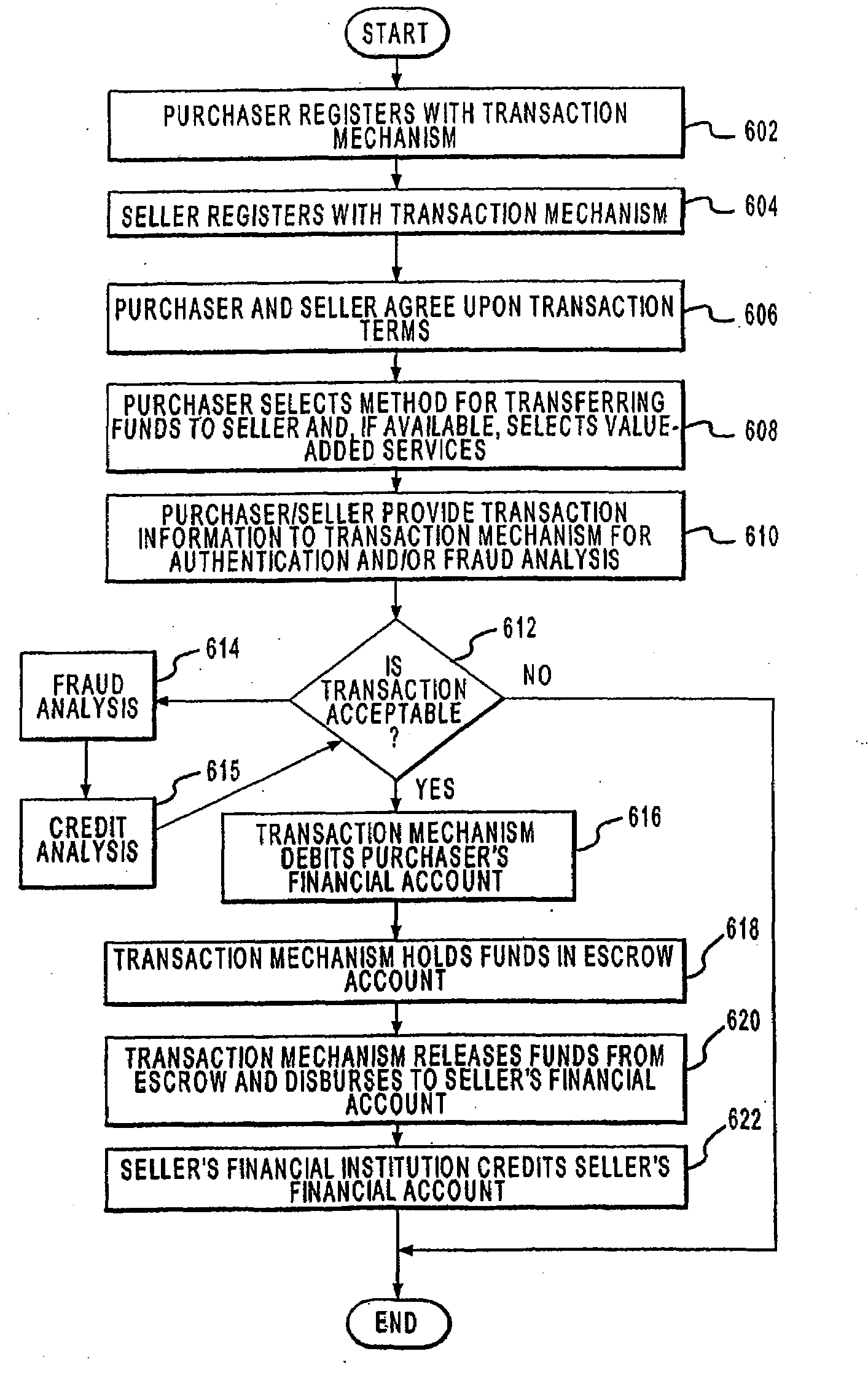

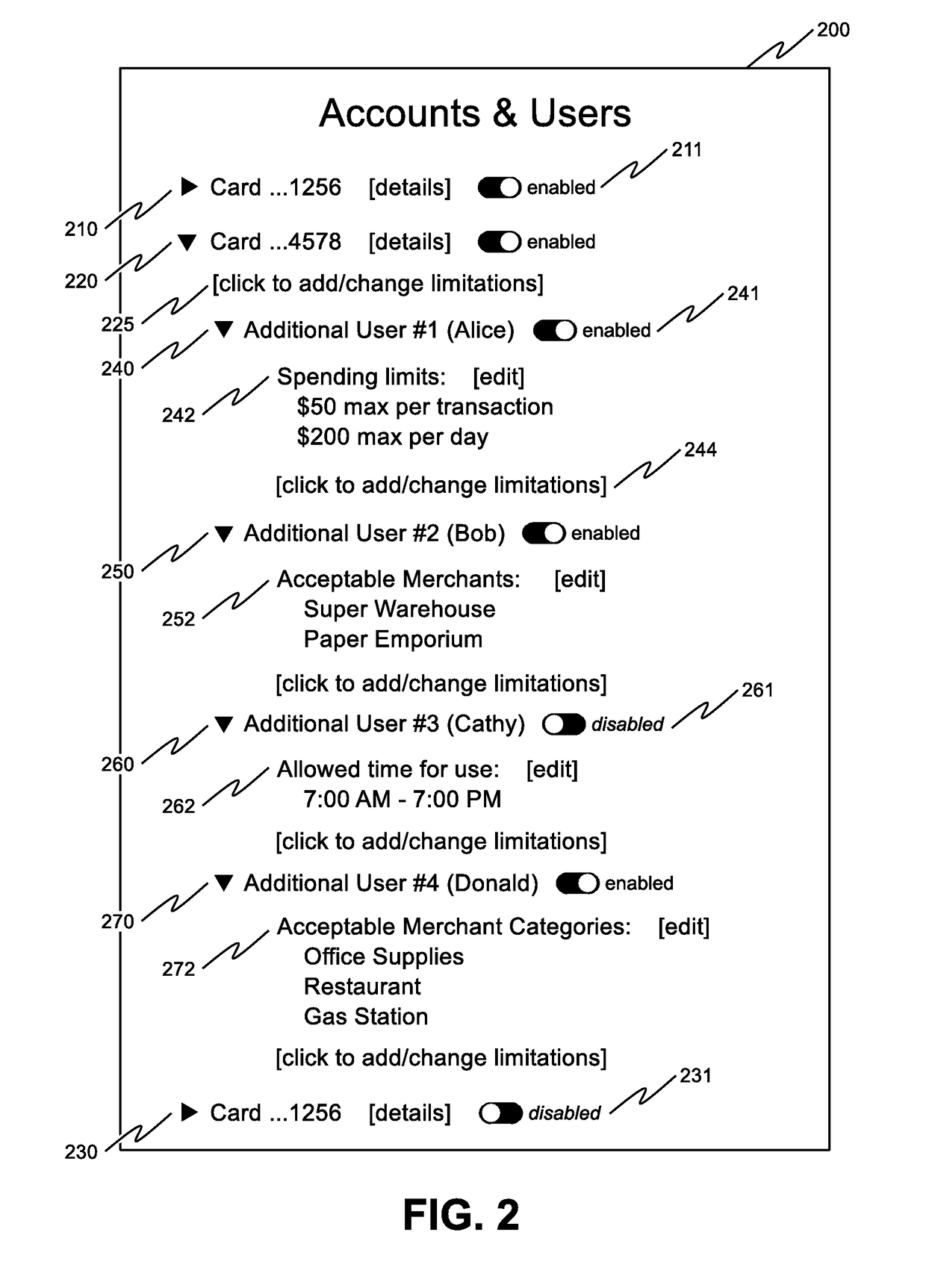

Systems and Methods for Allocating an Amount Between Sub-Accounts

InactiveUS20090083181A1Easy to optimizeIncrease purchase intentionFinanceProtocol authorisationTransaction accountDatabase

Owner:LIBERTY PEAK VENTURES LLC

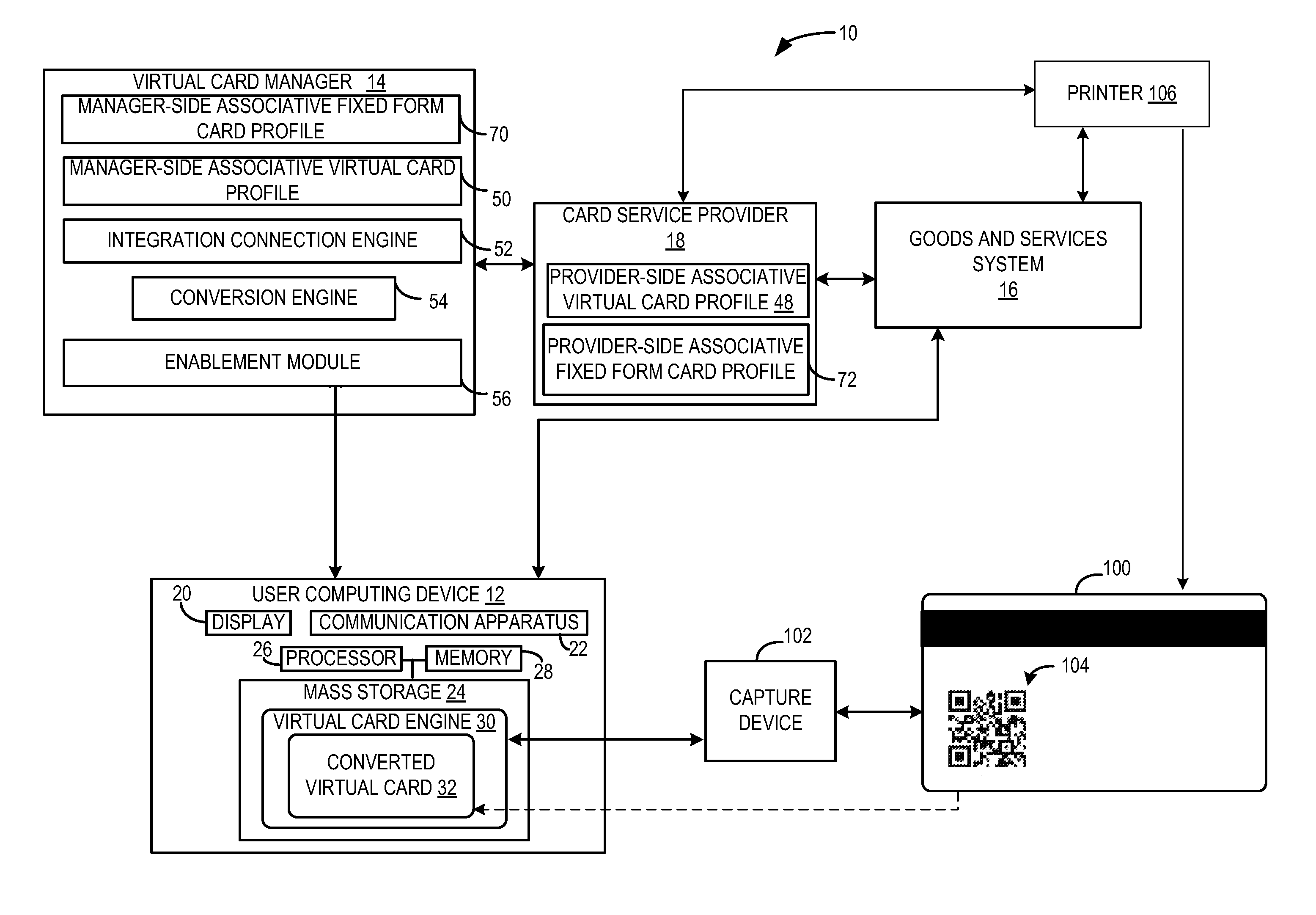

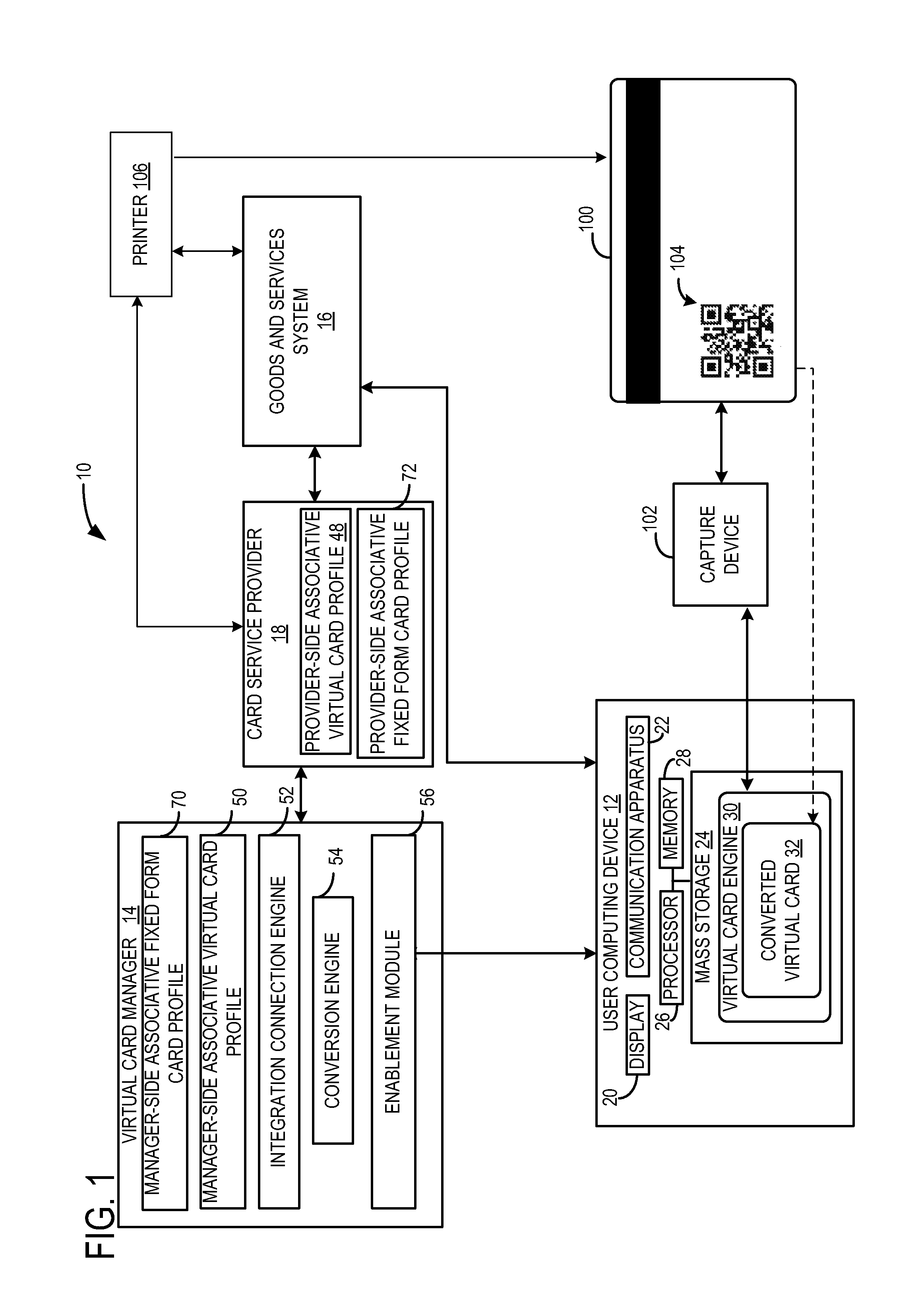

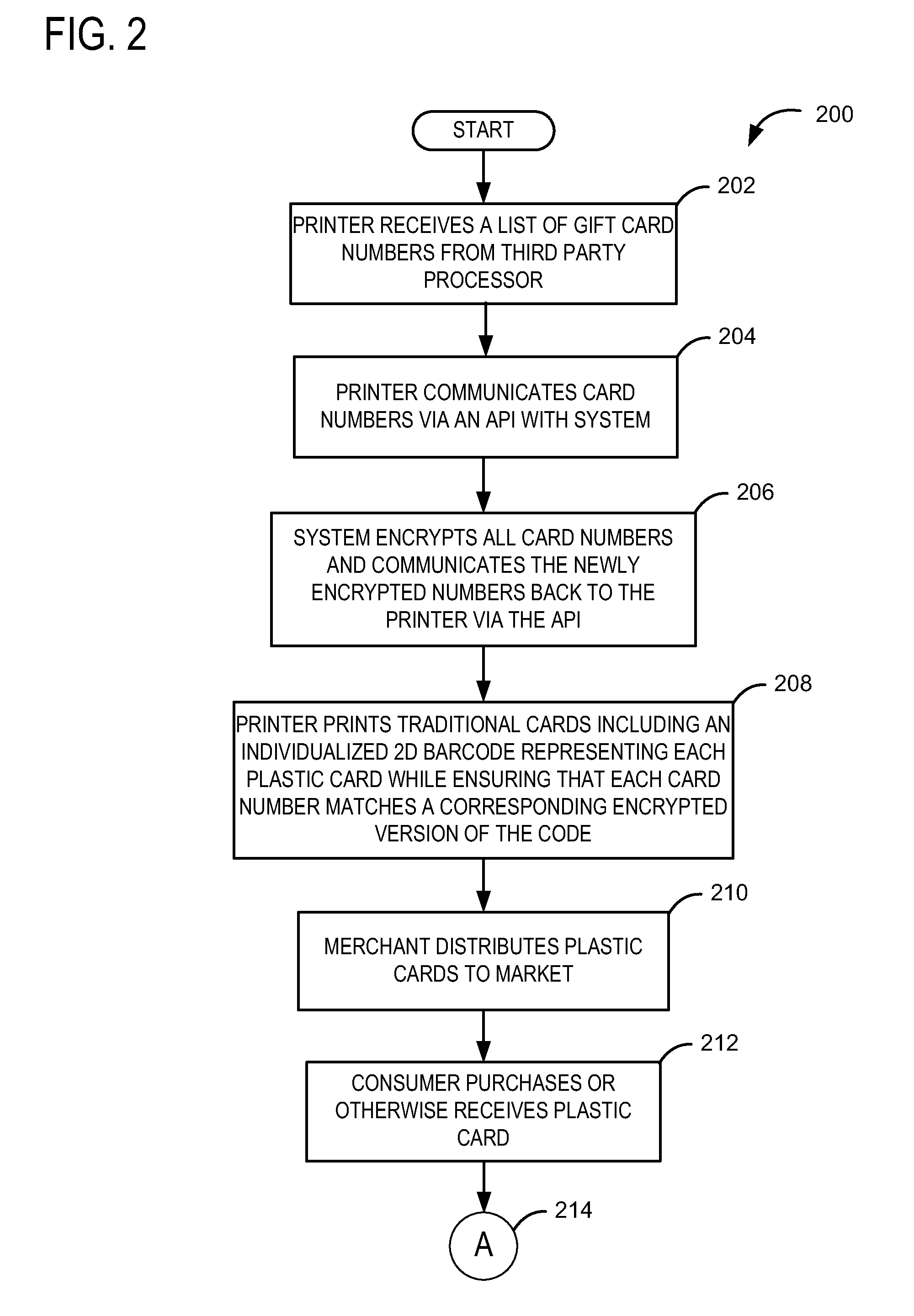

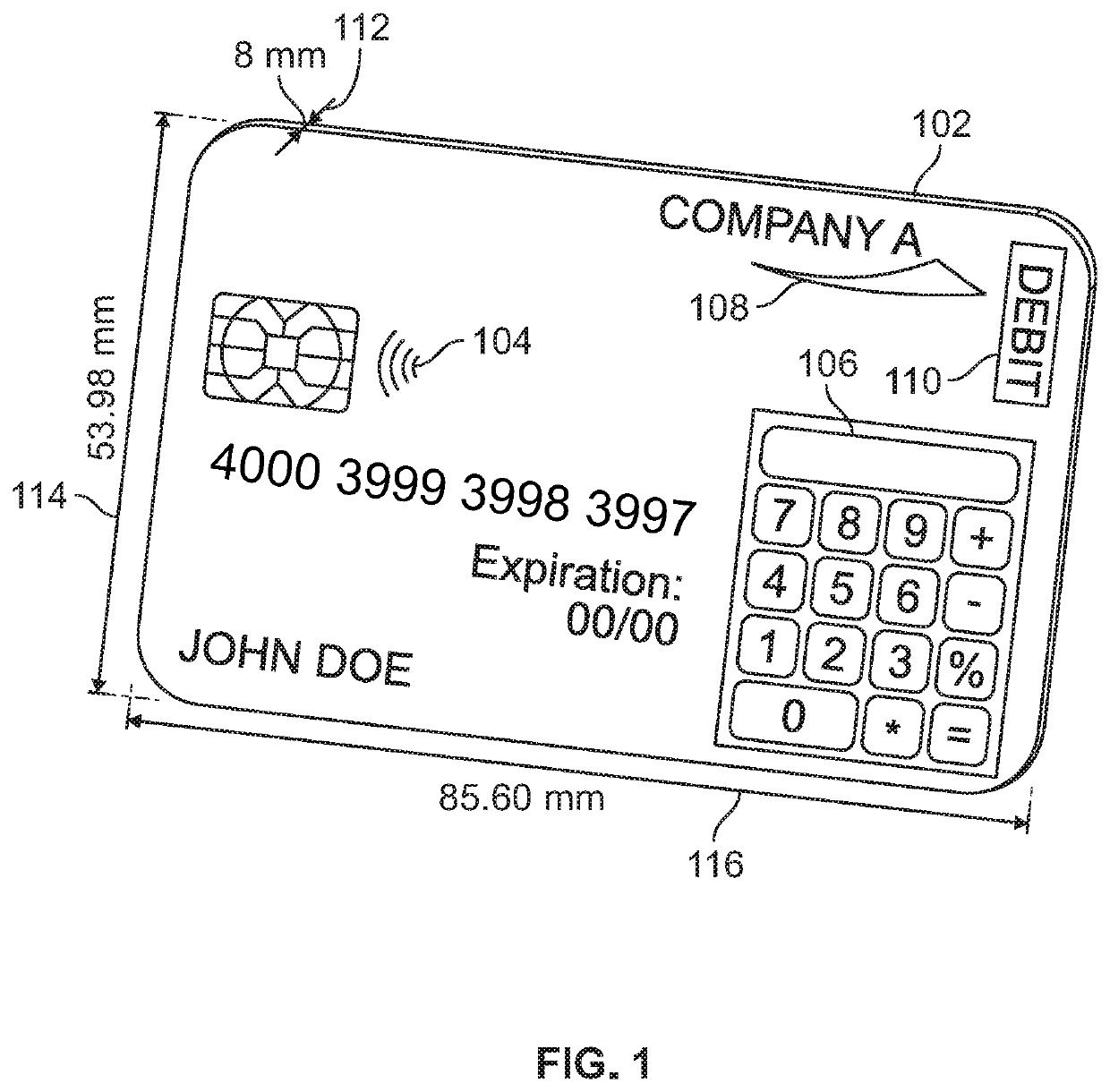

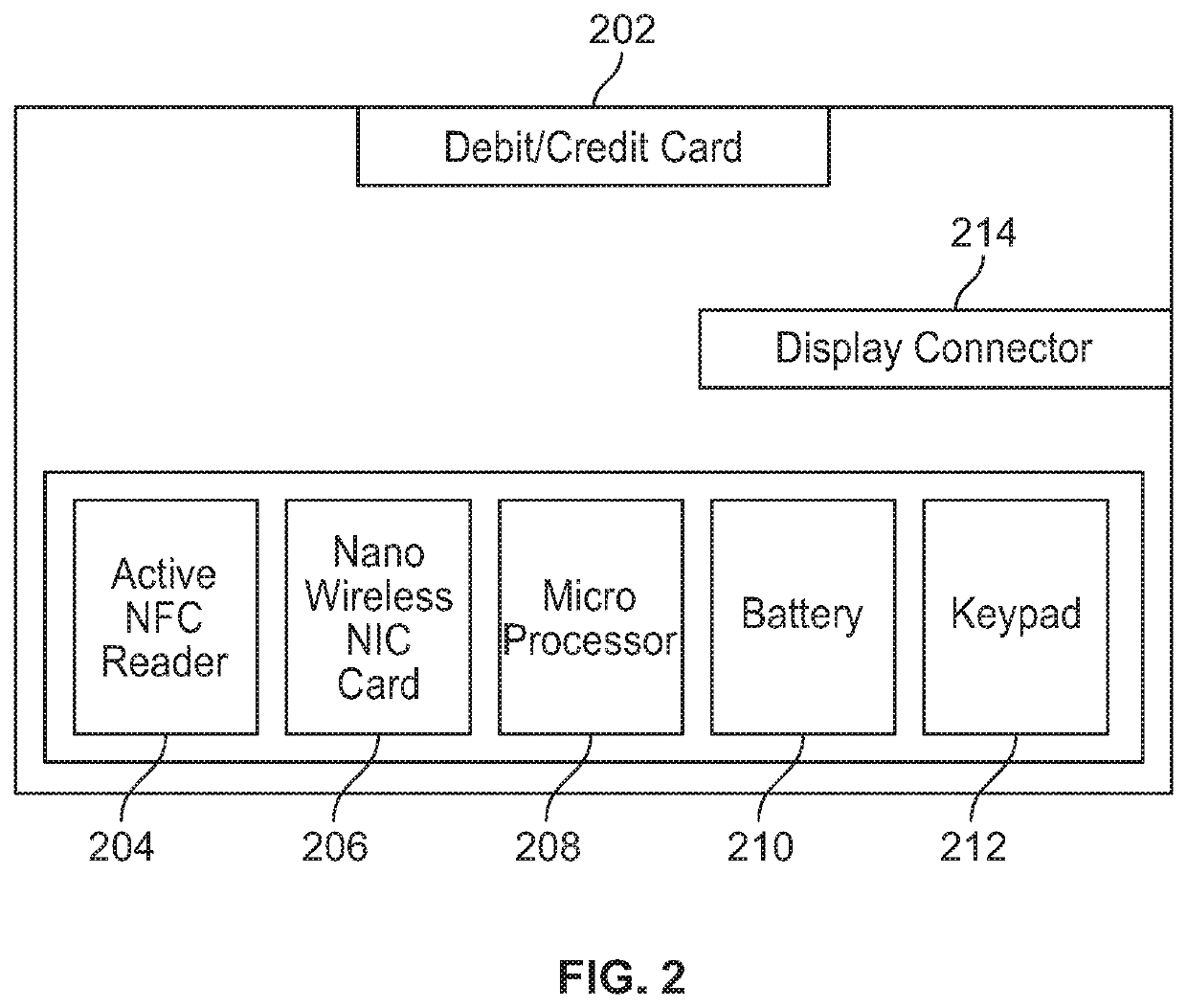

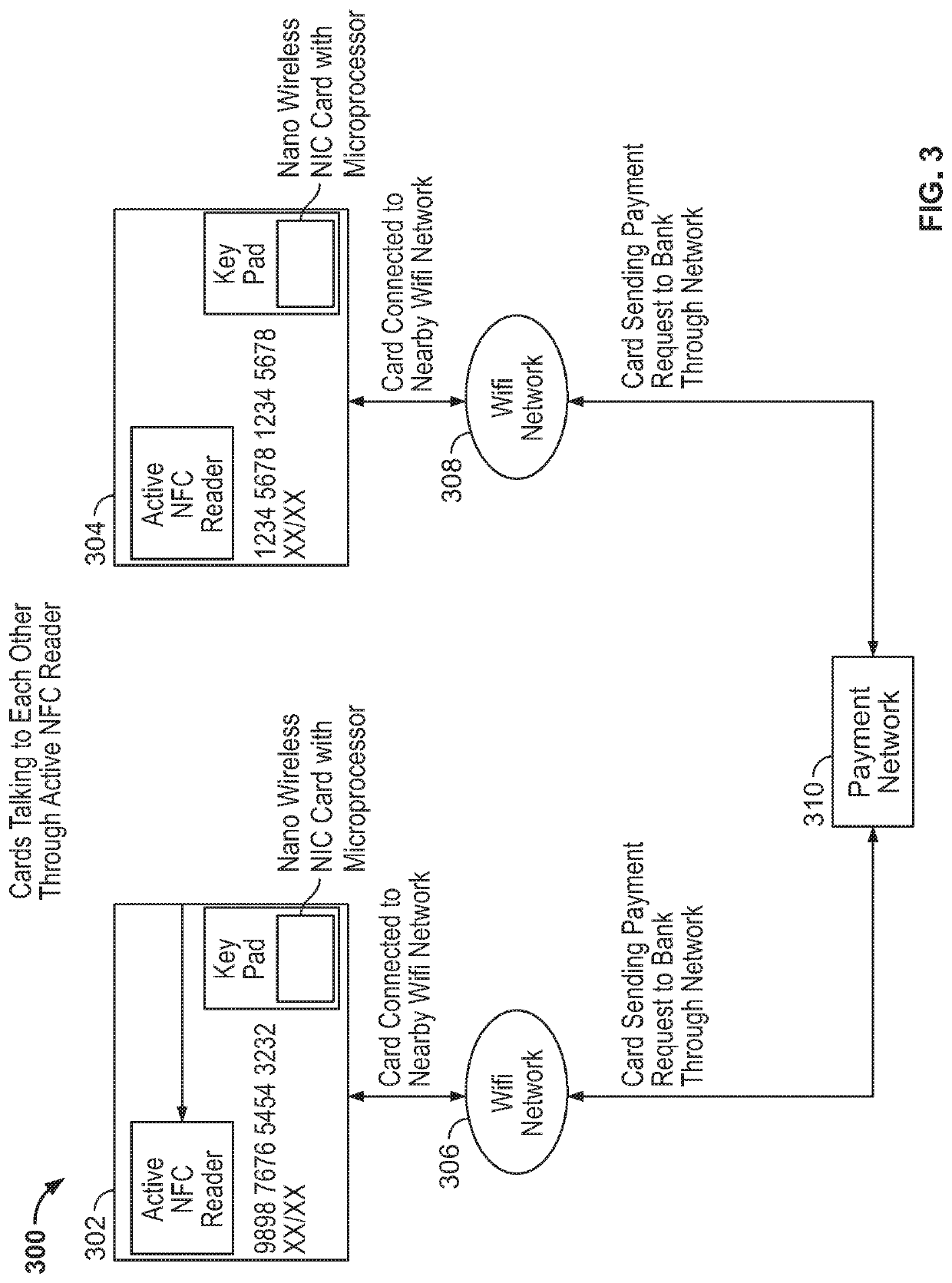

Systems and methods for fixed form card to virtual card communication

InactiveUS20120323787A1Improve securityReduce the possibilityFinanceProtocol authorisationLarge capacityMass storage

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

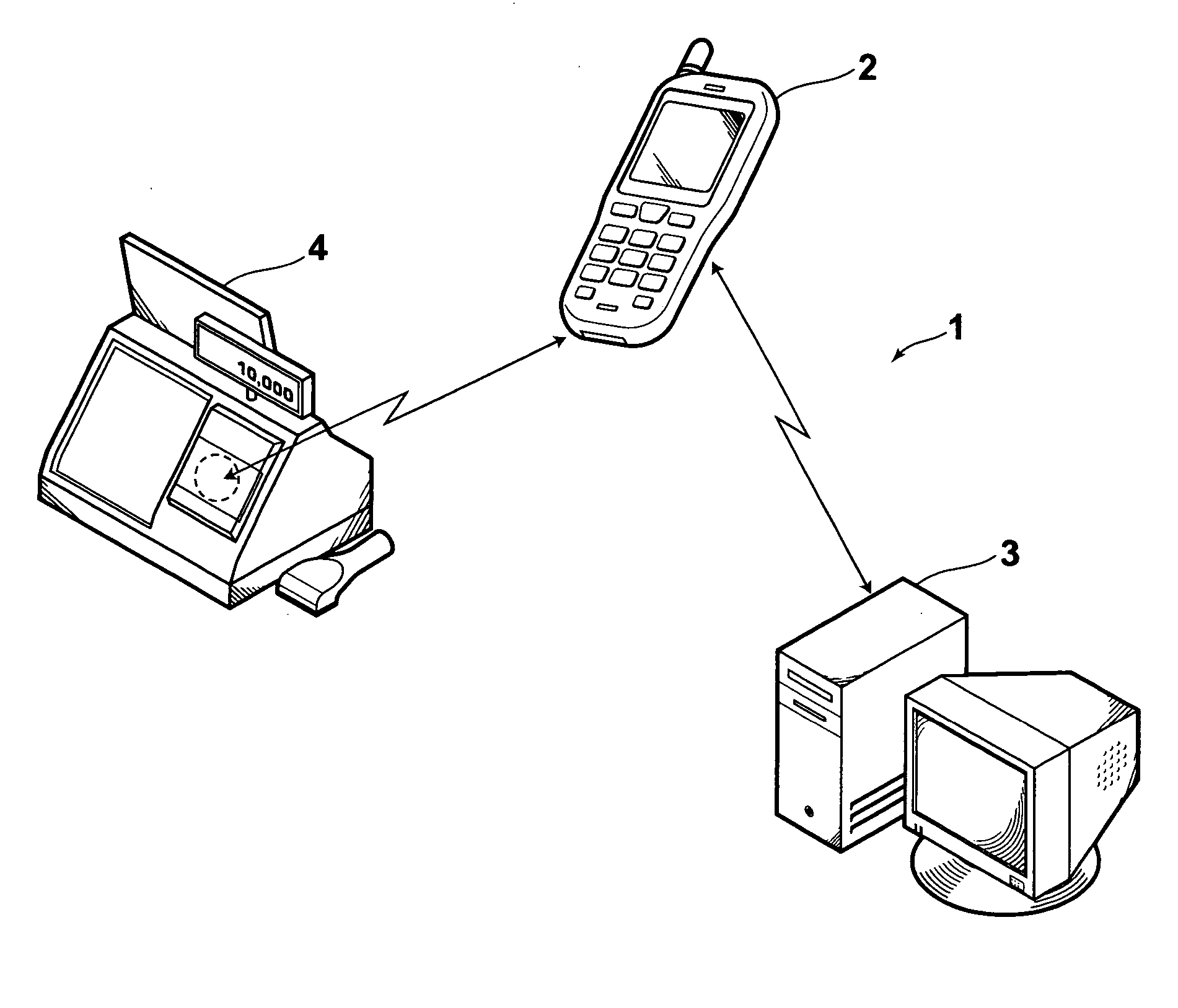

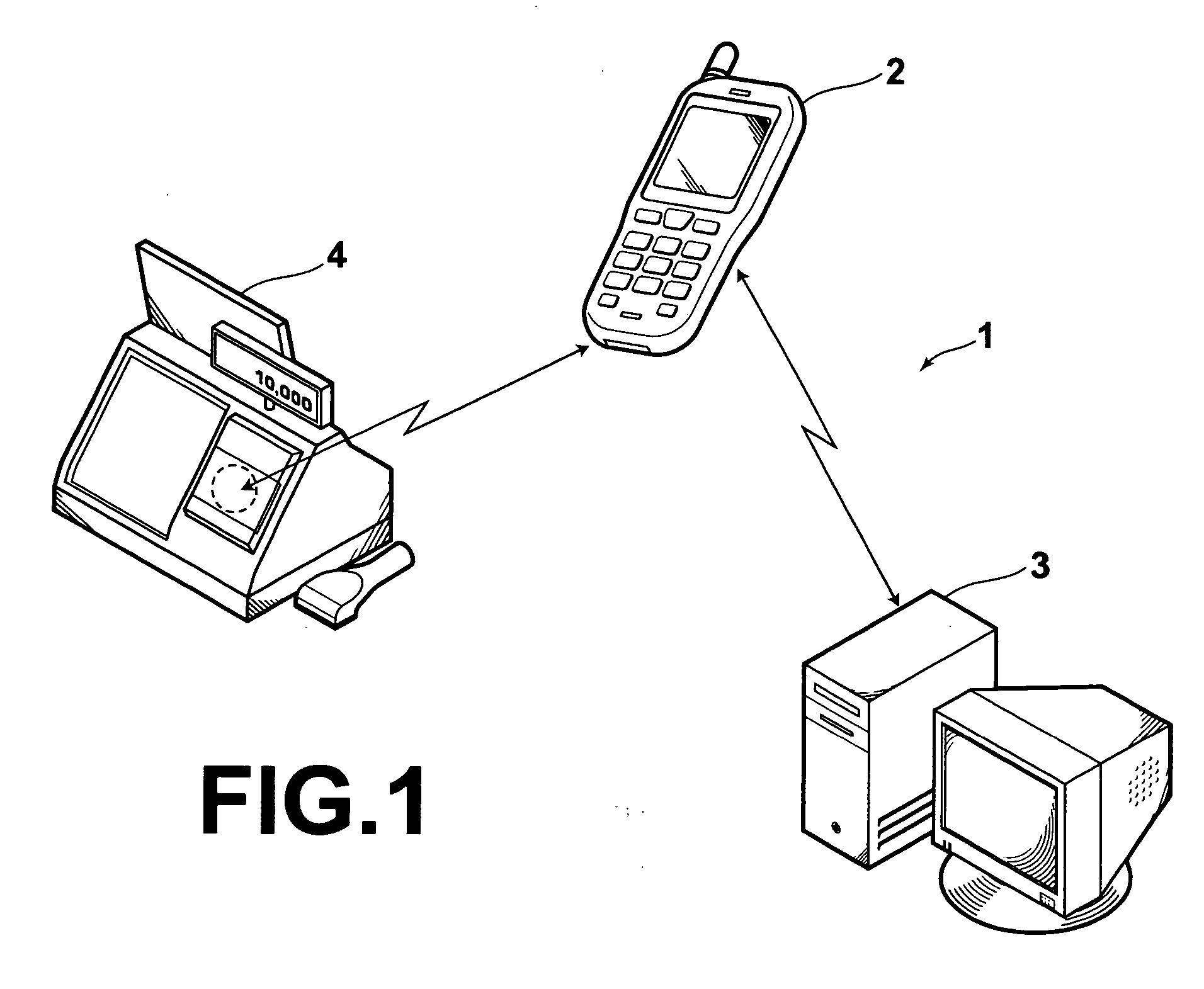

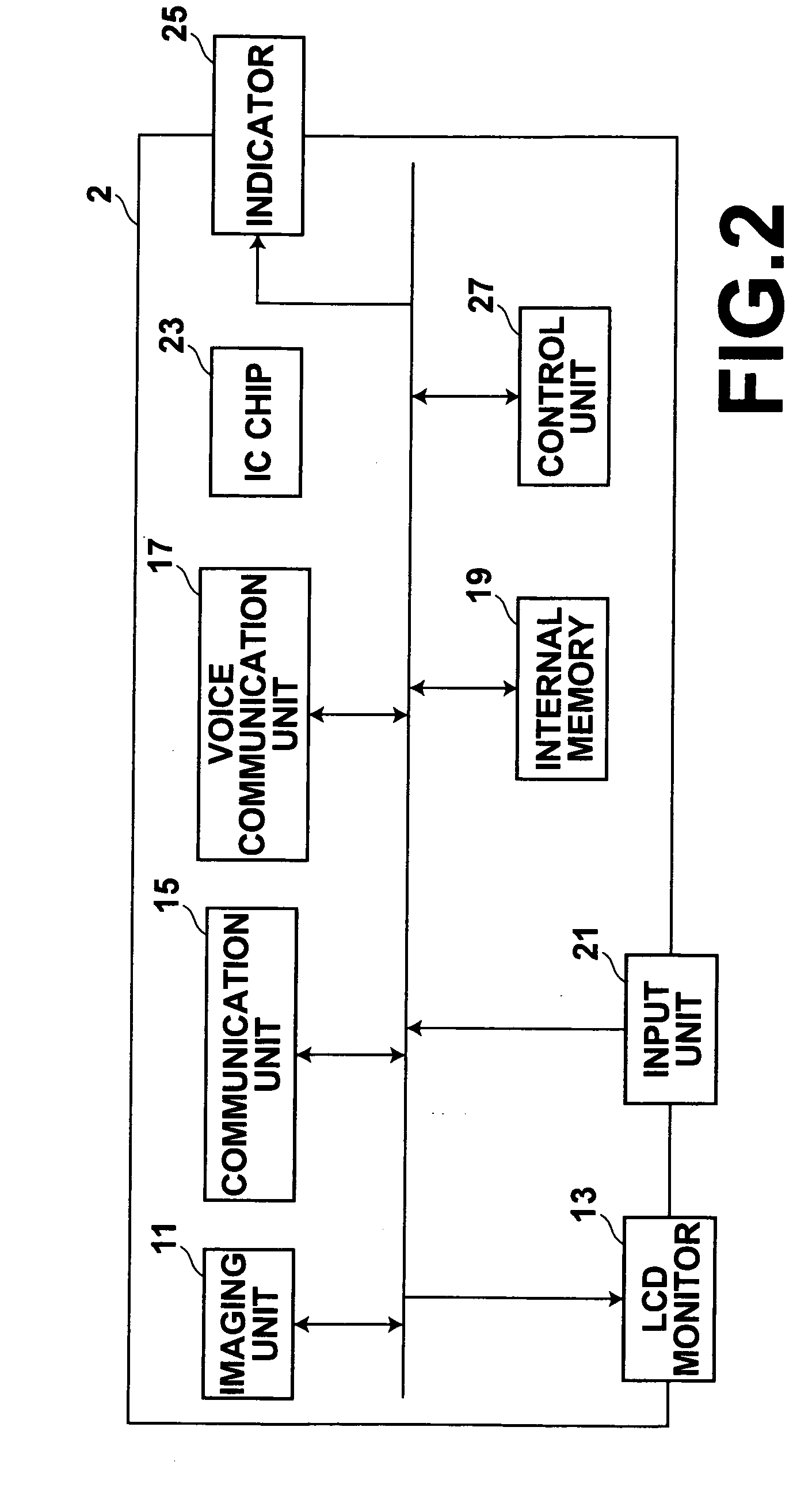

Authentication system for mobile terminal having electronic money function

InactiveUS20060160525A1Reduce usageUnauthorised/fraudulent call preventionEavesdropping prevention circuitsPasswordComputer terminal

Owner:FUJIFILM CORP

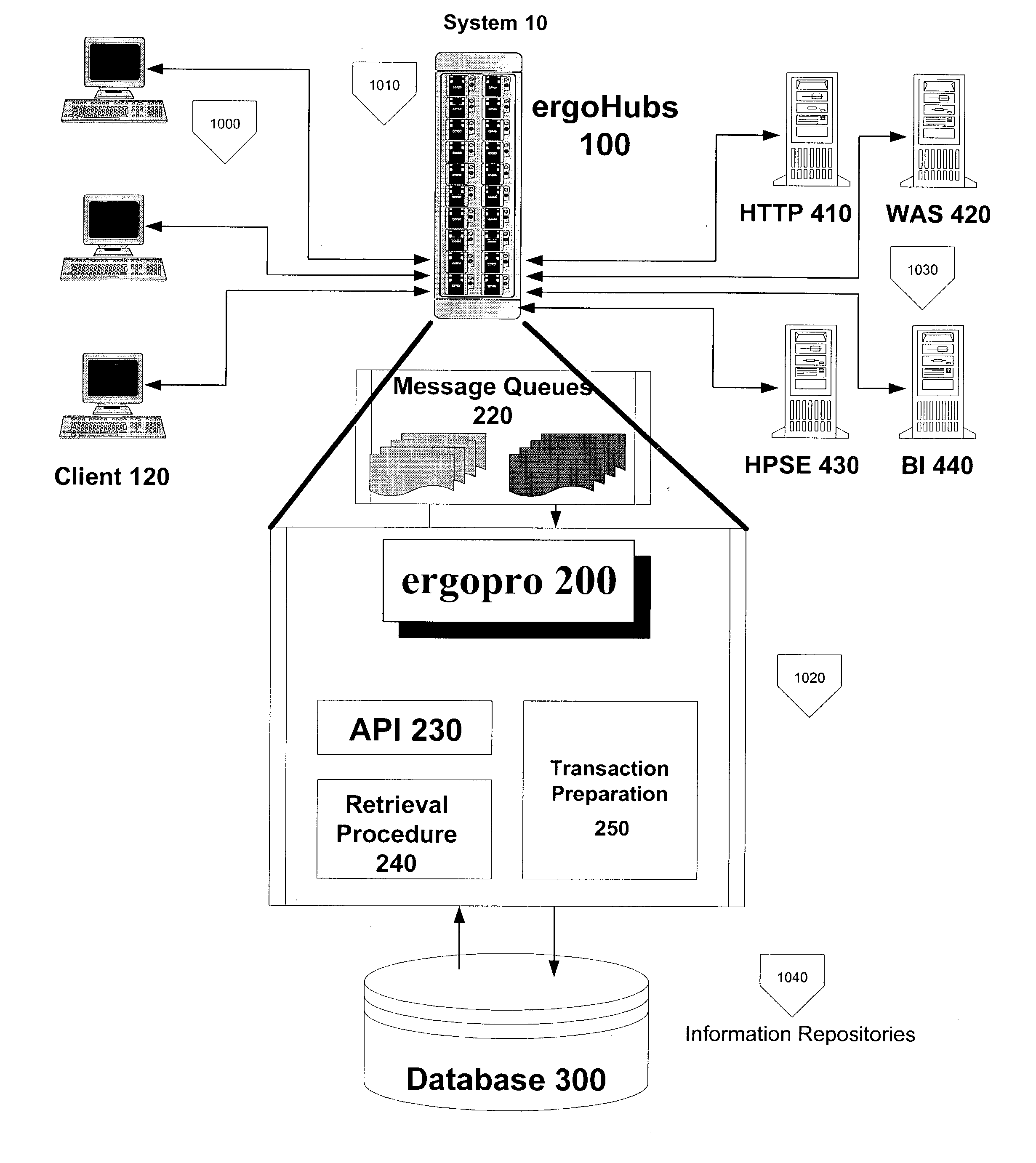

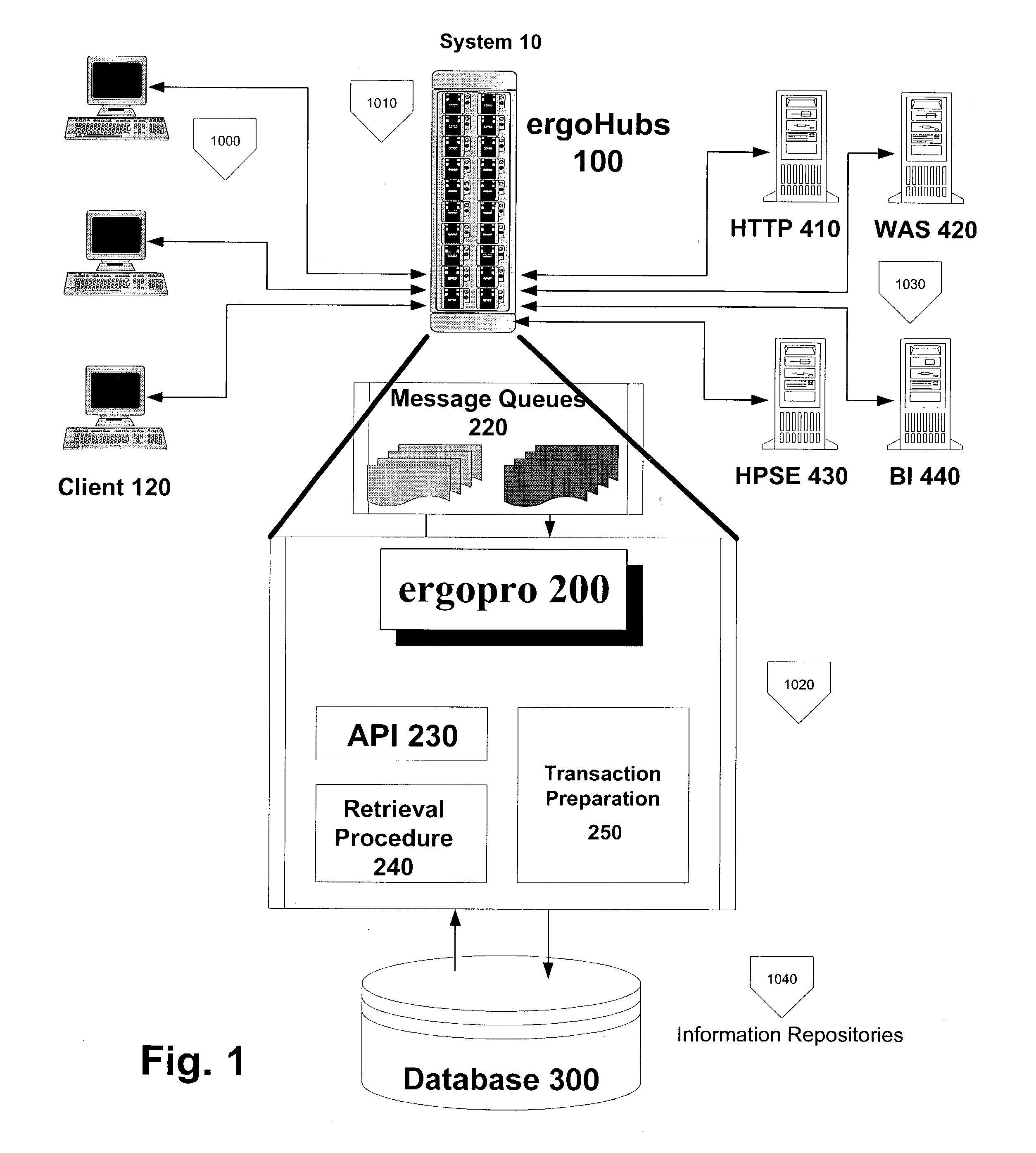

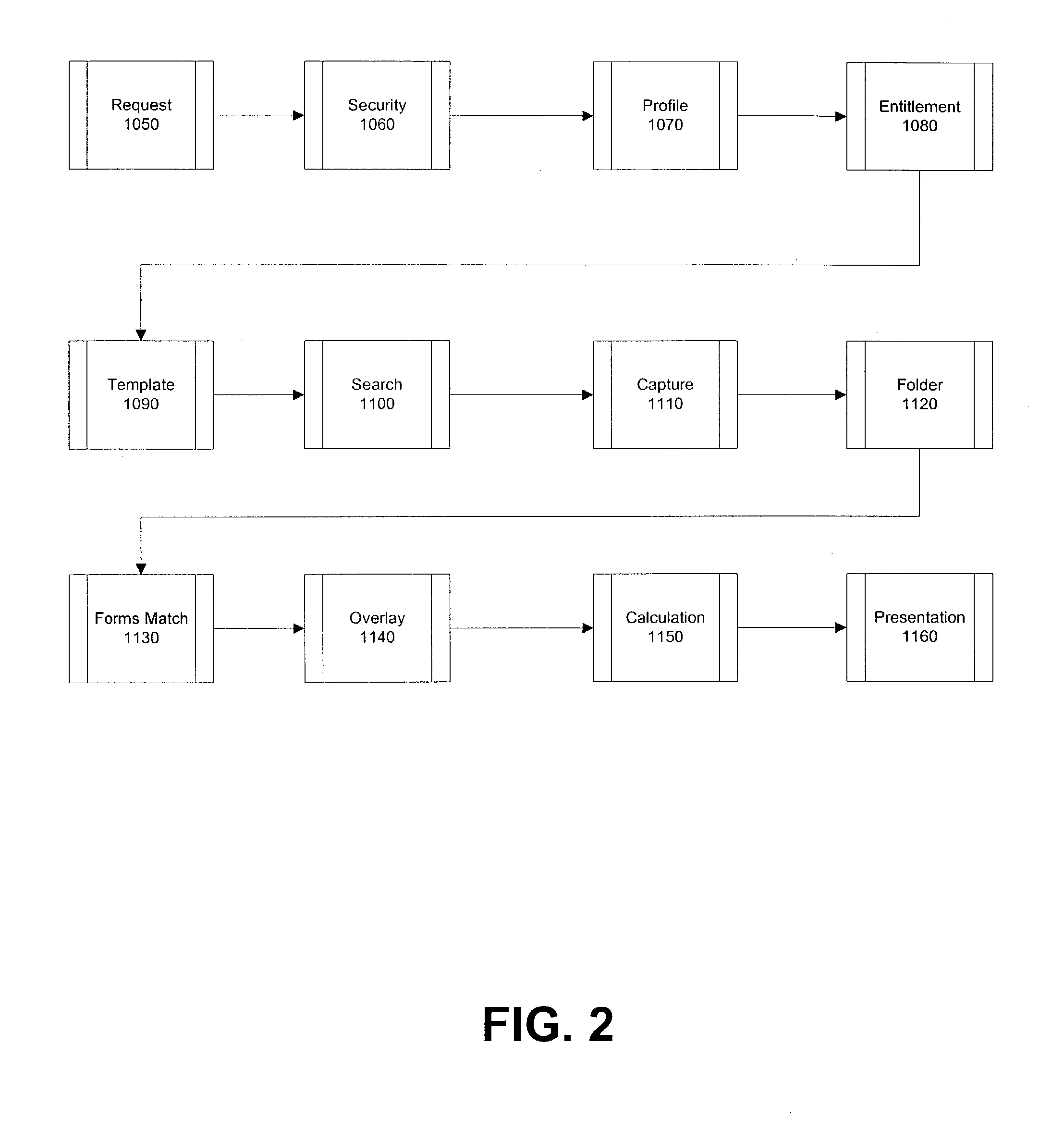

Method for the standardization and syndication of business transactions

InactiveUS20030191661A1Overcomes prohibitive overhead costEfficiently and seamlessly conductFinanceOffice automationClient-sideKnowledge management

Owner:ERGOMUNDUS

Transaction fraud depth detection method based on feature differentiation

ActiveCN109034194AEffective detection of fraudCharacter and pattern recognitionProtocol authorisationAlgorithmFeature based

The invention relates to a transaction fraud depth detection method based on feature differentiation, which is characterized in that a differentiation feature generation method based on transaction time and a fraud transaction detection method with outlier sample detection are proposed. The invention discloses a network transaction fraud detection method. The method provided by the invention starts from practicability, establishes a network transaction fraud detection system through a differentiation feature generation method and a fraud transaction detection method with outlier sample detection, and provides technical support for solving the fraud transaction detection.

Owner:DONGHUA UNIV

Cost effective card reader and methods to be configured to be coupled to a mobile device

A decoding system, with a decoding engine, runs on a mobile device. The decoding engine decodes signals produced from a read of a first party's financial transaction card. The decoding engine accepts and initializes incoming signals from a read of the first party's financial transaction card until the signals reach a steady state, identifies peaks in the incoming signals and digitizes the identified peaks into bits. A transaction engine is coupled to the decoding engine. The transaction engine receives, as its input, decoded first party's financial transaction card information from the decoding engine, and serves as an intermediary between the first party and a second party. The first party does not have to share his / her financial transaction card information with the second party. The transaction engine is configured to be coupled to a payment system and a first party's financial transaction card institution or a first party's financial account.

Owner:BLOCK INC

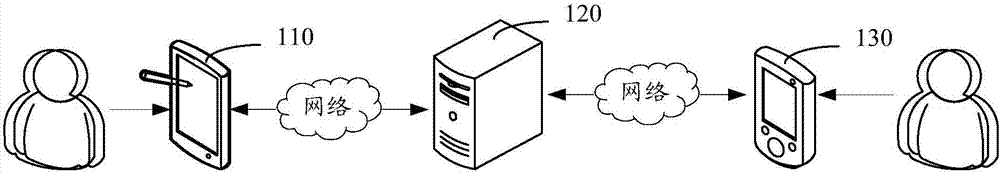

Methods of authenticating a user for data exchange

A method of facilitating the exchange of data between a user having a computing device, and a remote entity, where a first connection has been established between the user and the remote entity, and where the user has associated data exchange information with an application on the computing device, the data exchange information defining properties of the data to be exchanged between the user and the remote entity. The method comprises establishing, at a server, a second connection to the computing device; enabling retrieval of a user authentication attribute associated with the data exchange information; enabling retrieval of a device authentication attribute associated with the data exchange information;enabling authentication of the user using the user authentication attribute; and enabling authentication of the computing device using the device authentication attribute, where data may be exchanged between the computing device and the remote entity in accordance with the data exchange information following authentication of the user and the computing device.

Owner:ECKOH UK

Real time verification of transfers of funds

InactiveUS20180005241A1Buying/selling/leasing transactionsProtocol authorisationMobile wirelessReal-time computing

Owner:VURIFY GRP LLC

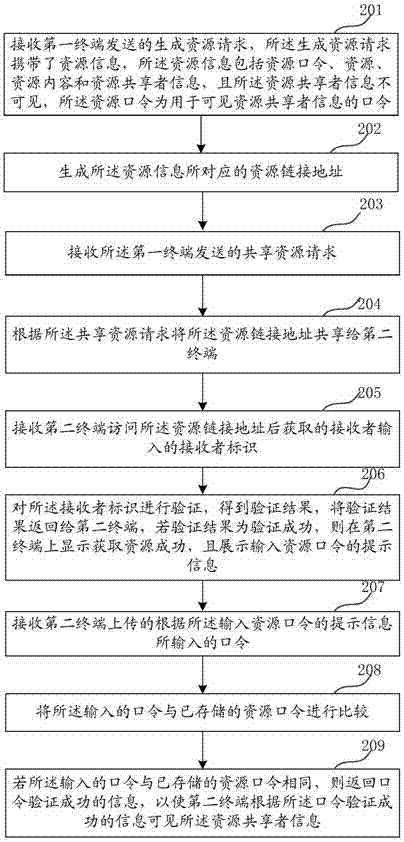

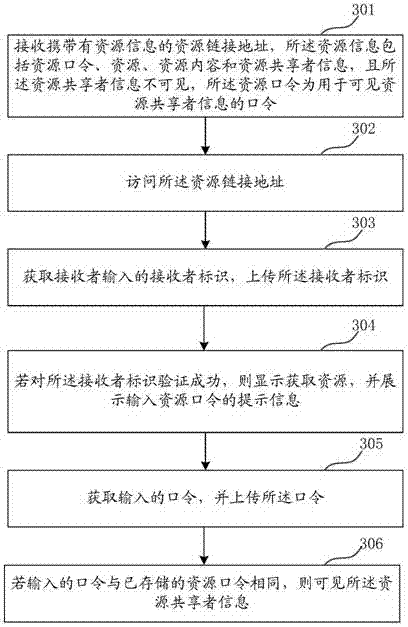

Method and system of sharing resources

InactiveCN106960333AImprove securityTransmissionProtocol authorisationInformation sharingResource information

Owner:SHENZHEN NIC TECH CO LTD

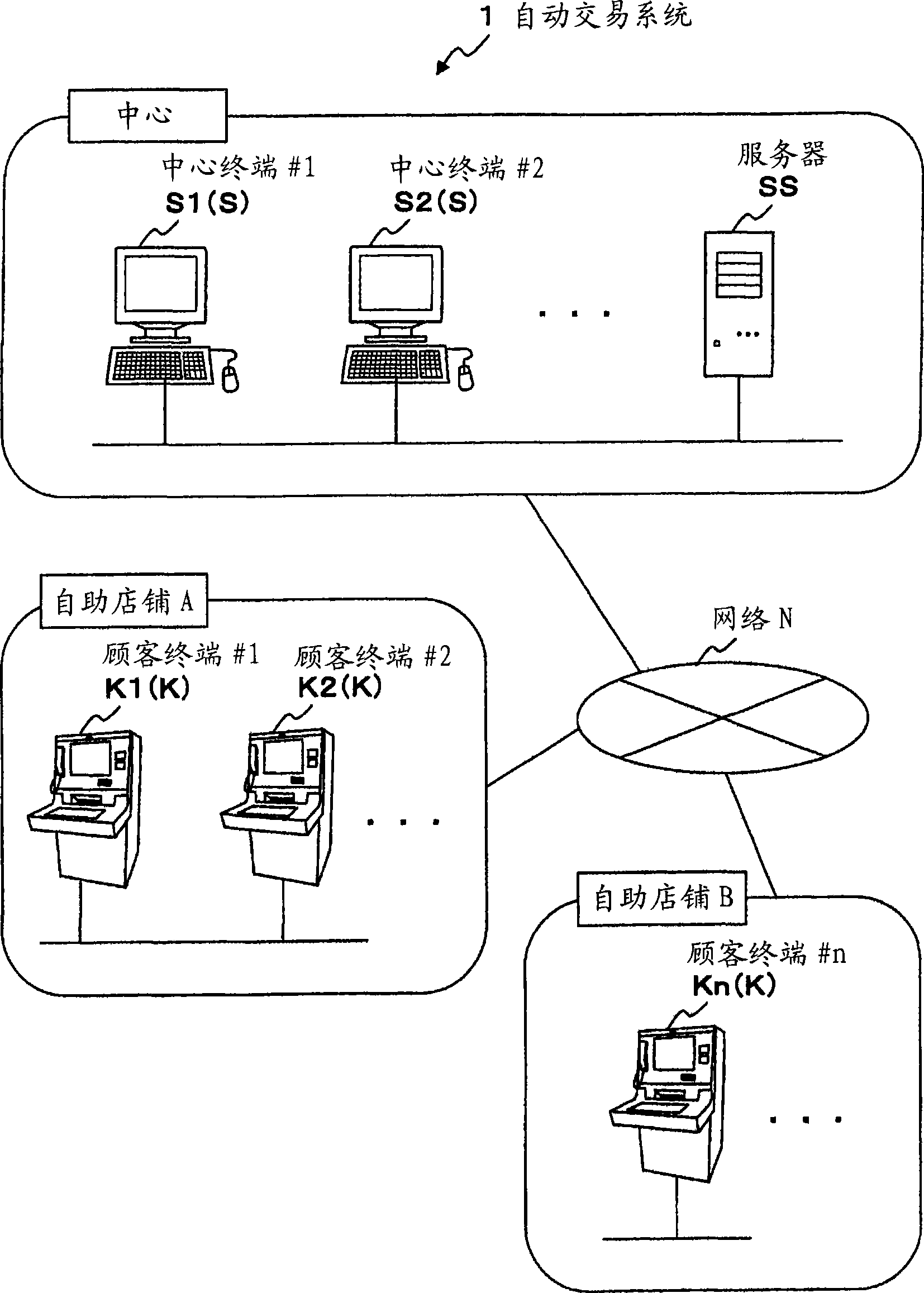

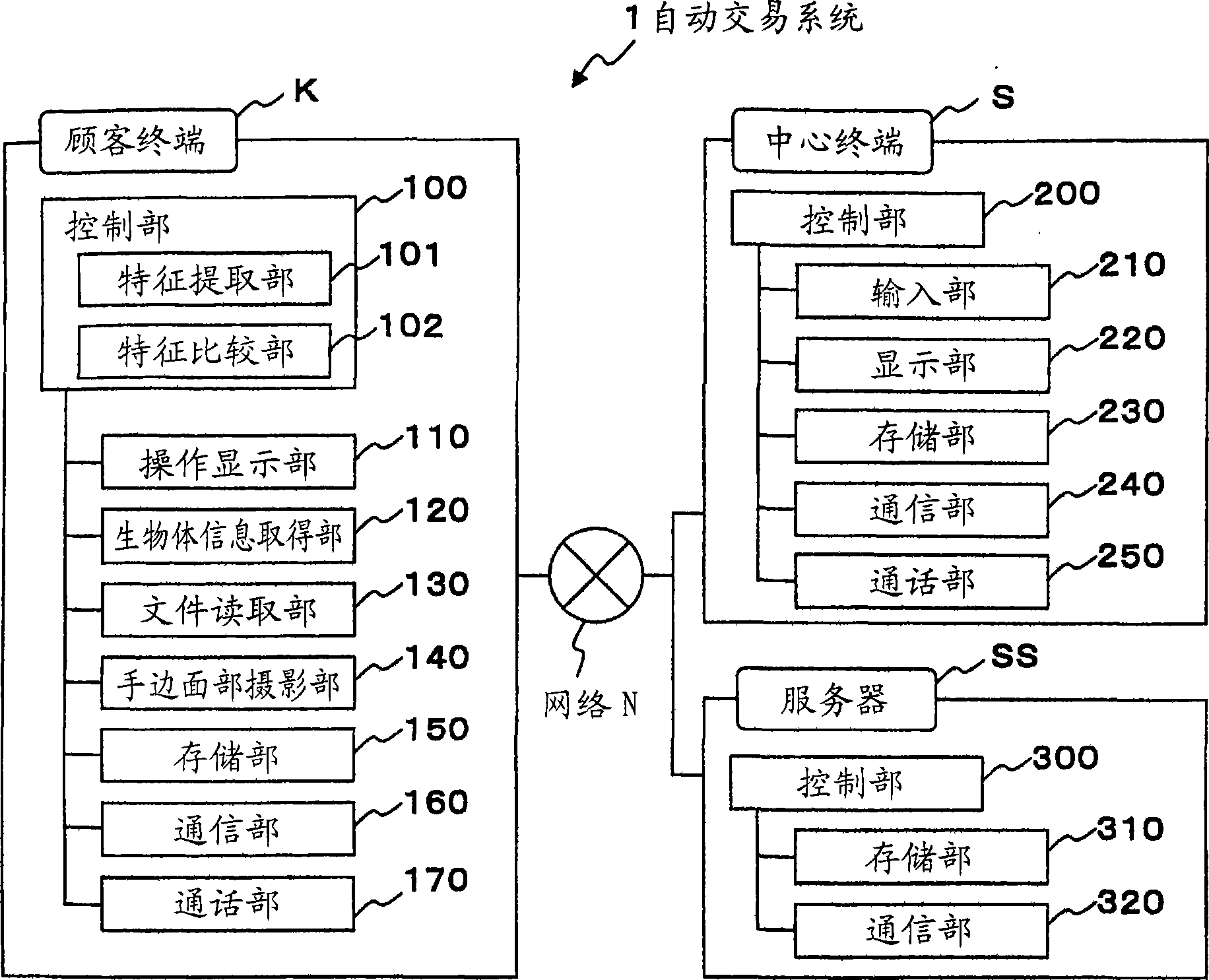

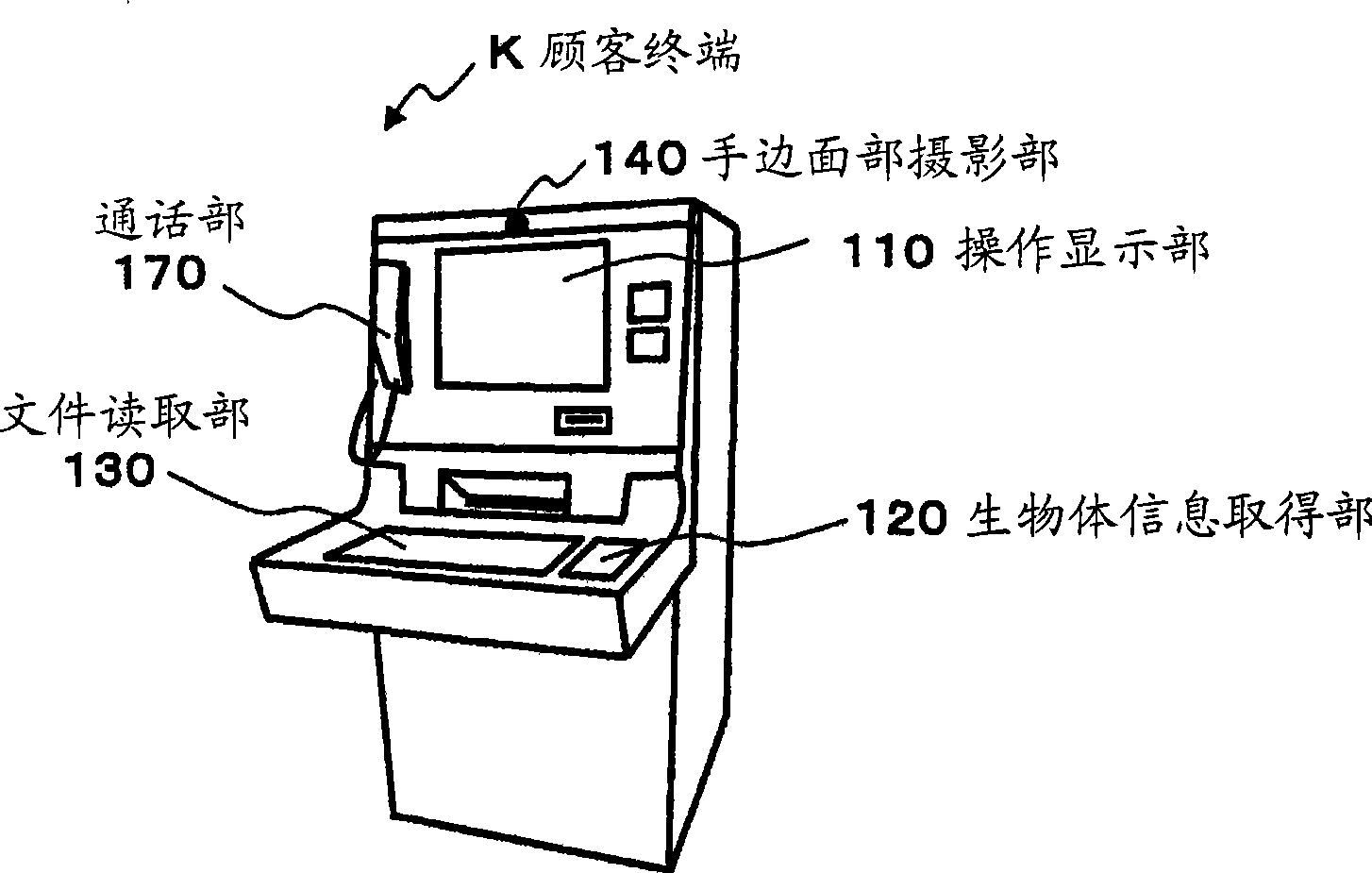

Automatic traction apparatus and automatic traction system

InactiveCN101499197APrevent wrongdoingComplete banking machinesImage analysisTraction systemFeature extraction

Owner:OKI ELECTRIC IND CO LTD

GPS determined location based access to linked information and delivery thereof

Various methods are provided for facilitating access to linked information to GPS or short-range wireless equipped devices. One example method may comprise receiving, via a network, an indication of an interaction between a primary device and a third-party device, the indication comprising at least a first element and a second element, the first element indicative of user identification information and the second element indicative of at least one of a location or a bounded region, determining, as a function of at least the first element and the second element, a data object that upon validation is configured for use a subsequent interaction, and transmitting, to a mobile device, an electronic communication comprising an indication, configured for rendering on the mobile device, of the data object.

Owner:GROUPON INC

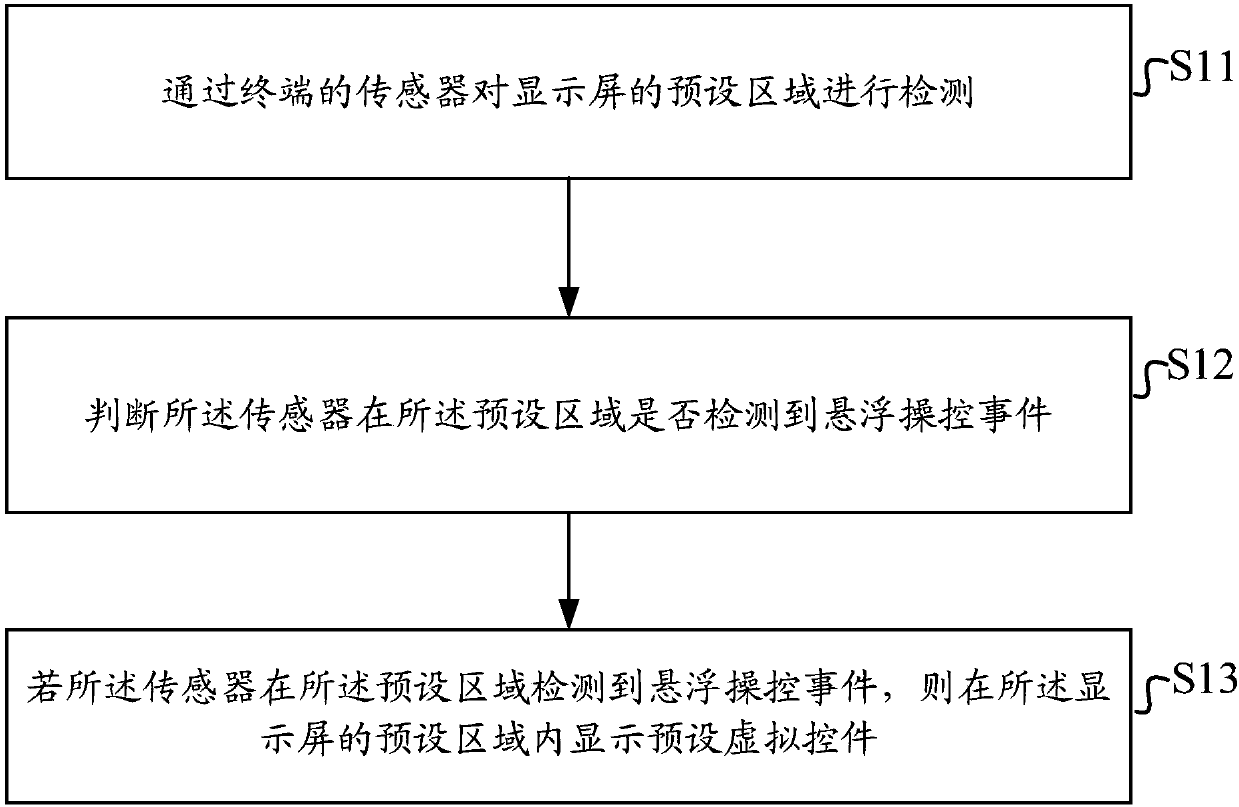

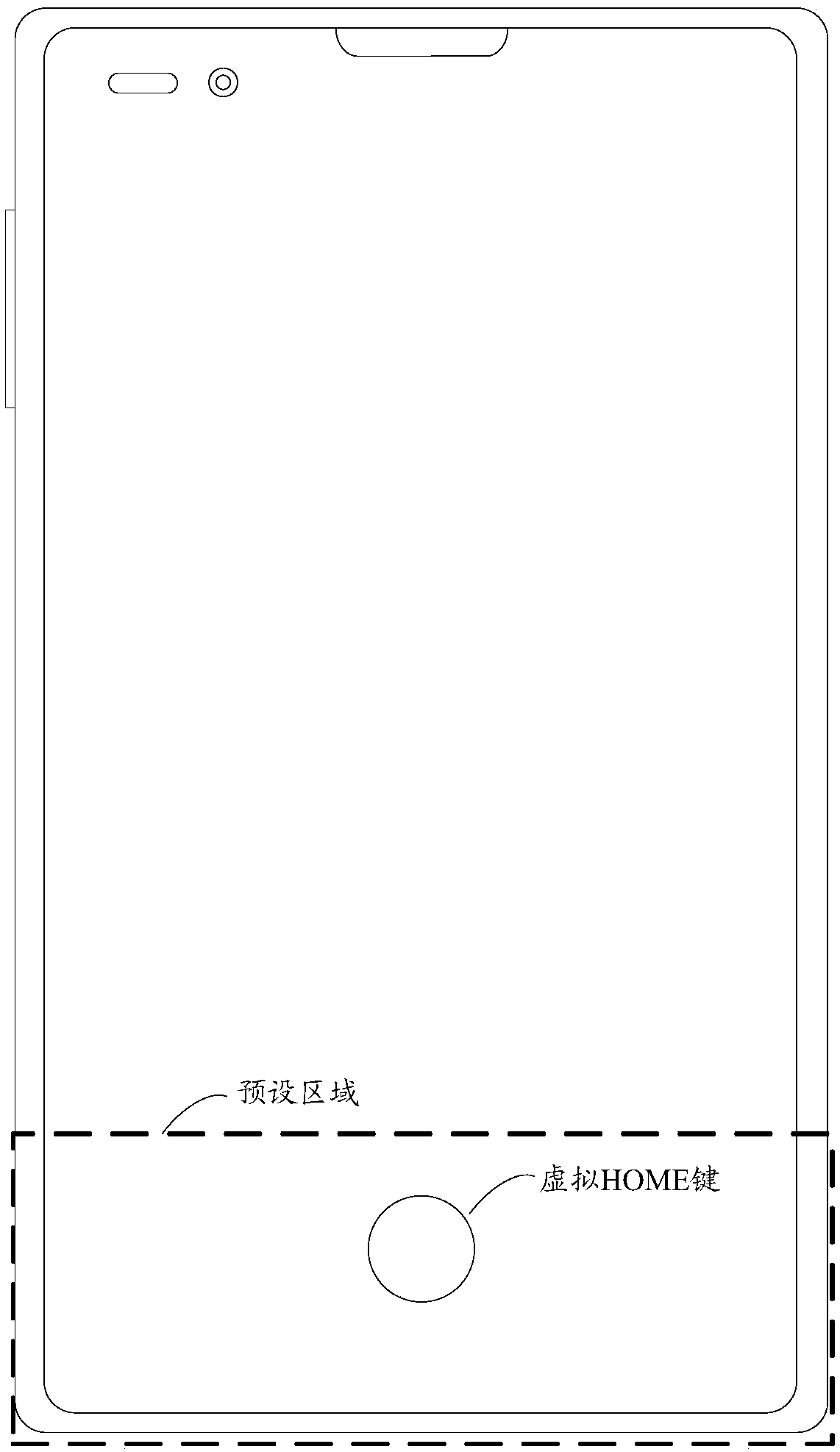

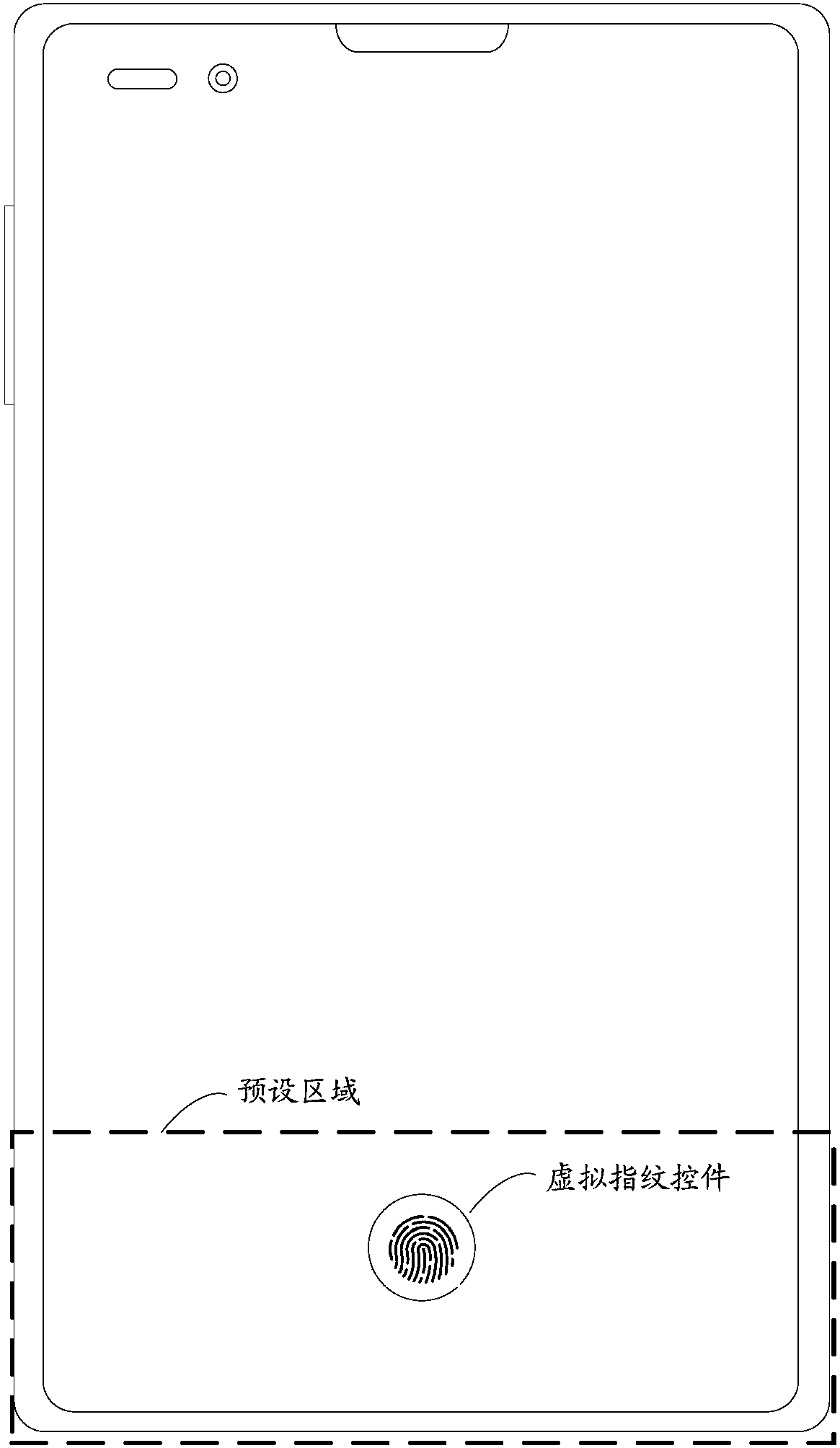

Display control method and device, terminal and readable storage medium

InactiveCN107678613AImprove experienceSimplified displayDigital data authenticationInput/output processes for data processingVirtual controlComputer engineering

Owner:MEIZU TECH CO LTD

Digital money mining system and method based on biometric ID authentication

InactiveCN109034799AAuthentication is reliableDigital data authenticationProtocol authorisationDigital currencyIdentity recognition

Owner:晓看科技(上海)有限公司

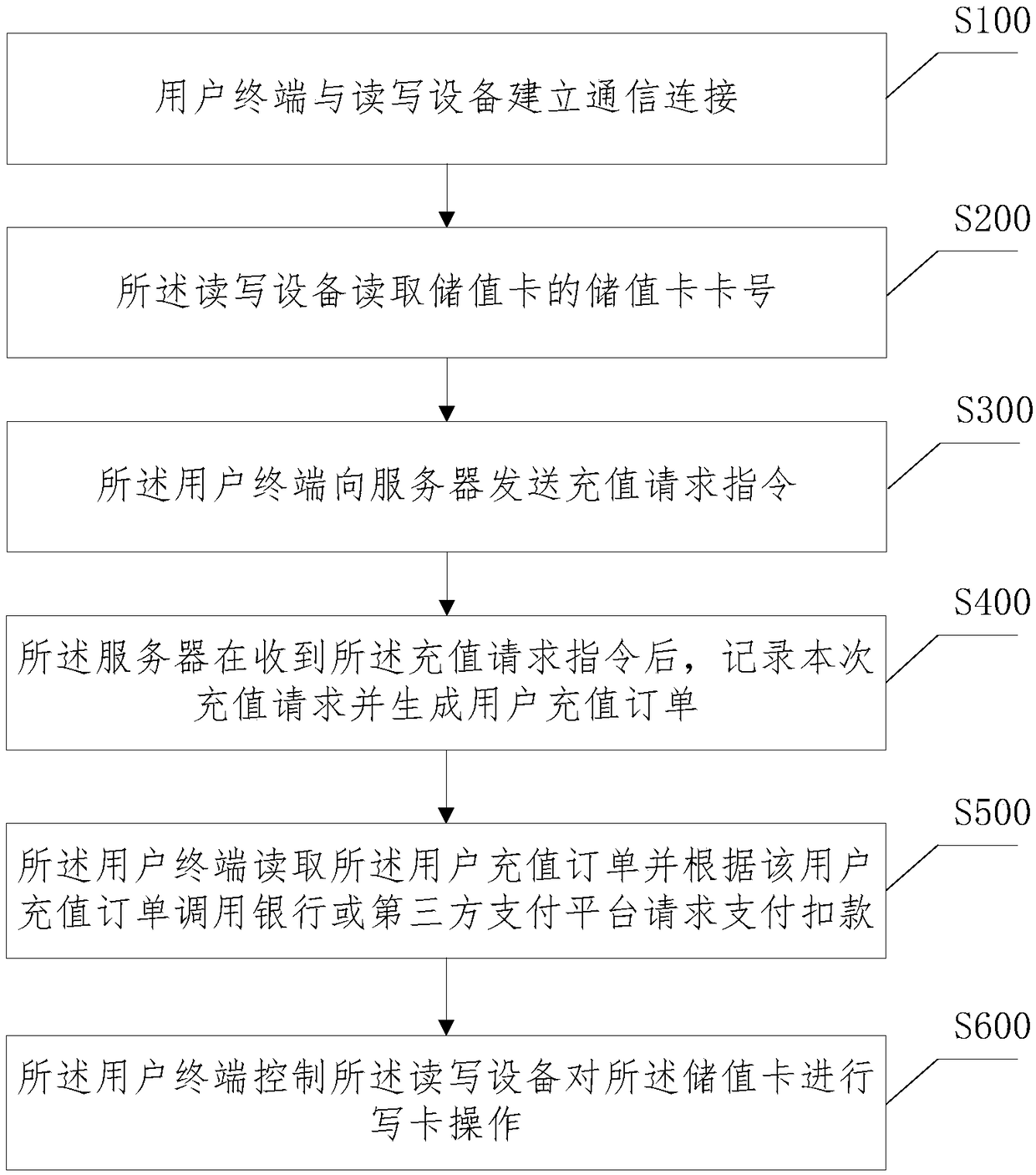

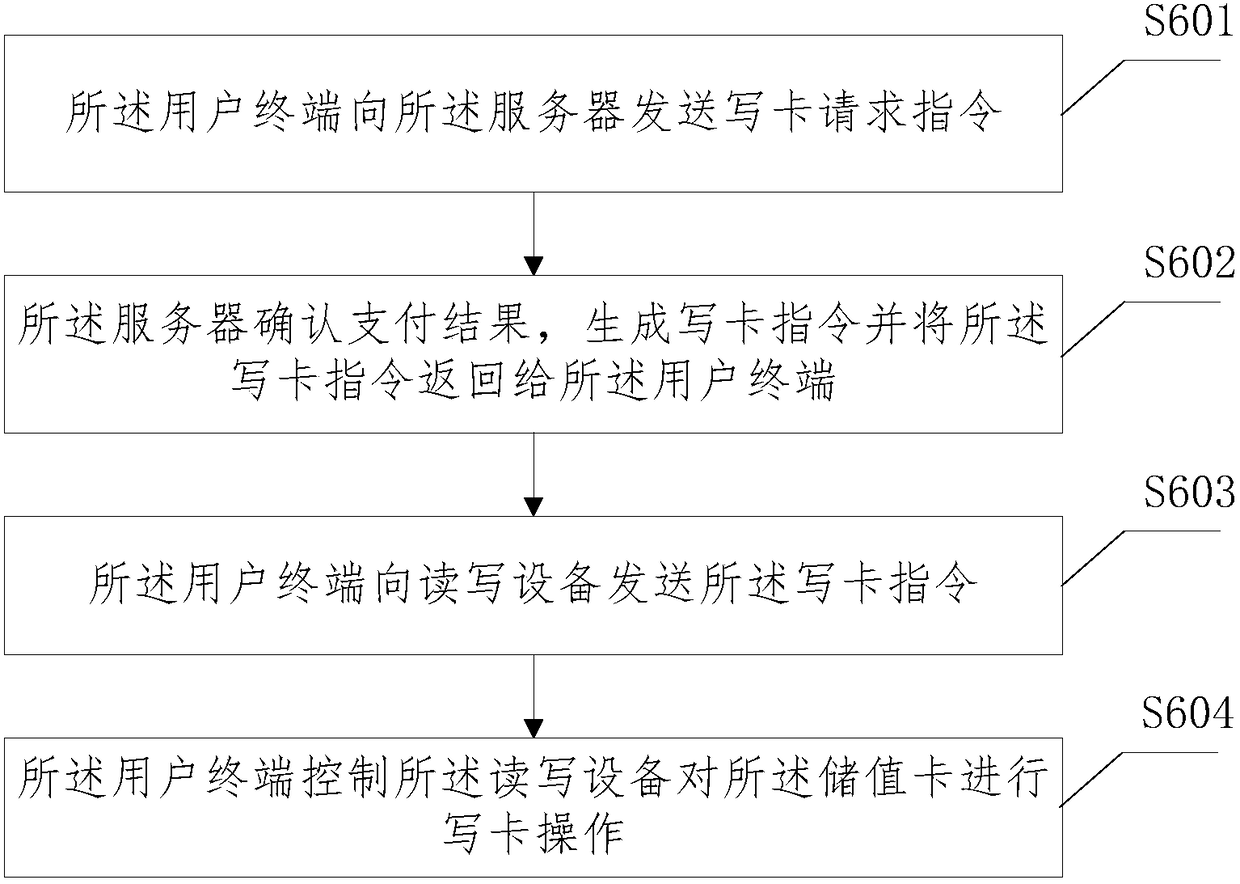

Recharging method and system of value card

InactiveCN108280643APayments involving neutral partyProtocol authorisationStored-value cardThird-Party Payments

Owner:深圳喆行科技有限公司

Card-to-card direct payment with generated one-time password communicated from one card to a second card

Owner:BANK OF AMERICA CORP

Systems and techniques to utilize an active link in a uniform resource locator to perform a money exchange

PendingUS20220366410A1Cryptography processingDigital data authenticationUniform resource locatorDistributed computing

Embodiments are generally directed to systems, device, and techniques to utilize a uniform resource locator to exchange money.

Owner:CAPITAL ONE SERVICES

Mobile Internet service application-based on line payment system

Owner:四川省和信源创劳务有限公司

Electronic payment method, device and terminal

InactiveCN106570691AReduce the risk of lossAvoid unreadableTransmissionProtocol authorisationUser inputBackup validation

The embodiment of the invention discloses an electronic payment method comprising the following steps: receiving a user inputted payment confirm order; responding to the payment confirm order, sending verify essential factor request information to N storage nodes, wherein the verify essential factor request information is used for requesting a server to issue verify essential factors forming an identity verify template, and N is an integer >=2; receiving M verify essential factors of K storage nodes from N storage nodes, wherein K and M are respectively integer >=1, and K is <N; combining M verify essential factors so as to form the identity verify template; using the identity verify template to verify user inputted to-be-verified information; if verification fails, using a backup identity verify flow to verify the to-be-verified information; if the backup identity verify flow successes, sending an online payment order to the server, wherein the online payment order is used for indicating the server to carry out online payment. The embodiment also discloses an electronic payment device and a terminal.

Owner:NUBIA TECH CO LTD

Digital currency exchange method, device, equipment and medium

PendingCN111598556AImprove processing efficiencyTo achieve the effect of decentralizationPayment circuitsProtocol authorisationDigital currencyComputer network

Owner:牛津(海南)区块链研究院有限公司

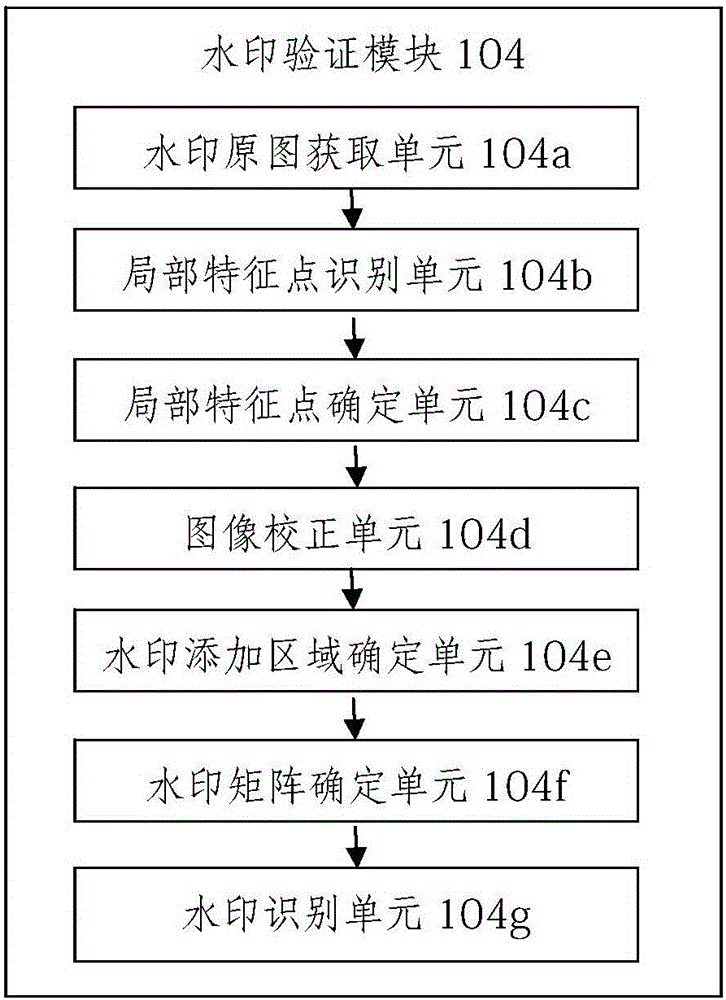

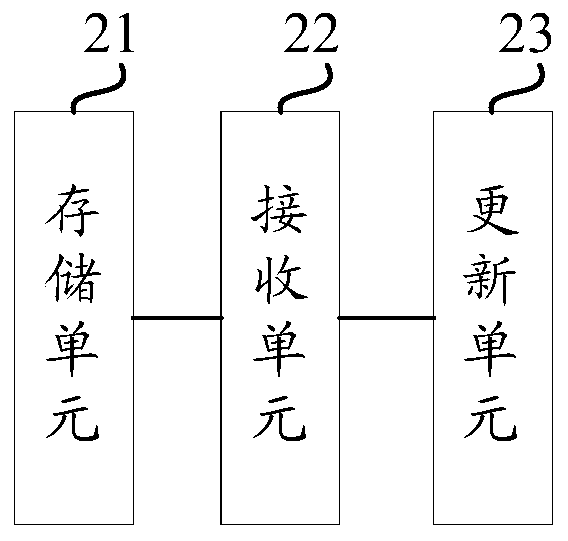

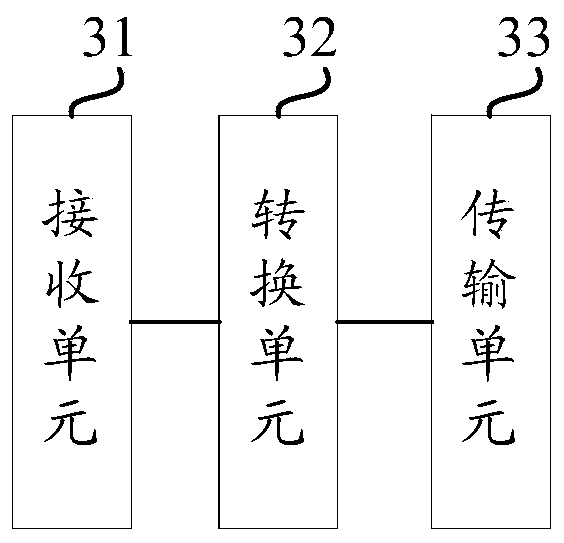

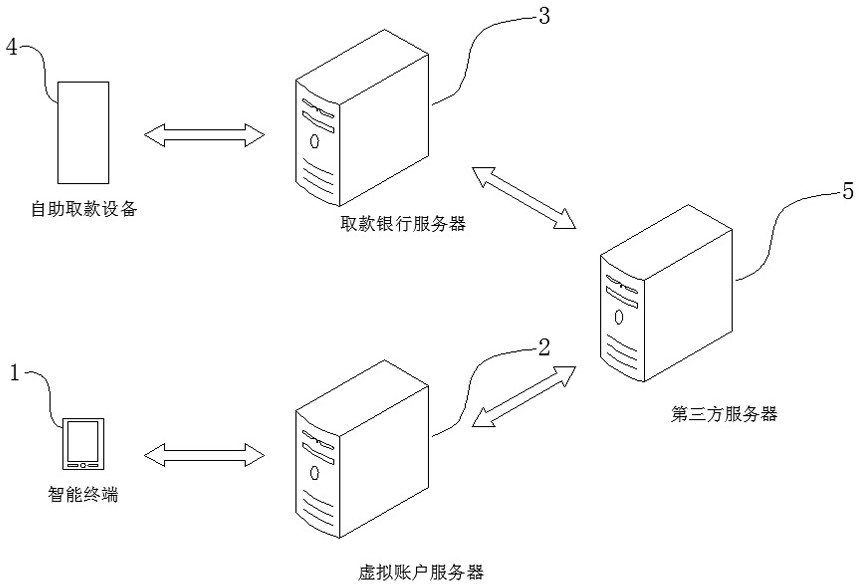

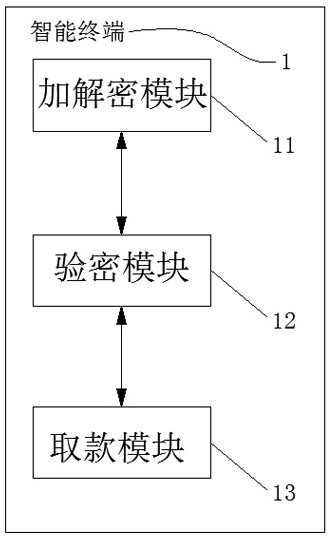

Virtual account-based card-free cash withdrawal method, device and storage medium

PendingCN112365254AImprove convenienceRealize cardless cash withdrawal operationFinanceProtocol authorisationWithdrawal RequestAuthorization

Owner:江苏朗之皓科技有限公司

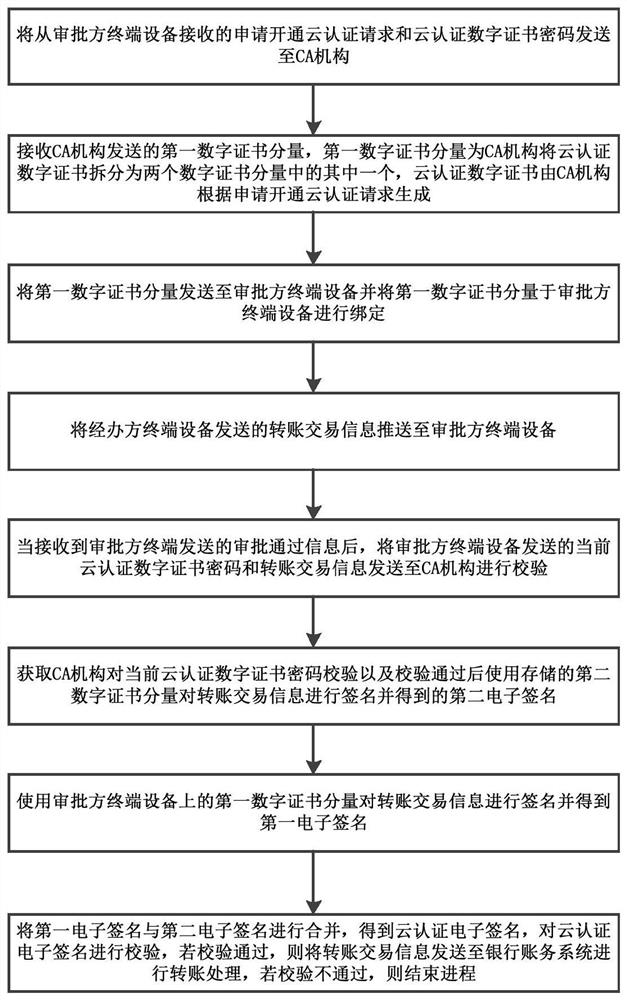

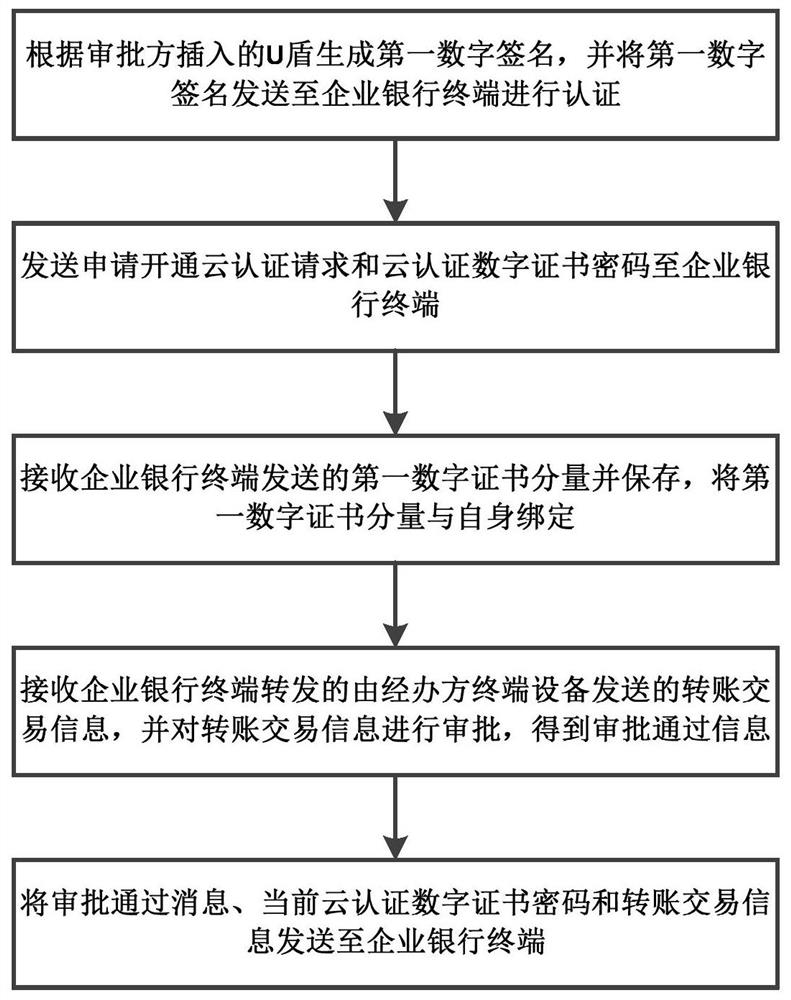

Fund payment approval method and equipment based on enterprise cloud authentication and medium

PendingCN113240423AImprove convenienceImprove securityDigital data authenticationProtocol authorisationInternet privacyEngineering

The invention provides a fund payment examination and approval method based on enterprise cloud authentication. The method comprises the steps of forwarding an application for opening a cloud authentication request, receiving a first digital certificate component, forwarding the first digital certificate component, pushing an examination and approval message, forwarding a current cloud authentication digital certificate password, obtaining a second electronic signature, and obtaining a first electronic signature and verifying the electronic signature. According to the fund payment examination and approval method based on the enterprise cloud authentication, when the examination and approval party of the enterprise customer examines and approves the to-be-examined and approved transfer transaction information sent by the handler, a USB key does not need to be inserted, and the examination and approval can be carried out in a cloud authentication mode of directly inputting the current cloud authentication digital certificate password, so the problems that a USB key is not convenient to carry and the USB key is damaged and the like are solved, and the convenience of handling mobile finance is improved; in the aspect of safety, a scattered digital certificate storage scheme is adopted, a cloud authentication digital certificate password is used for access protection, and the safety is higher compared with file certificate storage.

Owner:GUANGDONG HUAXING BANK CO LTD

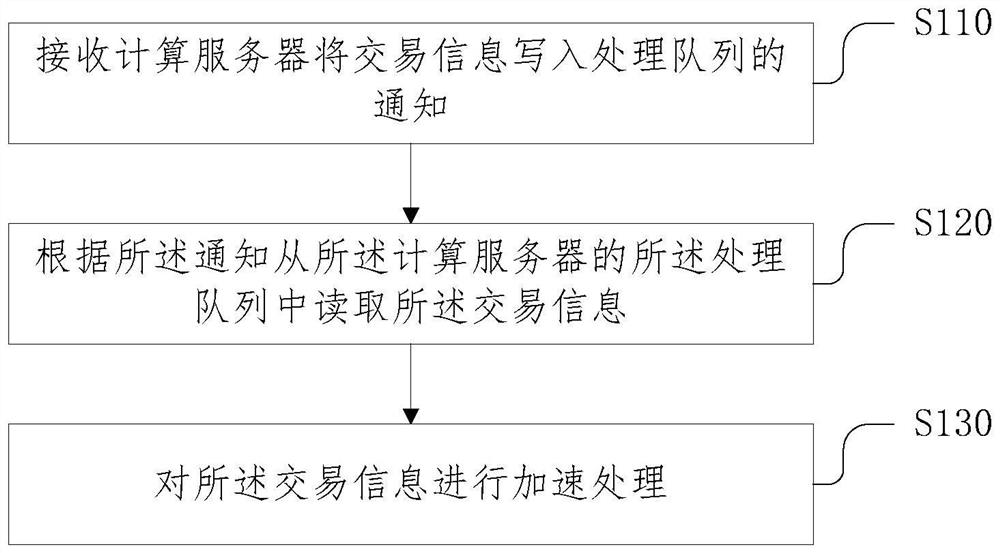

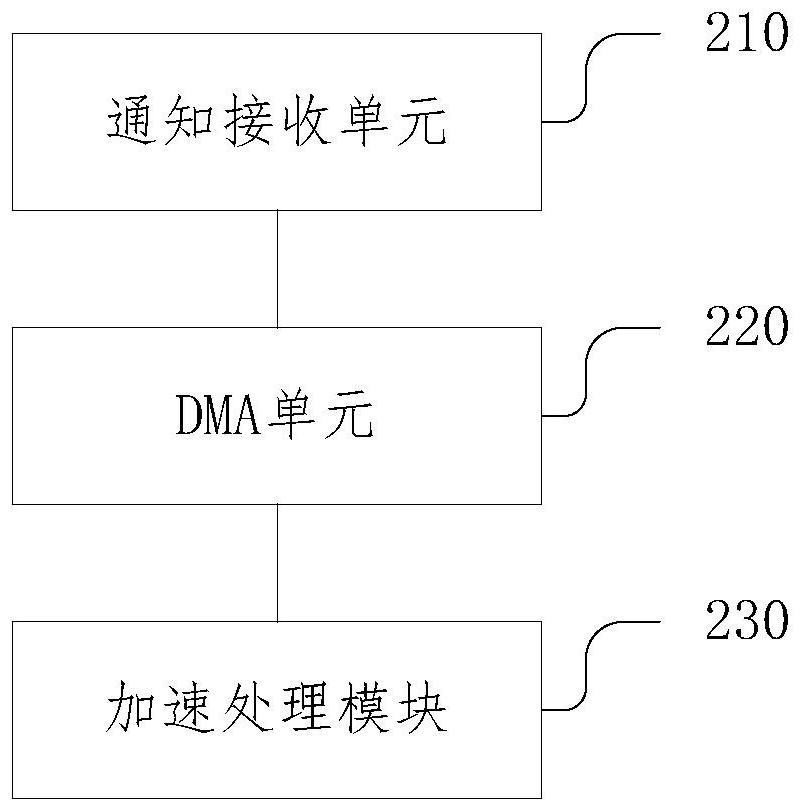

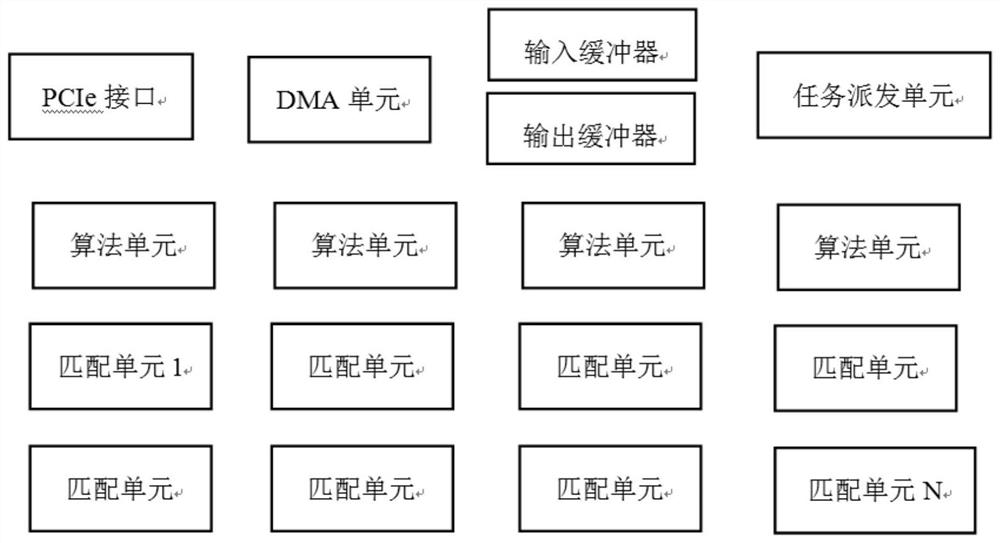

Data processing acceleration method and device, electronic equipment and storage medium

Owner:北京智云芯科技有限公司

Smart watch payment method using two-dimensional code

Owner:江门市圣猴时实业有限公司

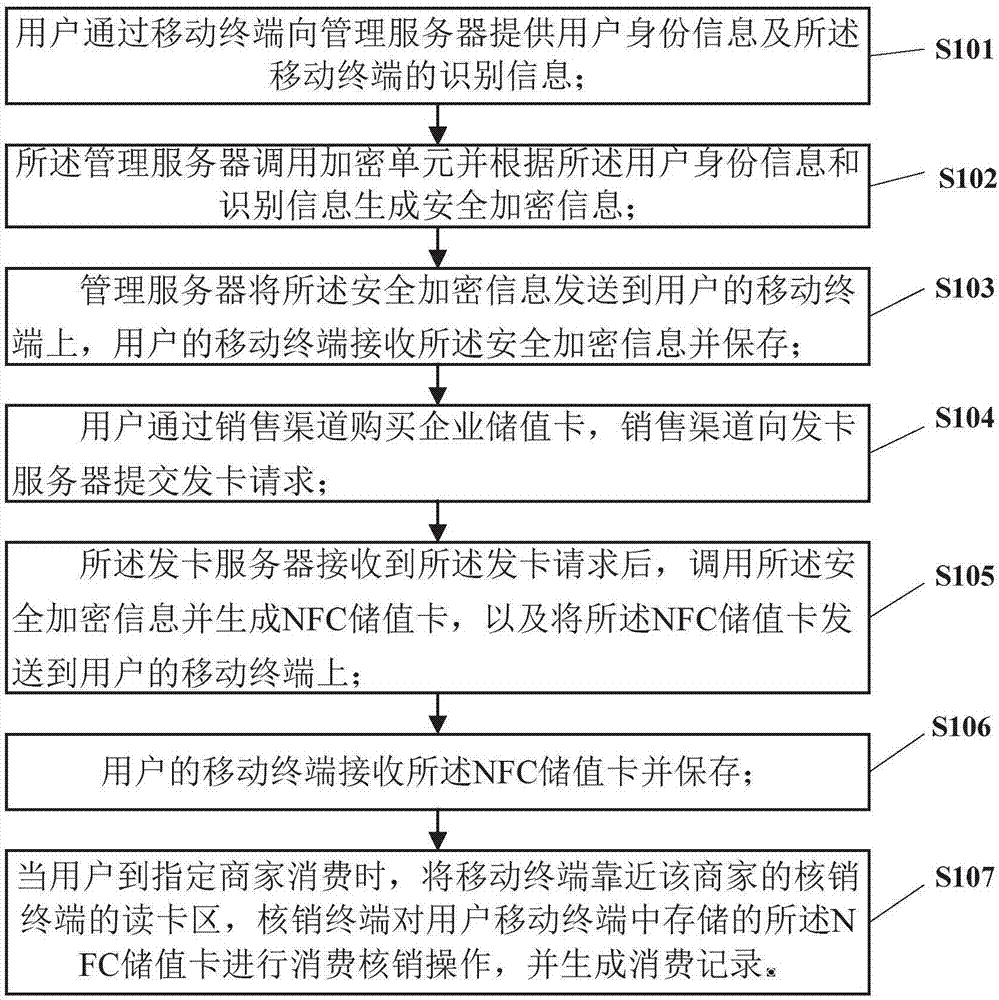

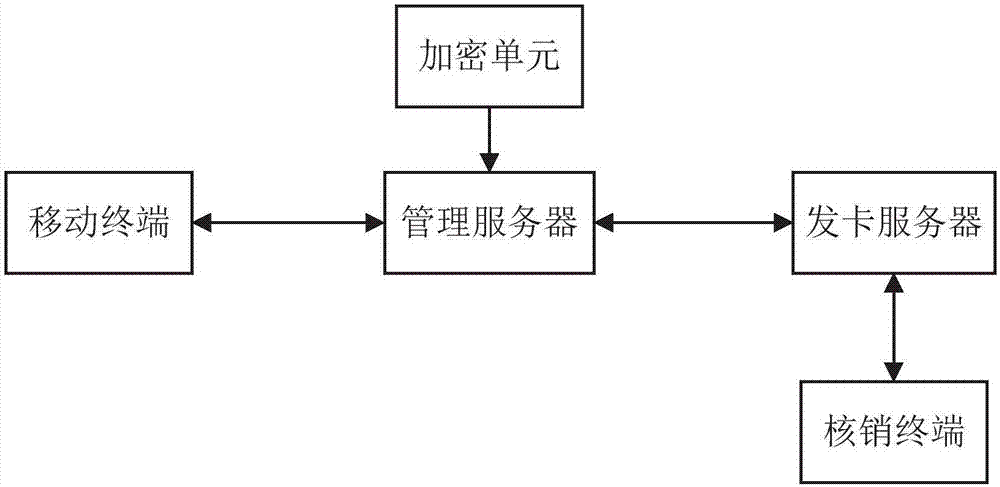

Enterprise value card issuing method and system based on NFC

InactiveCN107993064AEasy to operateConsumption does not affectProtocol authorisationComputer terminalStored-value card

Owner:深圳消费物联科技有限公司

Who we serve

- R&D Engineer

- R&D Manager

- IP Professional

Why Eureka

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Social media

Try Eureka

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap